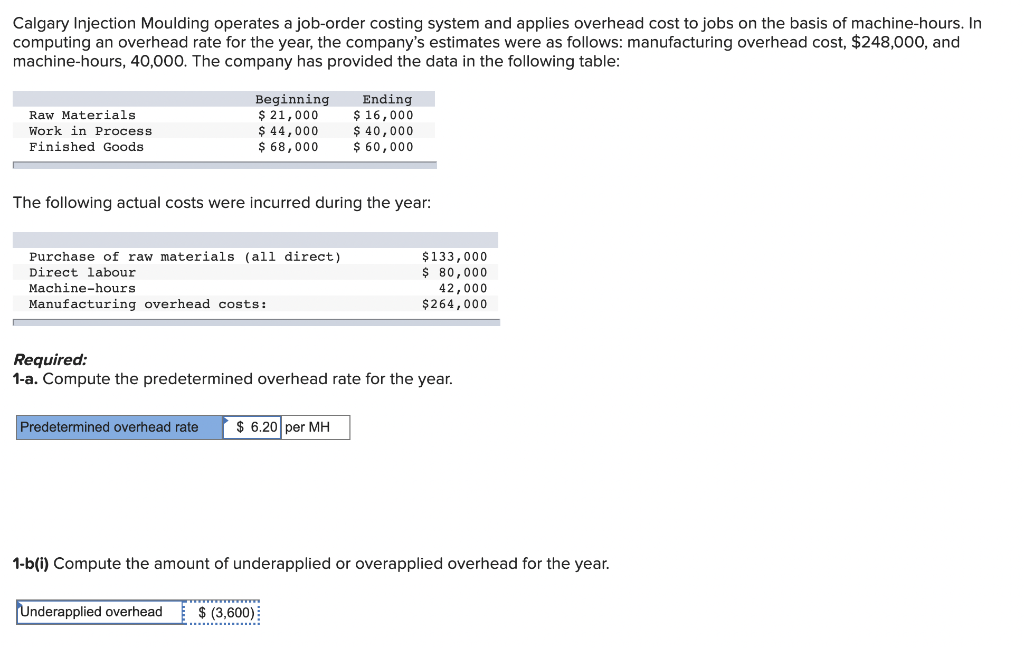

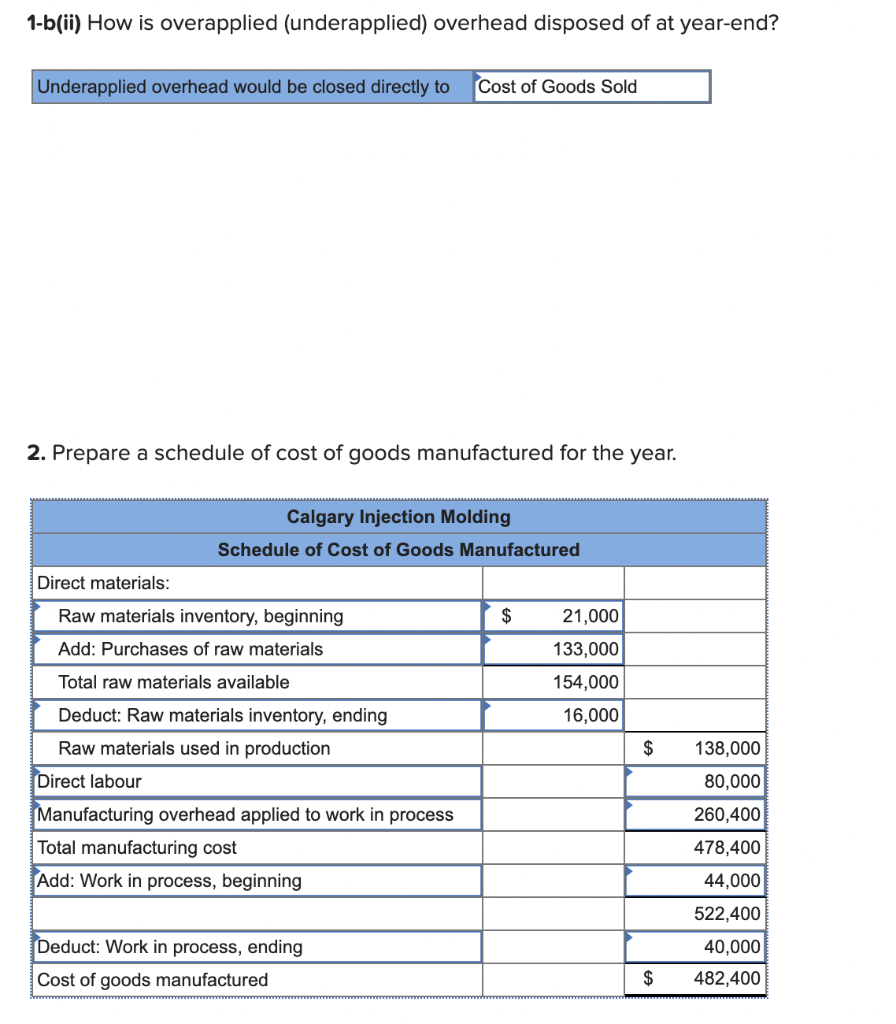

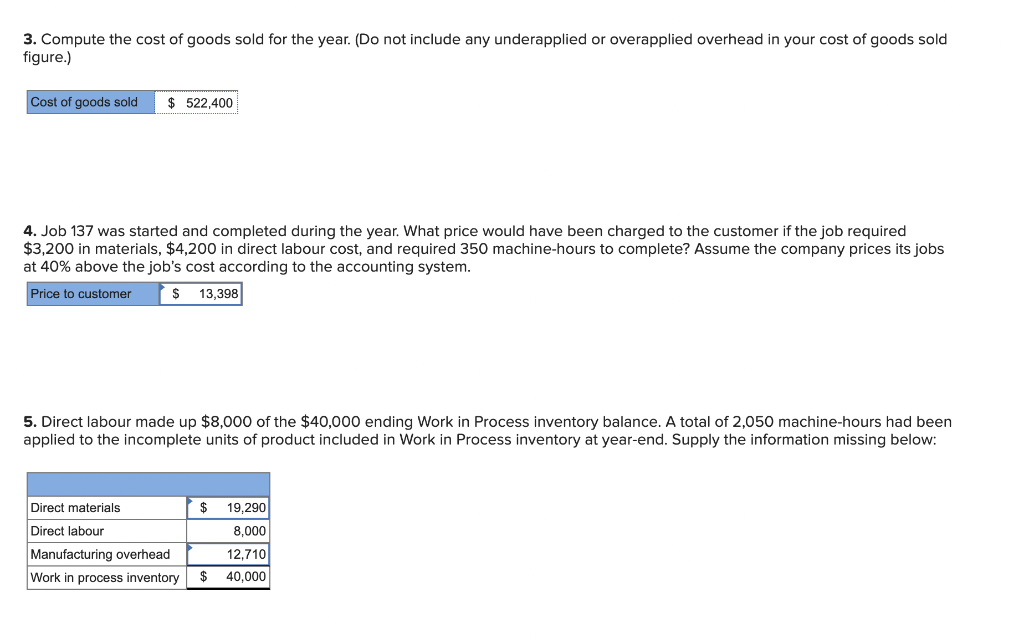

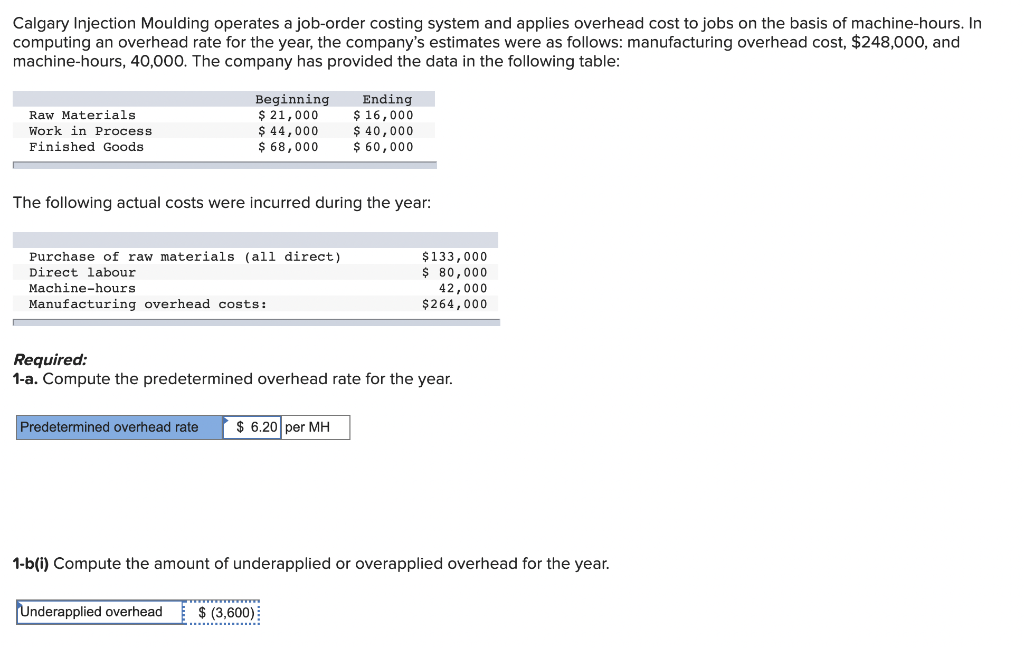

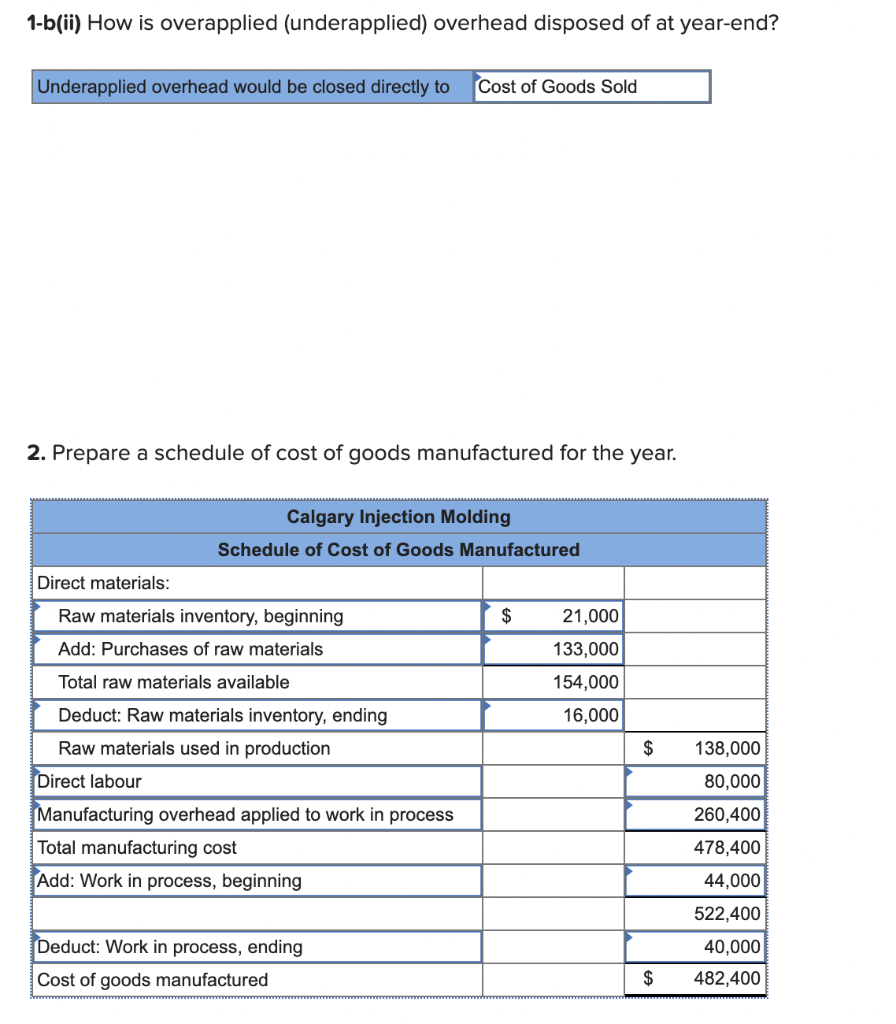

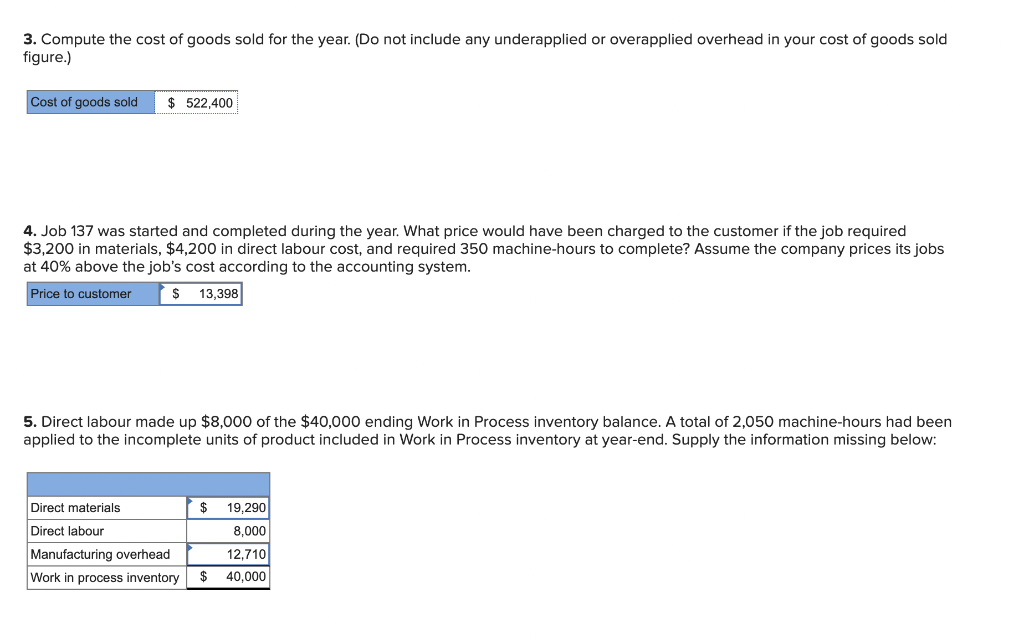

Calgary Injection Moulding operates a job-order costing system and applies overhead cost to jobs on the basis of machine-hours. In computing an overhead rate for the year, the company's estimates were as follows: manufacturing overhead cost, $248,000, and machine-hours, 40,000. The company has provided the data in the following table: Raw Materials Work in Process Finished Goods Beginning $ 21,000 $ 44,000 $ 68,000 Ending $ 16,000 $ 40,000 $ 60,000 The following actual costs were incurred during the year: Purchase of raw materials (all direct) Direct labour Machine-hours Manufacturing overhead costs: $133,000 $ 80,000 42,000 $264,000 Required: 1-a. Compute the predetermined overhead rate for the year. Predetermined overhead rate $ 6.20 per MH 1-b(i) Compute the amount of underapplied or overapplied overhead for the year. TTTT Underapplied overhead $ (3,600) 1-b(ii) How is overapplied (underapplied) overhead disposed of at year-end? Underapplied overhead would be closed directly to Cost of Goods Sold 2. Prepare a schedule of cost of goods manufactured for the year. Calgary Injection Molding Schedule of Cost of Goods Manufactured Direct materials: $ 21,000 133,000 154,000 16,000 Raw materials inventory, beginning Add: Purchases of raw materials Total raw materials available Deduct: Raw materials inventory, ending Raw materials used in production Direct labour Manufacturing overhead applied to work in process Total manufacturing cost Add: Work in process, beginning $ 138,000 80,000 260,400 478,400 44,000 522,400 Deduct: Work in process, ending Cost of goods manufactured 40,000 482,400 $ 3. Compute the cost of goods sold for the year. (Do not include any underapplied or overapplied overhead in your cost of goods sold figure.) Cost of goods sold $ 522,400 4. Job 137 was started and completed during the year. What price would have been charged to the customer if the job required $3,200 in materials, $4,200 in direct labour cost, and required 350 machine-hours to complete? Assume the company prices its jobs at 40% above the job's cost according to the accounting system. Price to customer $ 13,398 5. Direct labour made up $8,000 of the $40,000 ending Work in Process inventory balance. A total of 2,050 machine-hours had been applied to the incomplete units of product included in Work in Process inventory at year-end. Supply the information missing below: $ 19.290 8,000 Direct materials Direct labour Manufacturing overhead Work in process inventory 12,710 $ 40,000