Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calgary Paper Company produces paper for photocopiers. The company has developed standard overhead rates based on a monthly capacity of 64,000 direct-labor hours as

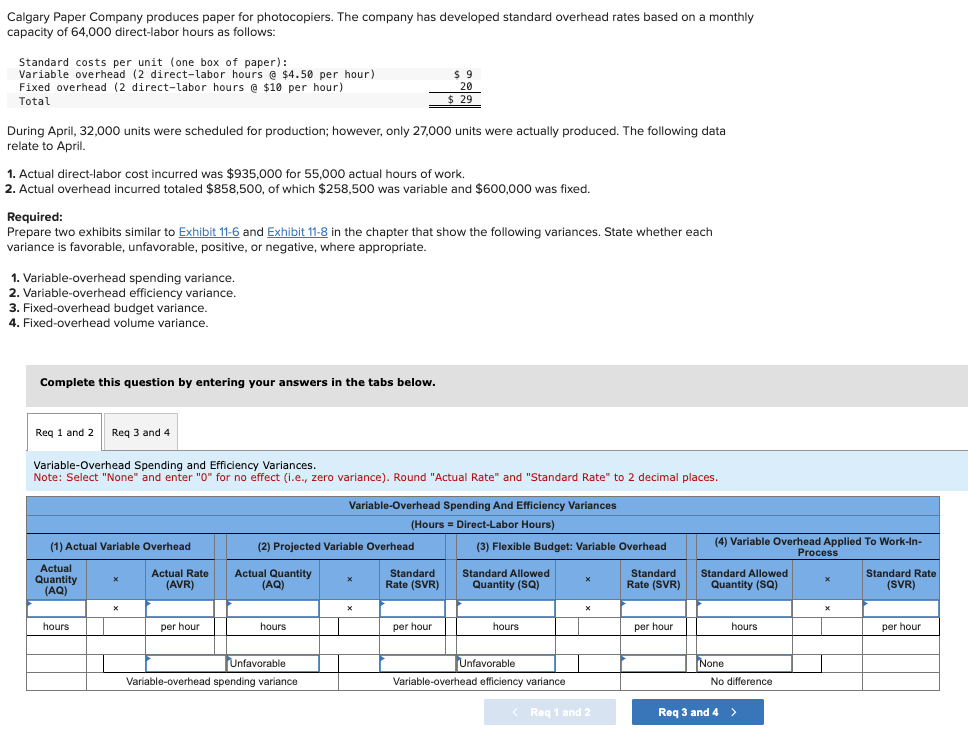

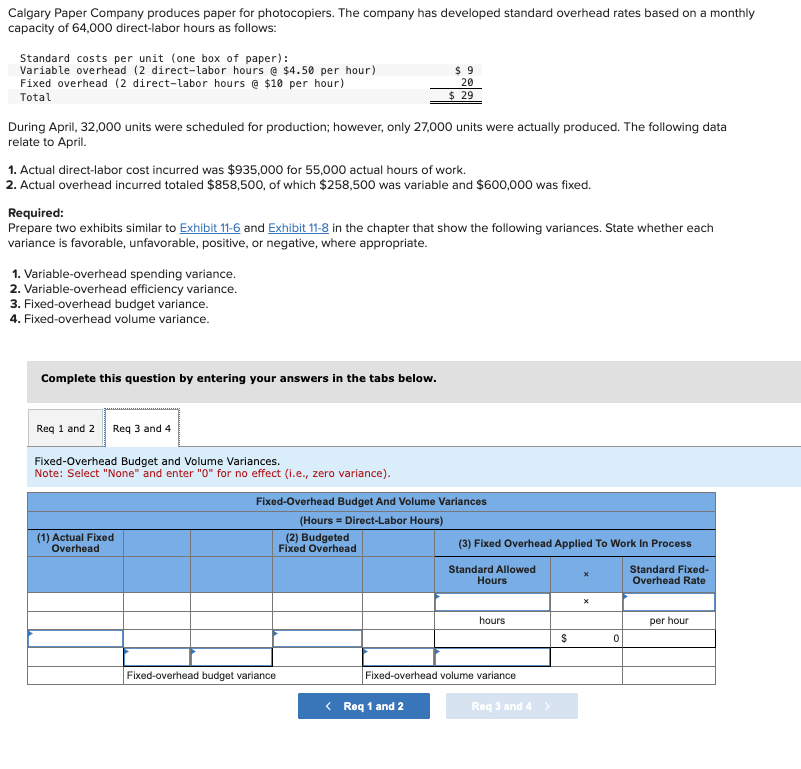

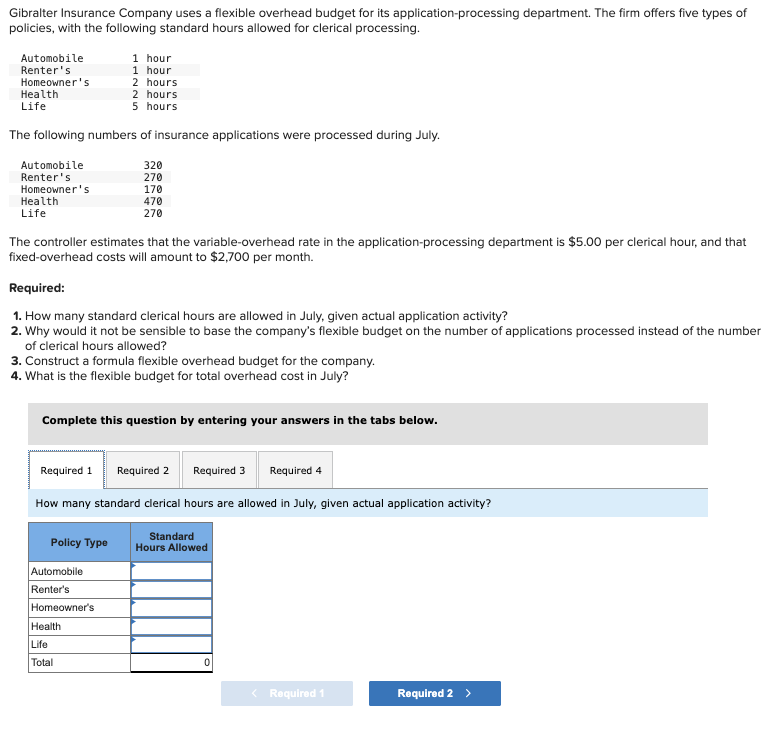

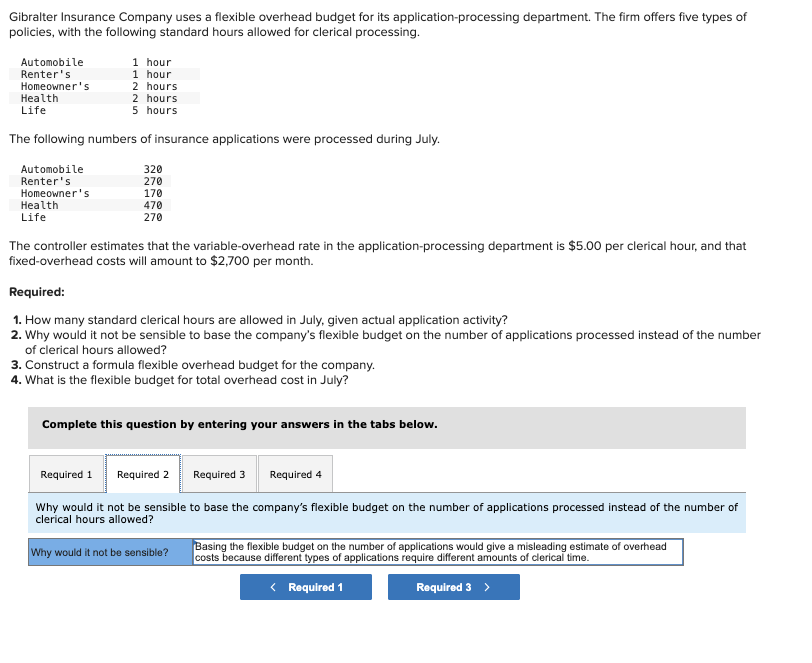

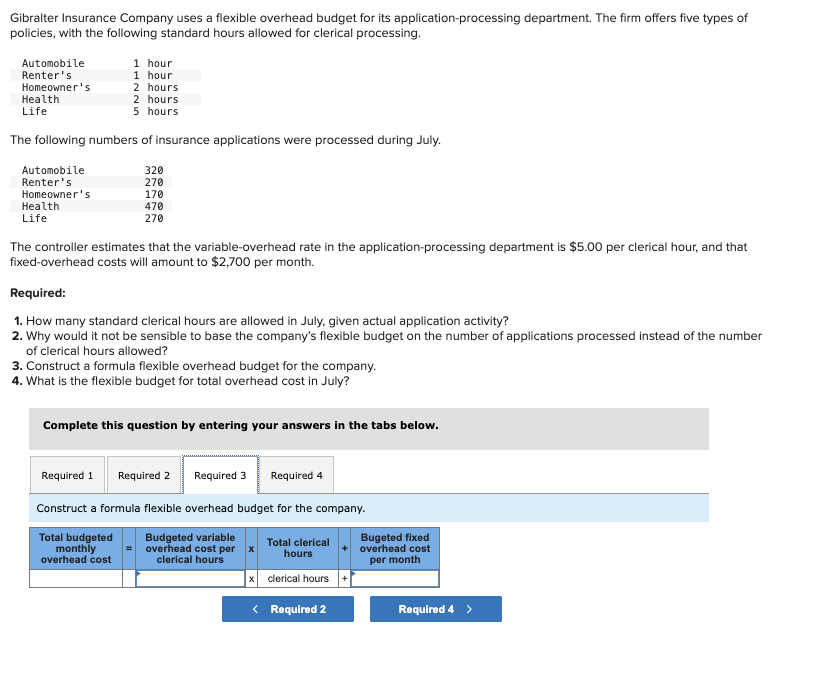

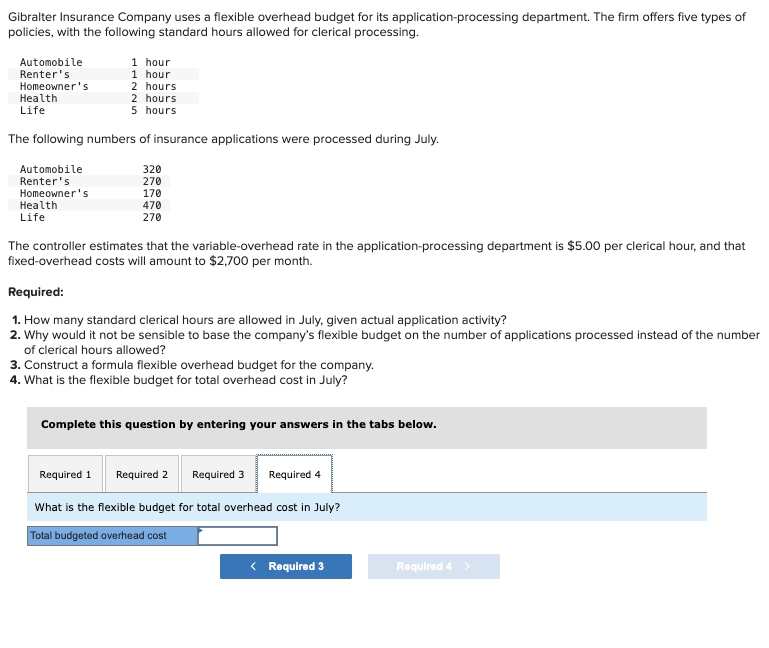

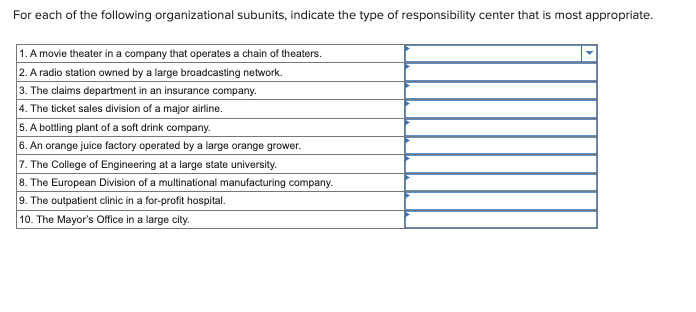

Calgary Paper Company produces paper for photocopiers. The company has developed standard overhead rates based on a monthly capacity of 64,000 direct-labor hours as follows: Standard costs per unit (one box of paper): Variable overhead (2 direct-labor hours @ $4.50 per hour) Fixed overhead (2 direct-labor hours @ $10 per hour) Total $ 9 20 $ 29 During April, 32,000 units were scheduled for production; however, only 27,000 units were actually produced. The following data relate to April. 1. Actual direct-labor cost incurred was $935,000 for 55,000 actual hours of work. 2. Actual overhead incurred totaled $858,500, of which $258,500 was variable and $600,000 was fixed. Required: Prepare two exhibits similar to Exhibit 11-6 and Exhibit 11-8 in the chapter that show the following variances. State whether each variance is favorable, unfavorable, positive, or negative, where appropriate. 1. Variable-overhead spending variance. 2. Variable-overhead efficiency variance. 3. Fixed-overhead budget variance. 4. Fixed-overhead volume variance. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 and 4 Variable-Overhead Spending and Efficiency Variances. Note: Select "None" and enter "0" for no effect (i.e., zero variance). Round "Actual Rate" and "Standard Rate" to 2 decimal places. Variable-Overhead Spending And Efficiency Variances (Hours = Direct-Labor Hours) (1) Actual Variable Overhead (2) Projected Variable Overhead Actual Quantity (AQ) x Actual Rate (AVR) Actual Quantity (AQ) x Standard Rate (SVR) (3) Flexible Budget: Variable Overhead Standard Allowed Quantity (SQ) (4) Variable Overhead Applied To Work-In- Process x Standard Rate (SVR) Standard Allowed Quantity (SQ) Standard Rate (SVR) hours per hour hours per hour hours per hour hours per hour Unfavorable Variable-overhead spending variance Unfavorable Variable-overhead efficiency variance None No difference < Req 1 and 2 Req 3 and 4 > Calgary Paper Company produces paper for photocopiers. The company has developed standard overhead rates based on a monthly capacity of 64,000 direct-labor hours as follows: Standard costs per unit (one box of paper): Variable overhead (2 direct-labor hours @ $4.50 per hour) Fixed overhead (2 direct-labor hours @ $10 per hour) Total $ 9 20 $ 29 During April, 32,000 units were scheduled for production; however, only 27,000 units were actually produced. The following data relate to April. 1. Actual direct-labor cost incurred was $935,000 for 55,000 actual hours of work. 2. Actual overhead incurred totaled $858,500, of which $258,500 was variable and $600,000 was fixed. Required: Prepare two exhibits similar to Exhibit 11-6 and Exhibit 11-8 in the chapter that show the following variances. State whether each variance is favorable, unfavorable, positive, or negative, where appropriate. 1. Variable-overhead spending variance. 2. Variable-overhead efficiency variance. 3. Fixed-overhead budget variance. 4. Fixed-overhead volume variance. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 and 4 Fixed-Overhead Budget and Volume Variances. Note: Select "None" and enter "0" for no effect (i.e., zero variance). (1) Actual Fixed Overhead Fixed-Overhead Budget And Volume Variances (Hours = Direct-Labor Hours) (2) Budgeted Fixed Overhead (3) Fixed Overhead Applied To Work In Process Standard Allowed Hours Standard Fixed- Overhead Rate x hours $ 0 Fixed-overhead volume variance Fixed-overhead budget variance < Req 1 and 2 Req 3 and 4 > per hour Gibralter Insurance Company uses a flexible overhead budget for its application-processing department. The firm offers five types of policies, with the following standard hours allowed for clerical processing. Automobile Renter's Homeowner's Health Life 1 hour 1 hour 2 hours 2 hours 5 hours The following numbers of insurance applications were processed during July. Automobile Renter's 320 270 Homeowner's 170 Health 470 270 Life The controller estimates that the variable-overhead rate in the application-processing department is $5.00 per clerical hour, and that fixed-overhead costs will amount to $2,700 per month. Required: 1. How many standard clerical hours are allowed in July, given actual application activity? 2. Why would it not be sensible to base the company's flexible budget on the number of applications processed instead of the number of clerical hours allowed? 3. Construct a formula flexible overhead budget for the company. 4. What is the flexible budget for total overhead cost in July? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 How many standard clerical hours are allowed in July, given actual application activity? Standard Policy Type Hours Allowed Automobile Renter's Homeowner's Health Life Total 0 < Required 1 Required 2 > Gibralter Insurance Company uses a flexible overhead budget for its application-processing department. The firm offers five types of policies, with the following standard hours allowed for clerical processing. Automobile Renter's 1 hour 1 hour Homeowner's Health Life 2 hours 2 hours 5 hours The following numbers of insurance applications were processed during July. Automobile 320 Renter's 270 Homeowner's 170 Health Life 470 270 The controller estimates that the variable-overhead rate in the application-processing department is $5.00 per clerical hour, and that fixed-overhead costs will amount to $2,700 per month. Required: 1. How many standard clerical hours are allowed in July, given actual application activity? 2. Why would it not be sensible to base the company's flexible budget on the number of applications processed instead of the number of clerical hours allowed? 3. Construct a formula flexible overhead budget for the company. 4. What is the flexible budget for total overhead cost in July? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Why would it not be sensible to base the company's flexible budget on the number of applications processed instead of the number of clerical hours allowed? Why would it not be sensible? Basing the flexible budget on the number of applications would give a misleading estimate of overhead costs because different types of applications require different amounts of clerical time. < Required 1 Required 3 > Gibralter Insurance Company uses a flexible overhead budget for its application-processing department. The firm offers five types of policies, with the following standard hours allowed for clerical processing. Automobile Renter's 1 hour 1 hour Homeowner's 2 hours Health Life 2 hours 5 hours The following numbers of insurance applications were processed during July. Automobile 320 Renter's 270 Homeowner's 170 Health Life 470 270 The controller estimates that the variable-overhead rate in the application-processing department is $5.00 per clerical hour, and that fixed-overhead costs will amount to $2,700 per month. Required: 1. How many standard clerical hours are allowed in July, given actual application activity? 2. Why would it not be sensible to base the company's flexible budget on the number of applications processed instead of the number of clerical hours allowed? 3. Construct a formula flexible overhead budget for the company. 4. What is the flexible budget for total overhead cost in July? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Construct a formula flexible overhead budget for the company. Total budgeted monthly overhead cost Budgeted variable overhead cost per clerical hours Total clerical hours x clerical hours < Required 2 Bugeted fixed overhead cost per month Required 4 > Gibralter Insurance Company uses a flexible overhead budget for its application-processing department. The firm offers five types of policies, with the following standard hours allowed for clerical processing. Automobile Renter's 1 hour 1 hour Homeowner's 2 hours Health Life 2 hours 5 hours The following numbers of insurance applications were processed during July. Automobile 320 Renter's 270 Homeowner's 170 Health Life 470 270 The controller estimates that the variable-overhead rate in the application-processing department is $5.00 per clerical hour, and that fixed-overhead costs will amount to $2,700 per month. Required: 1. How many standard clerical hours are allowed in July, given actual application activity? 2. Why would it not be sensible to base the company's flexible budget on the number of applications processed instead of the number of clerical hours allowed? 3. Construct a formula flexible overhead budget for the company. 4. What is the flexible budget for total overhead cost in July? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 What is the flexible budget for total overhead cost in July? Total budgeted overhead cost < Required 3 Required 4 > For each of the following organizational subunits, indicate the type of responsibility center that is most appropriate. 1. A movie theater in a company that operates a chain of theaters. 2. A radio station owned by a large broadcasting network. 3. The claims department in an insurance company. 4. The ticket sales division of a major airline. 5. A bottling plant of a soft drink company. 6. An orange juice factory operated by a large orange grower. 7. The College of Engineering at a large state university. 8. The European Division of a multinational manufacturing company. 9. The outpatient clinic in a for-profit hospital. 10. The Mayor's Office in a large city.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Variable Overhead spending Variance 11000 U Unfavorable 2 Variable Overhead Efficiency Variance 45...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started