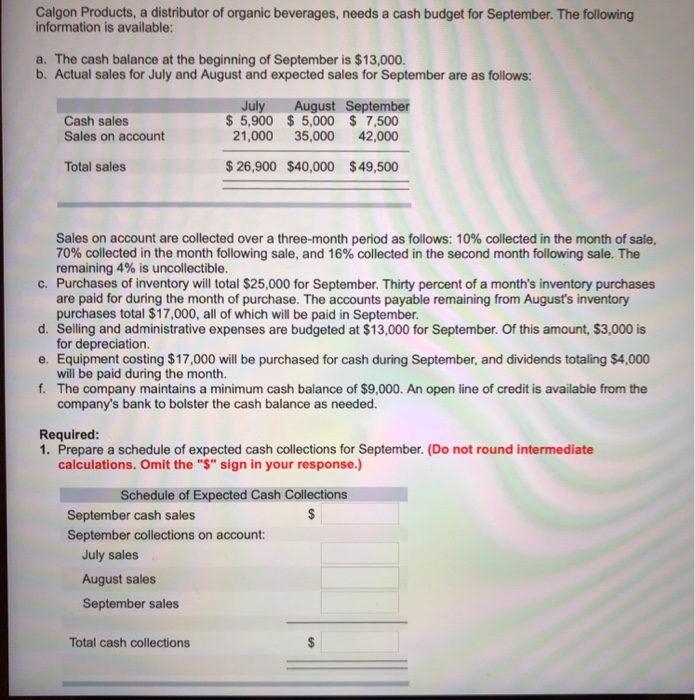

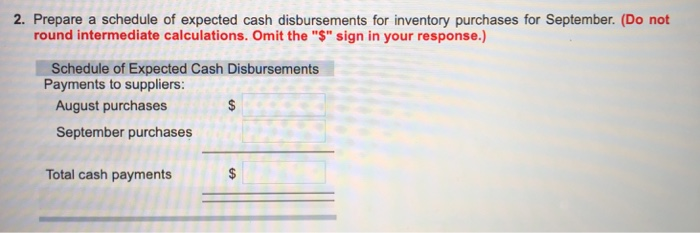

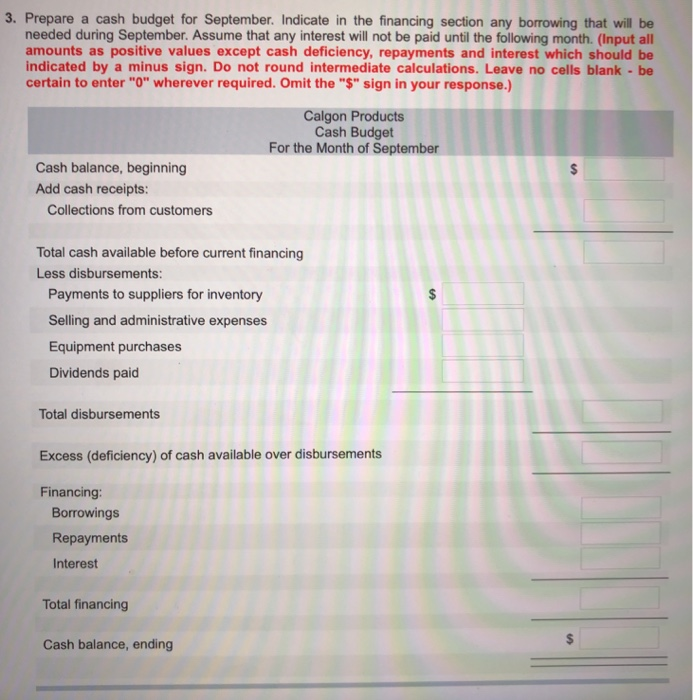

Calgon Products, a distributor of organic beverages, needs a cash budget for September. The following information is available: a. The cash balance at the beginning of September is $13,000. b. Actual sales for July and August and expected sales for September are as follows: July August September 5,900 $ 5,000 7,500 21,000 35,000 42,000 Cash sales Sales on account Total sales $26,900 $40,000 $49,500 Sales on account are collected over a three-month period as follows: 10% collected in the month of sale, 70% collected in the month following sale, and 16% collected in the second month following sale. The remaining 4% is uncollectible. Purchases of inventory will total $25,000 for September. Thirty percent of a month's inventory purchases are paid for during the month of purchase. The accounts payable remaining from August's inventory purchases total $17,000, all of which will be paid in September. c. d. Selling and administrative expenses are budgeted at $13,000 for September. Of this amount, $3,000 is e. Equipment costing $17,000 will be purchased for cash during September, and dividends totaling $4,000 f. The company maintains a minimum cash balance of $9,000. An open line of credit is available from the for depreciation. will be paid during the month. company's bank to bolster the cash balance as needed Required: 1. Prepare a schedule of expected cash collections for September. (Do not round intermediate calculations. Omit the "$" sign in your response.) Schedule of Expected Cash Collections September cash sales September collections on account: July sales August sales September sales Total cash collections 2. Prepare a schedule of expected cash disbursements for inventory purchases for September. (Do not round intermediate calculations. Omit the "$" sign in your response.) Schedule of Expected Cash Disbursements August purchases September purchases Payments to suppliers: Total cash payments 3. Prepare a cash budget for September. Indicate in the financing section any borrowing that will be needed during September. Assume that any interest will not be paid until the following month. (Input all amounts as positive values except cash deficiency, repayments and interest which should be indicated by a minus sign. Do not round intermediate calculations. Leave no cells blank be certain to enter "O" wherever required. Omit the "$" sign in your response.) Calgon Products Cash Budget For the Month of September Cash balance, beginning Add cash receipts: Collections from customers Total cash available before current financing Less disbursements: Payments to suppliers for inventory Selling and administrative expenses Equipment purchases Dividends paid Total disbursements Excess (deficiency) of cash available over disbursements Financing Borrowings Repayments Interest Total financing Cash balance, ending