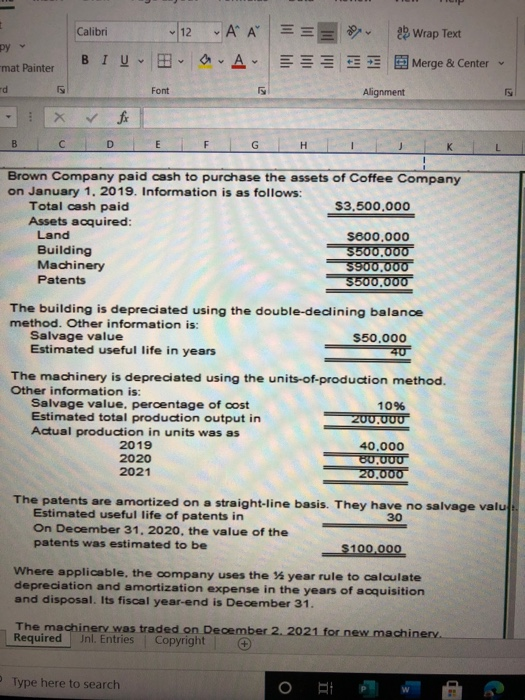

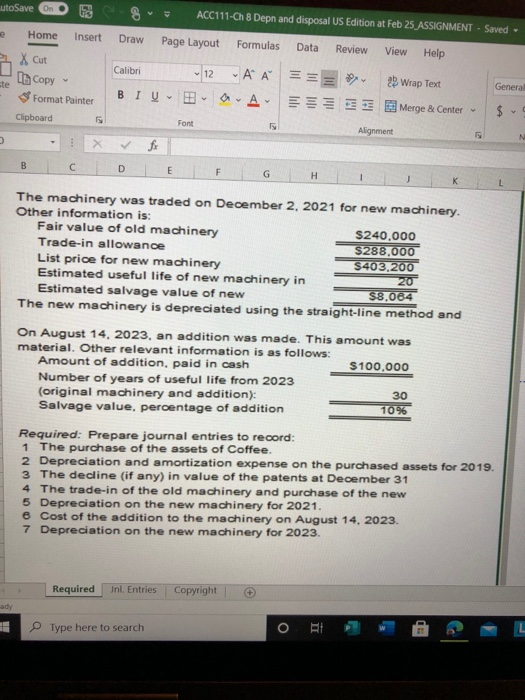

Calibri 12 2 Wrap Text mat Painter 12 AA == 18-a.A- BIU Merge & Center Td Font Alignment 21 B F G H Brown Company paid cash to purchase the assets of Coffee Company on January 1, 2019. Information is as follows: Total cash paid $3,500,000 Assets acquired: Land $800,000 Building $500,000 Machinery $900.000 Patents $500,000 The building is depreciated using the double-declining balance method. Other information is: Salvage value 550.000 Estimated useful life in years 20 The machinery is depreciated using the units-of-production method. Other information is: Salvage value, percentage of cost 10% Estimated total production output in 200.000 Actual production in units was as 2019 40.000 2020 80.000 2021 20.000 The patents are amortized on a straight-line basis. They have no salvage valu Estimated useful life of patents in 30 On December 31, 2020, the value of the patents was estimated to be $100.000 Where applicable, the company uses the year rule to calculate depreciation and amortization expense in the years of acquisition and disposal. Its fiscal year-end is December 31. The machinery was traded on December 2. 2021 for new machinery Required Jnl Entries Copyright Type here to search utoSave On ACC111-Ch 8 Depn and disposal US Edition at Feb 25 ASSIGNMENT - Saved - e Home Insert Draw Page Layout Formulas Data Review View Help Calibri X Cut lo Copy ste Format Painter 12 AA ===> 25 Wrap Text General BIU y Merge & Center $ Clipboard Font Alignment N fi B D E F G H 1 The machinery was traded on December 2, 2021 for new machinery. Other information is: Fair value of old machinery $240.000 Trade-in allowance $288.000 List price for new machinery S403.200 Estimated useful life of new machinery in 20 Estimated salvage value of new $8.084 The new machinery is depreciated using the straight-line method and On August 14, 2023, an addition was made. This amount was material. Other relevant information is as follows: Amount of addition, paid in cash $100,000 Number of years of useful life from 2023 30 (original machinery and addition): Salvage value, percentage of addition 10% Required: Prepare journal entries to record: 1 The purchase of the assets of Coffee. 2 Depreciation and amortization expense on the purchased assets for 2019. 3 The decline (if any) in value of the patents at December 31 4 The trade-in of the old machinery and purchase of the new 5 Depreciation on the new machinery for 2021. 6 Cost of the addition to the machinery on August 14, 2023. 7 Depreciation on the new machinery for 2023. Required Inl, Entries Copyright ady Type here to search o Clipboard Font J16 X for B D E Brown Company GENERAL JOURNAL Dec. 2019 Description PR Debit Credit Page 1 Required Jnl. Entries Copyright