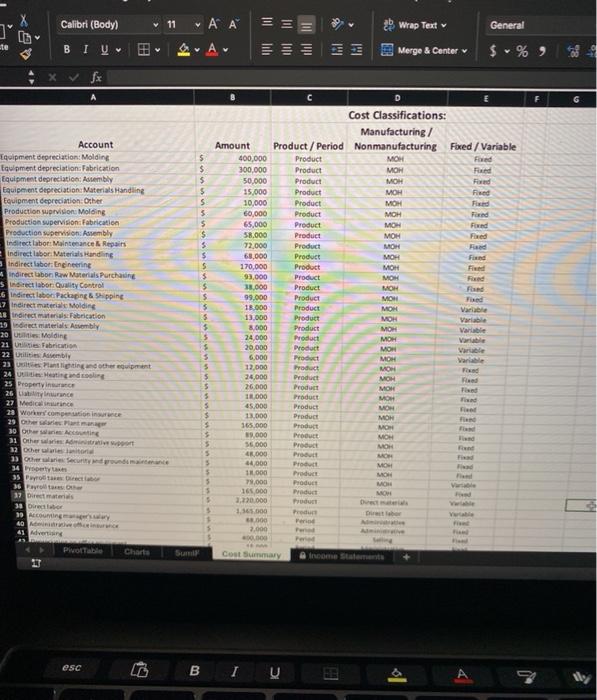

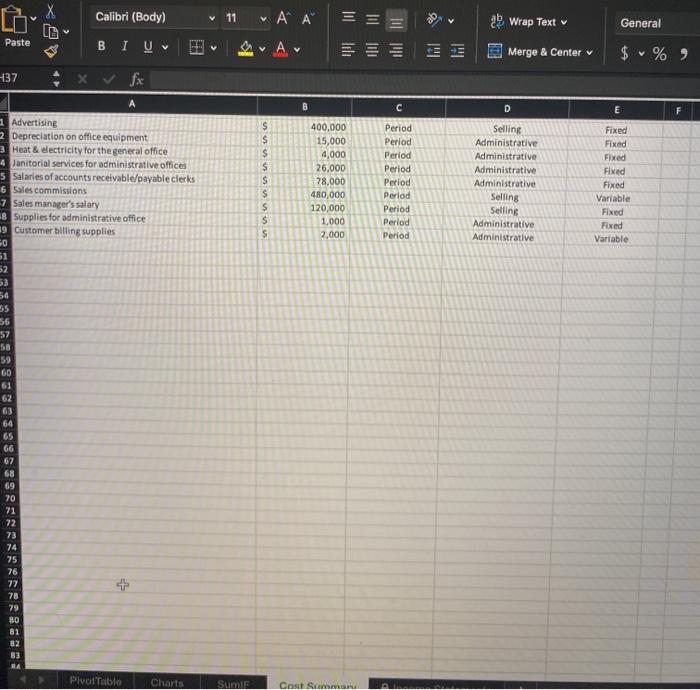

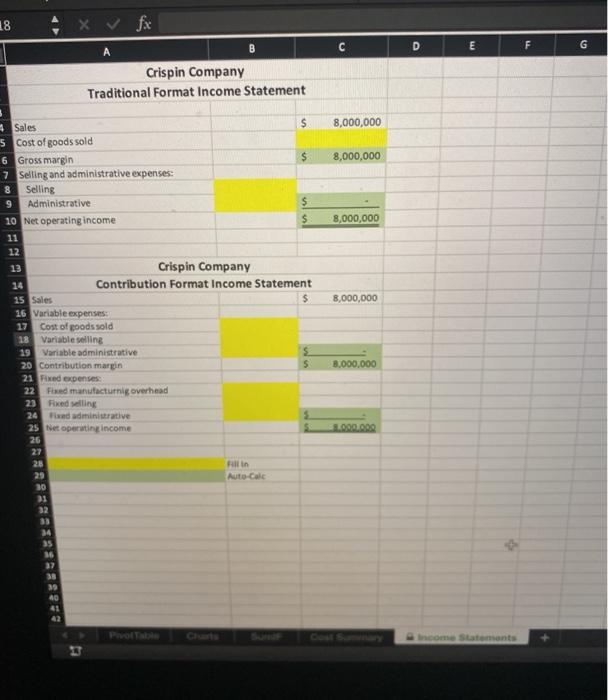

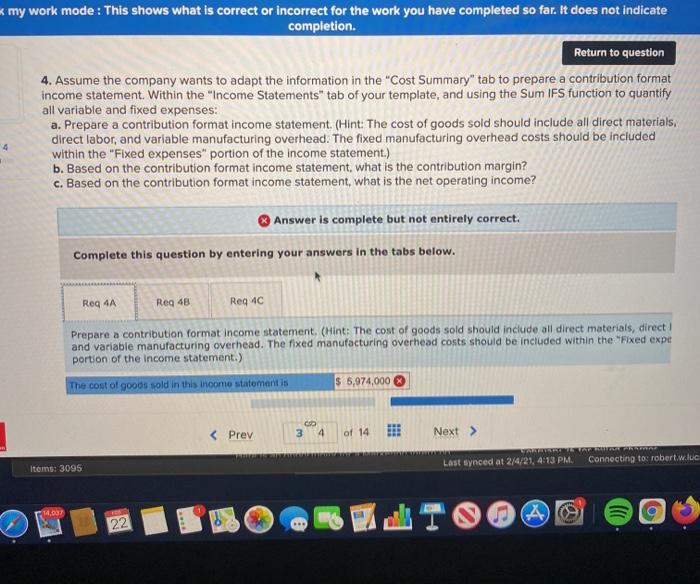

Calibri (Body) 11 ' III General Wrap Text ] te BIU v A- == = Merge & Center $ %) X G Red Account Equipment depreciation: Molding Equipment depreciation: Fabrication Equipment depreciation Assembly Equipment depreciation Material Handling Equipment depreciation Other Production suprision Molding Production supervision Fabrication Production wpervision Assembly Indirect labor Maintenance & Repairs Indirect labor Material Handling Indirect labor: Engineering indirect labor, Raw Materials Purchasing section Quality Control 6 Indirect labo Packaging & Shipping 27 Indirect material Molding 28 indirectas Fabrication 39 ct material Ambly 20 U Molding 21 Fabrication 22 Utilities. Amb 23 Martigning and other equipment 24 Mengunding 25 Property 26 de 27 Medicine 28 Works.compertoninge 29 Others Part 30 Os Acting 31 Others Ad 32 here told 33 herries Secundum 34 opery Cost Classifications: Manufacturing / Amount Product / Period Nonmanufacturing Fored / Variable 5 400.000 Product MOH Fored $ 300,000 Product MOH Fad $ 50,000 Product MOH Ford $ 15,000 Product MOH $ 10,000 Product MOH 5 60,000 Product MOH Faxed 5 65,000 Product MOH Fund $ 58.000 Product MOH Fored 5 72.000 Product MOH Rad $ 68,000 Product MOH Find 5 170,000 Product MON F 5 93,000 Product MON $ Product MON $ 99.000 Product MON Fixed 5 18.000 Product MOM Var 5 13.000 Product Variable $ 8.000 Product MOH Variable 5 24.000 Product MOH Var 20,000 Product MOH Variable 5 6.000 Product MOH 5 12.000 Product MO $ 24.000 Product MOH $ 26.000 Product MOH 5 11,000 Product MOH 5 45.000 Product F $ 13.000 Product MON $ 165.000 Product MON 19.000 Product MON 5 56.000 Product MOH Run 3 48.000 Produit MH 5 44000 Product MOH Fad 5 110.000 Produce MOH 5 79,000 Product MON Var 5 165.000 Product MO $ 2,270.000 De 5 1,565.000 Produ Durat 100 7.000 000 Per - Cost Summary 36 Foto 37 Direct mai 30 Direct 30 Accounting 40 41 Advertising Portable Charts Sun esc B IV X Calibri (Body) 11 A A Wrap Text General Paste BIU v lil Merge & Center $ %) 137 A E $ S $ S $ $ $ $ $ 400,000 15,000 4,000 26,000 78,000 480,000 120,000 1,000 2,000 Period Period Period Period Period Period Period Period Period Selling Administrative Administrative Administrative Administrative Selling Selling Administrative Administrative Fixed Fixed Fixed Fixed Fixed Variable Fixed Fixed Variable Advertising 2 Depreciation on office equipment 3 Heat & electricity for the general office 4 Janitorial services for administrative offices 5 Salaries of accounts receivable/payable clerks 6 Sales commissions -7 Sales manager's salary & Supplies for administrative office 19 Customer billing supplies SO 51 52 53 56 55 56 57 58 59 60 61 62 63 64 65 66 62 68 69 70 71 22 73 74 75 76 77 78 79 80 81 Pivot Table Charts Sumi Cast Summa 18 C B D E F F G A Crispin Company Traditional Format Income Statement 8,000,000 8,000,000 8,000,000 8,000,000 4 Sales $ 5 Cost of goods sold 6 Gross margin $ 7 Selling and administrative expenses: 8 Selling 9 Administrative $ 10 Net Operating income $ 11 12 Crispin Company 14 Contribution Format Income Statement 25 Sales $ 16 Variable expenses 17 Cost of goods sold 18 Variable selling 19 Variable administrative $ 20 Contribution margin 5 21 Fixed expenses 22 Feed manufacturnig overhead 23 Fixed selling 24 Find administrative 25 Net operating income 26 27 26 fill in 29 Auto-Calc 30 31 8.000.000 1.090.000 36 35 36 a + 39 40 41 k my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 4. Assume the company wants to adapt the information in the "Cost Summary" tab to prepare a contribution format income statement within the "Income Statements" tab of your template, and using the Sum IFS function to quantify all variable and fixed expenses: a. Prepare a contribution format income statement. (Hint: The cost of goods sold should include all direct materials, direct labor, and variable manufacturing overhead. The fixed manufacturing overhead costs should be included within the "Fixed expenses" portion of the income statement.) b. Based on the contribution format income statement, what is the contribution margin? c. Based on the contribution format income statement, what is the net operating income? 4 Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Roq 4A Reg 4B Req 4C Prepare a contribution format income statement. (Hint: The cost of goods sold should include all direct materials, direct and variable manufacturing overhead. The fixed manufacturing overhead costs should be included within the "Fixed expe portion of the income statement.) The cost of goods sold in this income statement is $ 5,974,000 Items: 3095 Last synced at 2/4/21, 4:13 PM Connecting to: robert.w.luc a 14.000 22 Calibri (Body) 11 ' III General Wrap Text ] te BIU v A- == = Merge & Center $ %) X G Red Account Equipment depreciation: Molding Equipment depreciation: Fabrication Equipment depreciation Assembly Equipment depreciation Material Handling Equipment depreciation Other Production suprision Molding Production supervision Fabrication Production wpervision Assembly Indirect labor Maintenance & Repairs Indirect labor Material Handling Indirect labor: Engineering indirect labor, Raw Materials Purchasing section Quality Control 6 Indirect labo Packaging & Shipping 27 Indirect material Molding 28 indirectas Fabrication 39 ct material Ambly 20 U Molding 21 Fabrication 22 Utilities. Amb 23 Martigning and other equipment 24 Mengunding 25 Property 26 de 27 Medicine 28 Works.compertoninge 29 Others Part 30 Os Acting 31 Others Ad 32 here told 33 herries Secundum 34 opery Cost Classifications: Manufacturing / Amount Product / Period Nonmanufacturing Fored / Variable 5 400.000 Product MOH Fored $ 300,000 Product MOH Fad $ 50,000 Product MOH Ford $ 15,000 Product MOH $ 10,000 Product MOH 5 60,000 Product MOH Faxed 5 65,000 Product MOH Fund $ 58.000 Product MOH Fored 5 72.000 Product MOH Rad $ 68,000 Product MOH Find 5 170,000 Product MON F 5 93,000 Product MON $ Product MON $ 99.000 Product MON Fixed 5 18.000 Product MOM Var 5 13.000 Product Variable $ 8.000 Product MOH Variable 5 24.000 Product MOH Var 20,000 Product MOH Variable 5 6.000 Product MOH 5 12.000 Product MO $ 24.000 Product MOH $ 26.000 Product MOH 5 11,000 Product MOH 5 45.000 Product F $ 13.000 Product MON $ 165.000 Product MON 19.000 Product MON 5 56.000 Product MOH Run 3 48.000 Produit MH 5 44000 Product MOH Fad 5 110.000 Produce MOH 5 79,000 Product MON Var 5 165.000 Product MO $ 2,270.000 De 5 1,565.000 Produ Durat 100 7.000 000 Per - Cost Summary 36 Foto 37 Direct mai 30 Direct 30 Accounting 40 41 Advertising Portable Charts Sun esc B IV X Calibri (Body) 11 A A Wrap Text General Paste BIU v lil Merge & Center $ %) 137 A E $ S $ S $ $ $ $ $ 400,000 15,000 4,000 26,000 78,000 480,000 120,000 1,000 2,000 Period Period Period Period Period Period Period Period Period Selling Administrative Administrative Administrative Administrative Selling Selling Administrative Administrative Fixed Fixed Fixed Fixed Fixed Variable Fixed Fixed Variable Advertising 2 Depreciation on office equipment 3 Heat & electricity for the general office 4 Janitorial services for administrative offices 5 Salaries of accounts receivable/payable clerks 6 Sales commissions -7 Sales manager's salary & Supplies for administrative office 19 Customer billing supplies SO 51 52 53 56 55 56 57 58 59 60 61 62 63 64 65 66 62 68 69 70 71 22 73 74 75 76 77 78 79 80 81 Pivot Table Charts Sumi Cast Summa 18 C B D E F F G A Crispin Company Traditional Format Income Statement 8,000,000 8,000,000 8,000,000 8,000,000 4 Sales $ 5 Cost of goods sold 6 Gross margin $ 7 Selling and administrative expenses: 8 Selling 9 Administrative $ 10 Net Operating income $ 11 12 Crispin Company 14 Contribution Format Income Statement 25 Sales $ 16 Variable expenses 17 Cost of goods sold 18 Variable selling 19 Variable administrative $ 20 Contribution margin 5 21 Fixed expenses 22 Feed manufacturnig overhead 23 Fixed selling 24 Find administrative 25 Net operating income 26 27 26 fill in 29 Auto-Calc 30 31 8.000.000 1.090.000 36 35 36 a + 39 40 41 k my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 4. Assume the company wants to adapt the information in the "Cost Summary" tab to prepare a contribution format income statement within the "Income Statements" tab of your template, and using the Sum IFS function to quantify all variable and fixed expenses: a. Prepare a contribution format income statement. (Hint: The cost of goods sold should include all direct materials, direct labor, and variable manufacturing overhead. The fixed manufacturing overhead costs should be included within the "Fixed expenses" portion of the income statement.) b. Based on the contribution format income statement, what is the contribution margin? c. Based on the contribution format income statement, what is the net operating income? 4 Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Roq 4A Reg 4B Req 4C Prepare a contribution format income statement. (Hint: The cost of goods sold should include all direct materials, direct and variable manufacturing overhead. The fixed manufacturing overhead costs should be included within the "Fixed expe portion of the income statement.) The cost of goods sold in this income statement is $ 5,974,000 Items: 3095 Last synced at 2/4/21, 4:13 PM Connecting to: robert.w.luc a 14.000 22