Answered step by step

Verified Expert Solution

Question

1 Approved Answer

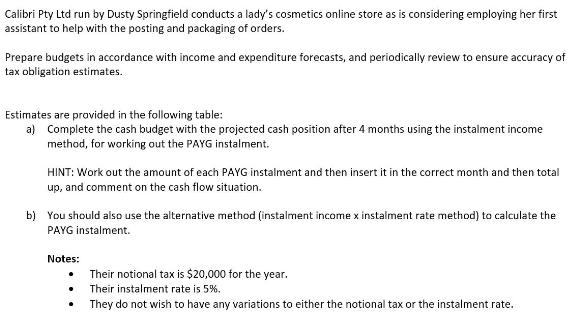

Calibri Pty Ltd run by Dusty Springfield conducts a lady's cosmetics online store as is considering employing her first assistant to help with the

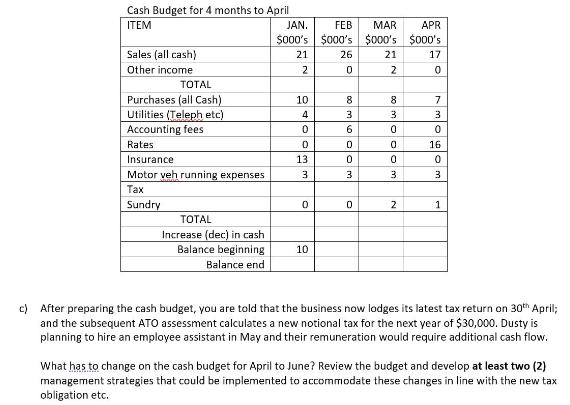

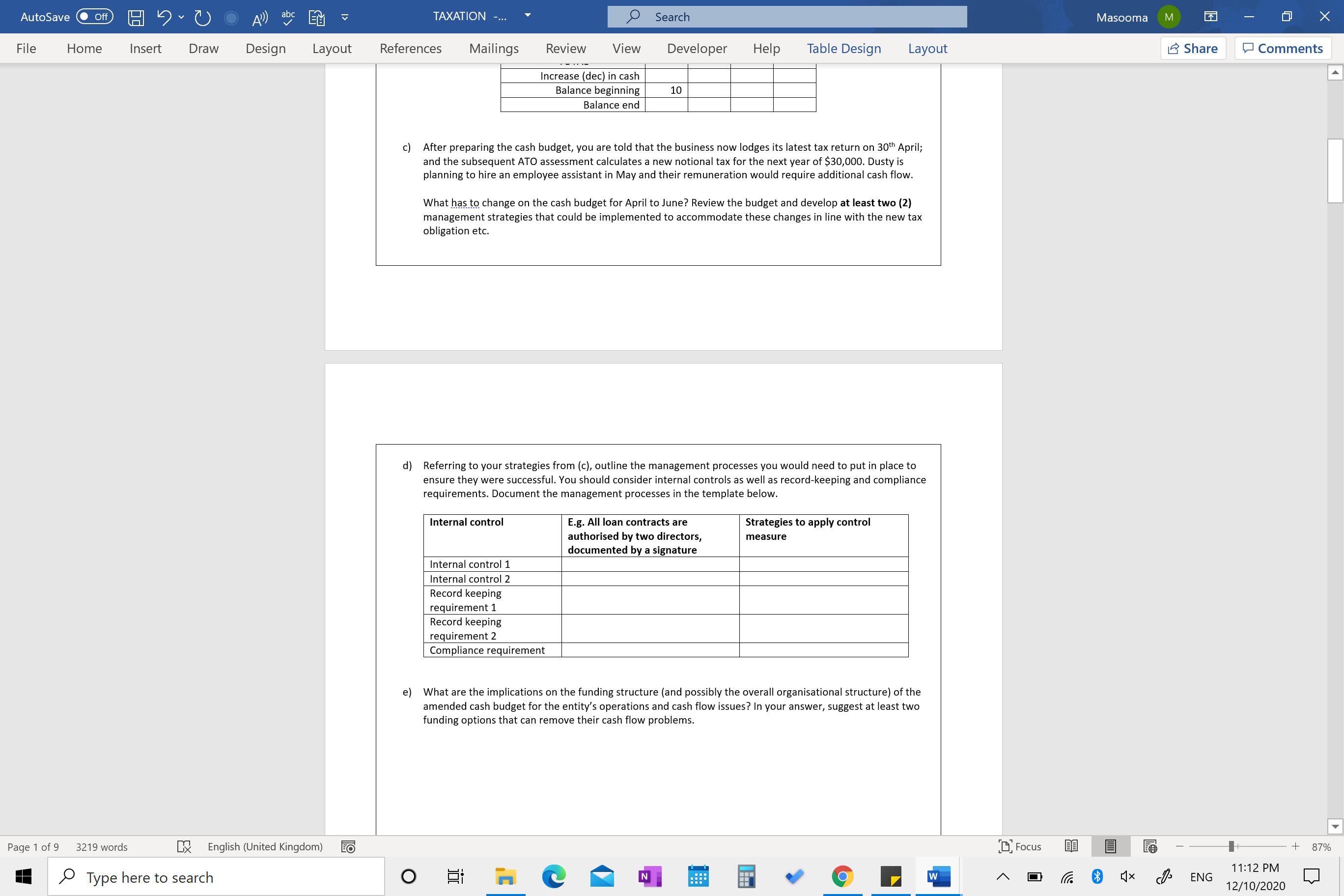

Calibri Pty Ltd run by Dusty Springfield conducts a lady's cosmetics online store as is considering employing her first assistant to help with the posting and packaging of orders. Prepare budgets in accordance with income and expenditure forecasts, and periodically review to ensure accuracy of tax obligation estimates. Estimates are provided in the following table: a) Complete the cash budget with the projected cash position after 4 months using the instalment income method, for working out the PAYG instalment. HINT: Work out the amount of each PAYG instalment and then insert it in the correct month and then total up, and comment on the cash flow situation. b) You should also use the alternative method (instalment income x instalment rate method) to calculate the PAYG instalment. Notes: Their notional tax is $20,000 for the year. Their instalment rate is 5%. They do not wish to have any variations to either the notional tax or the instalment rate. Cash Budget for 4 months to April ITEM Sales (all cash) Other income TOTAL Purchases (all Cash) Utilities (Teleph etc) Accounting fees Rates Insurance Motor veh running expenses Tax Sundry TOTAL Increase (dec) in cash Balance beginning Balance end JAN. $000's 21 2 10 4 0 0 13 Im 3 0 10 FEB $000's 26 0 omolc 8 3 6 0 0 3 0 MAR APR $000's $000's 21 17 2 0 8 WOOOW 00 3 0 0 0 3 N 7 3 0 16 0 3 1 c) After preparing the cash budget, you are told that the business now lodges its latest tax return on 30th April; and the subsequent ATO assessment calculates a new notional tax for the next year of $30,000. Dusty is planning to hire an employee assistant in May and their remuneration would require additional cash flow. What has to change on the cash budget for April to June? Review the budget and develop at least two (2) management strategies that could be implemented to accommodate these changes in line with the new tax obligation etc. AutoSave File A) abc E Home Insert Draw Design Layout Page 1 of 9 Off HU 3219 words English (United Kingdom) Type here to search ll TAXATION References Mailings Review View Increase (dec) in cash Balance beginning Balance end Internal control Search Developer Help Table Design After preparing the cash budget, you are told that the business now lodges its latest tax return on 30th April; and the subsequent ATO assessment calculates a new notional tax for the next year of $30,000. Dusty is planning to hire an employee assistant in May and their remuneration would require additional cash flow. Internal control 1 Internal control 2 Record keeping requirement 1 Record keeping requirement 2 Compliance requirement 10 What has to change on the cash budget for April to June? Review the budget and develop at least two (2) management strategies that could be implemented to accommodate these changes in line with the new tax obligation etc. Bi d) Referring to your strategies from (c), outline the management processes you would need to put in place to ensure they were successful. You should consider internal controls as well as record-keeping and compliance requirements. Document the management processes in the template below. Layout E.g. All loan contracts are authorised by two directors, documented by a signature Strategies to apply control measure e) What are the implications on the funding structure (and possibly the overall organisational structure) of the amended cash budget for the entity's operations and cash flow issues? In your answer, suggest at least two funding options that can remove their cash flow problems. Tim W Focus Masooma 1 M Share ENG Comments 11:12 PM 12/10/2020 + 87%

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

answer a preparation of cash budget for 4 months opening cash balance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started