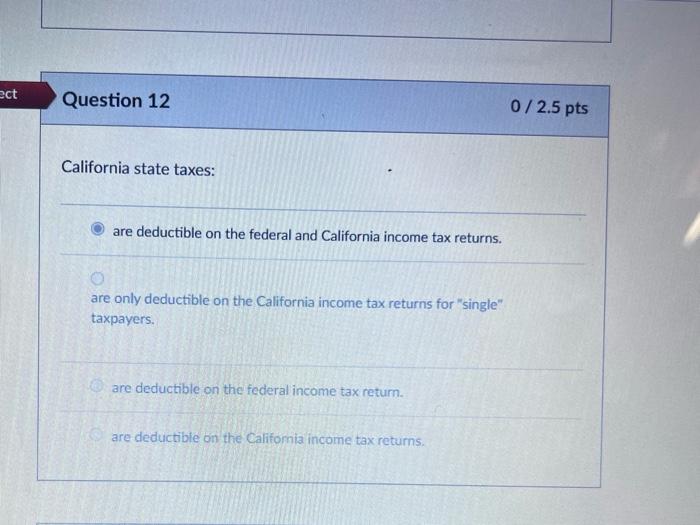

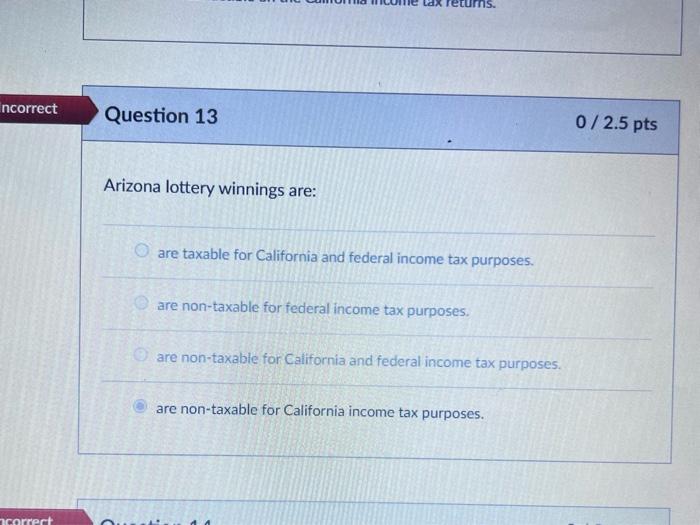

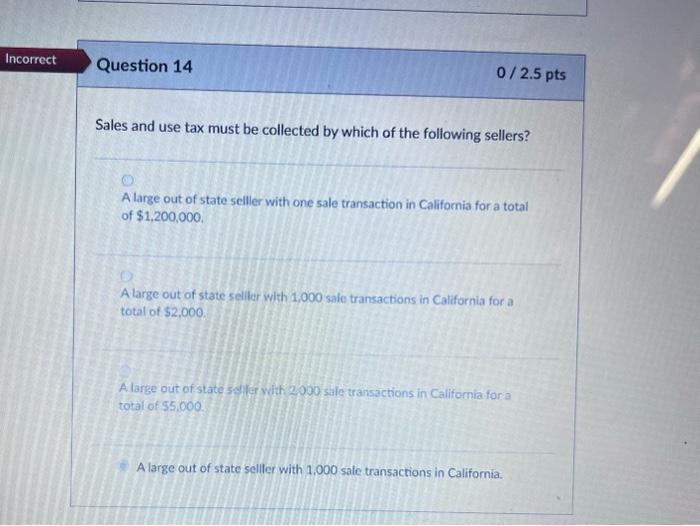

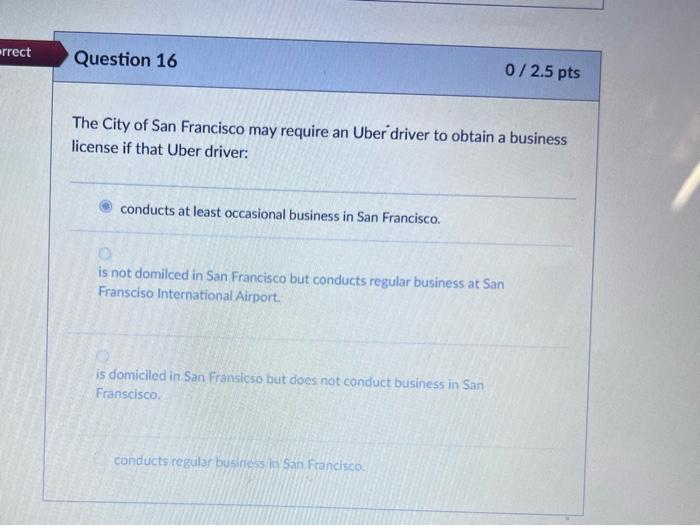

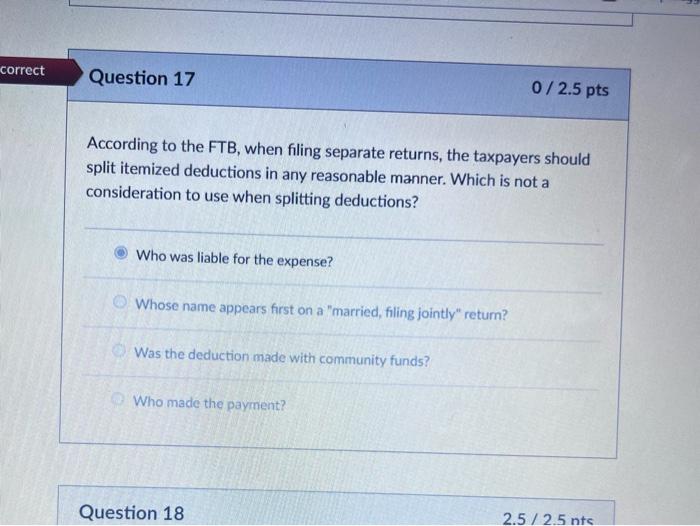

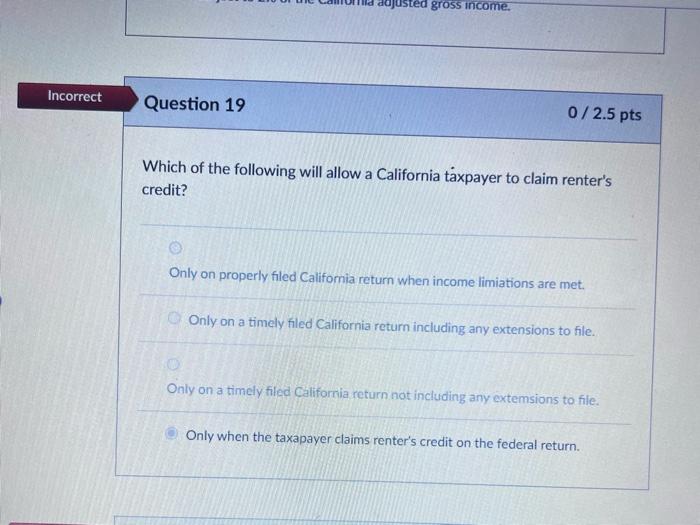

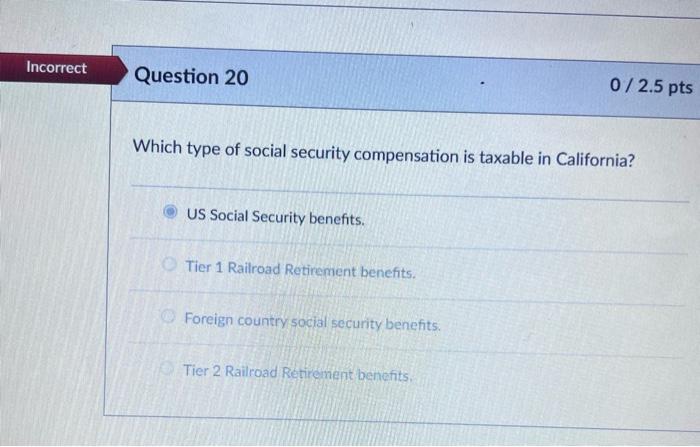

California state taxes: are deductible on the federal and California income tax returns. are only deductible on the California income tax returns for "single" taxpayers. are deductible on the federal income tax return. are deductible on the Califomia income tax returns. Question 13 0/2.5pts Arizona lottery winnings are: are taxable for California and federal income tax purposes. are non-taxable for federal income tax purposes. are non-taxable for California and federal income tax purposes. are non-taxable for California income tax purposes. Sales and use tax must be collected by which of the following sellers? A large out of state selller with one sale transaction in California for a total of $1,200,000. A large out of state seliler with 1,000 sale transactions in California for a total of $2,000 A large out of state seller yith 2090 sale transactions in California fora total of 55.000 A large out of state selller with 1,000 sale transactions in California. The City of San Francisco may require an Uber driver to obtain a business license if that Uber driver: conducts at least occasional business in San Francisco. is not domilced in San Francisco but conducts regular business at San Fransciso International Airport. is domiciled in San Fransicso but does not conduct business in San Franscisco. conducts regular busings in San Francisco. According to the FTB, when filing separate returns, the taxpayers should split itemized deductions in any reasonable manner. Which is not a consideration to use when splitting deductions? Who was liable for the expense? Whose name appears first on a "married, filing jointly" retum? Was the deduction made with community funds? Who made the payment? Which of the following will allow a California taxpayer to claim renter's credit? Only on properly filed Califormia return when income limiations are met. Only on a timely filed California return including any extensions to file. Only on a timely filed California return not including any extemsions to file. Only when the taxapayer claims renter's credit on the federal return. Which type of social security compensation is taxable in California? US Social Security benefits. Tier 1 Railroad Retirement benefits. Foreign country social security benefits. Tier 2 Railroad Retirement benefits