Question

Call option When St=1300 at time T, the payoff at T for the call option holder is ____________ (Required) When St=1300 at time T, the

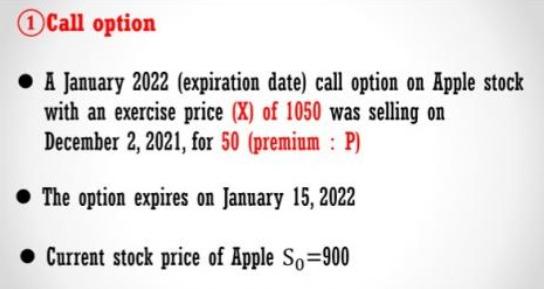

Call option

When St=1300 at time T, the payoff at T for the call option holder is ____________(Required)

When St=1300 at time T, the payoff at T for the call option writer is ____________(Required)

When St=1300 at time T, the net profits at T for the call option holder is ____________(Required)

When St=1300 at time T, the net profits at T for the call option writer is____________ (Required)

When St=1000 at time T, the payoff at T for the call option holder is ____________ (Required)

When St=1000 at time T, the payoff at T for the call option writer is ____________(Required)

When St=1000 at time T, the net profits at T for the call option holder is____________ (Required)

When St=1000 at time T, the net profits at T for the call option writer is ____________ (Required)

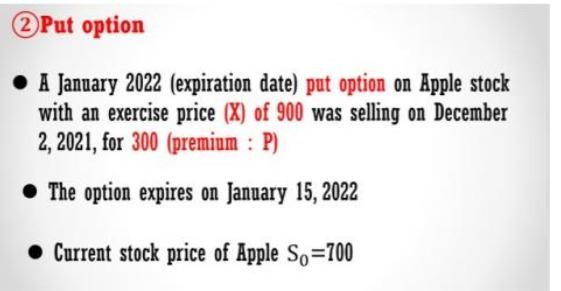

Put option

When St=1300 at time T, the payoff at T for the put option holder is ____________ (Required)

When St=1300 at time T, the payoff at T for the put option writer is ____________ (Required)

When St=1300 at time T, the net profits at T for the put option holder is ____________(Required)

When St=1300 at time T, the net profits at T for the put option writer is ____________(Required)

When St=400 at time T, the payoff at T for the put option holder is____________ (Required)

When St=400 at time T, the payoff at T for the put option writer is ____________ (Required)

When St=400 at time T, the net profits at T for the put option holder is ____________ (Required)

When St=400 at time T, the net profits at T for the put option writer is____________ (Required)

3.Which of the followings about trading options through the OTC market are true?

A multiple-choice question with several possible answers.(Required)

- Participants trade directly between two parties

- Options contracts traded through OTC are standardized

- Participants trade through the exchange

- Relatively Low liquidity

- Relatively High liquidity

- OTC is a decentralized market

- Relatively low counterparty risk

- Relatively high counterparty risk

- OTC is a centralized market

- Option contracts can be tailored to the needs of the traders

4. The Options Clearing Corporation (OCC) is the effective buyer and seller of options traded on exchange.

A question requiring a 'True/False' answer.(Required)

TrueFalse

5. Why options traded on exchange have lower counterparty risk?

A multiple-choice question with several possible answers.(Required)

- Marked to market

- Exchanges have the Options Clearing Corporation (OCC)

- Traded on margin

6. If the call option is in the money, this means the current stock price is higher than the strike price

A question requiring a 'True/False' answer.(Required)

TrueFalse

7. If the put option is in the money, this means the current stock price is higher than the strike price

A question requiring a 'True/False' answer.(Required)

TrueFalse

8. If the call option is out of the money, this means the current stock price is higher than the strike price

A question requiring a 'True/False' answer.(Required)

TrueFalse

9. If the put option is out of the money, this means the current stock price is higher than the strike price

A question requiring a 'True/False' answer.(Required)

TrueFalse

10. In the United States , most options took place on the NYSE and NASDAQ.

A question requiring a 'True/False' answer.(Required)

TrueFalse

11. In Japan, options are traded on Osaka securities exchange (Japan Exchange Group).

A question requiring a 'True/False' answer.(Required)

TrueFalse

12. Trading volumn indicates the total number of option cnntracts that are currently out there.

A question requiring a 'True/False' answer.(Required)

TrueFalse

No wrong answers please. Thanks for the help.

Call option A January 2022 (expiration date) call option on Apple stock with an exercise price (X) of 1050 was selling on December 2, 2021, for 50 (premium :P) The option expires on January 15, 2022 Current stock price of Apple So=900 2 Put option A January 2022 (expiration date) put option on Apple stock with an exercise price (X) of 900 was selling on December 2, 2021, for 300 (premium :P) The option expires on January 15, 2022 Current stock price of Apple Sn=700 Call option A January 2022 (expiration date) call option on Apple stock with an exercise price (X) of 1050 was selling on December 2, 2021, for 50 (premium :P) The option expires on January 15, 2022 Current stock price of Apple So=900 2 Put option A January 2022 (expiration date) put option on Apple stock with an exercise price (X) of 900 was selling on December 2, 2021, for 300 (premium :P) The option expires on January 15, 2022 Current stock price of Apple Sn=700Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started