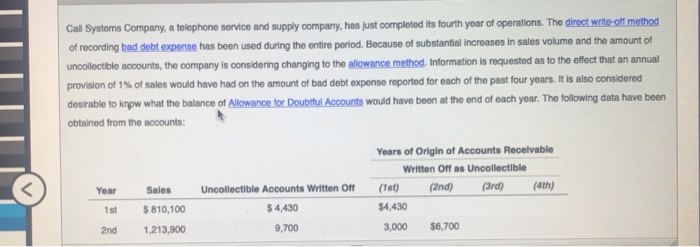

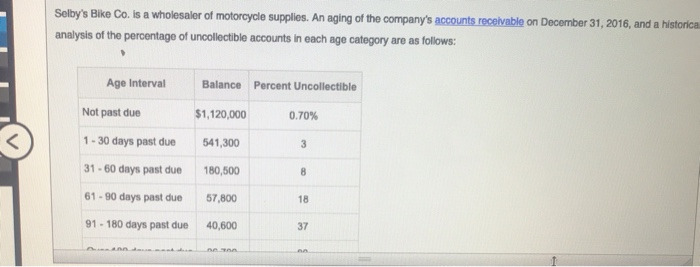

Call Systems Company, a telephone service and supply company, has just completed its fourth yoar of operations. The direct write-off method of recording bad debt expense has been used during the entire period. Because of substantial increases in sales volume and the amount of uncollectible accounts, the company is considering changing to the allowance method. Information is requested as to the effect that an annual provision of 1% of sales would have had on the amount of bad debt expense reported for each of the past four years. It is also considered desirable to knpw what the balance of Allowance for Doubthul Accounts would have been at the end of each year. The following data have obtained from the accounts: Years of Origin of Accounts Recelvable Written Off as Uncollectible (4th) (3rd) (1st) (2nd) Sales Uncollectible Accounts Written off Year $4,430 $4,430 $810,100 1st $6,700 3,000 9,700 2nd 1,213,900 Selby's Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31, 2016, and a historical analysis of the percentage of uncollectible accounts in each age category are as follows: Age Interval Balance Percent Uncollectible Not past due $1,120,000 0.70% 1-30 days past due 541,300 3 31-60 days past due 180,500 8 61-90 days past due 57,800 18 91-180 days past due 40,600 37 40o. ne z00 Call Systems Company, a telephone service and supply company, has just completed its fourth yoar of operations. The direct write-off method of recording bad debt expense has been used during the entire period. Because of substantial increases in sales volume and the amount of uncollectible accounts, the company is considering changing to the allowance method. Information is requested as to the effect that an annual provision of 1% of sales would have had on the amount of bad debt expense reported for each of the past four years. It is also considered desirable to knpw what the balance of Allowance for Doubthul Accounts would have been at the end of each year. The following data have obtained from the accounts: Years of Origin of Accounts Recelvable Written Off as Uncollectible (4th) (3rd) (1st) (2nd) Sales Uncollectible Accounts Written off Year $4,430 $4,430 $810,100 1st $6,700 3,000 9,700 2nd 1,213,900 Selby's Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31, 2016, and a historical analysis of the percentage of uncollectible accounts in each age category are as follows: Age Interval Balance Percent Uncollectible Not past due $1,120,000 0.70% 1-30 days past due 541,300 3 31-60 days past due 180,500 8 61-90 days past due 57,800 18 91-180 days past due 40,600 37 40o. ne z00