Answered step by step

Verified Expert Solution

Question

1 Approved Answer

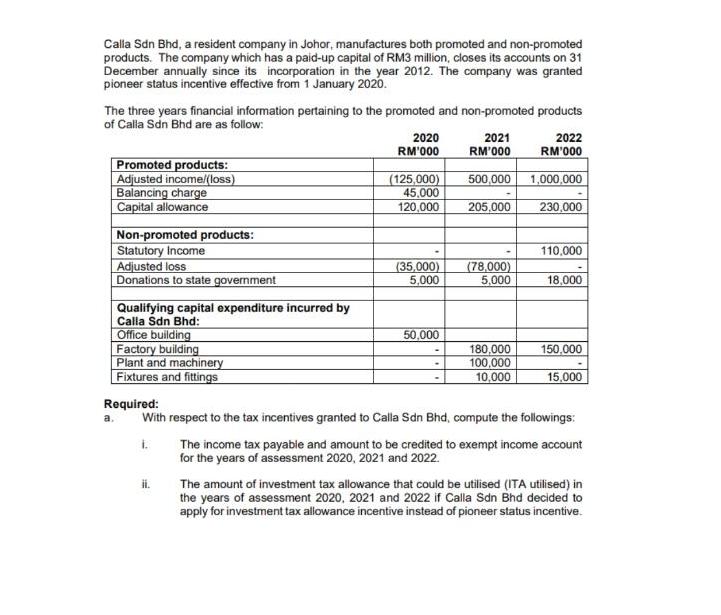

Calla Sdn Bhd, a resident company in Johor, manufactures both promoted and non-promoted products. The company which has a paid-up capital of RM3 million,

Calla Sdn Bhd, a resident company in Johor, manufactures both promoted and non-promoted products. The company which has a paid-up capital of RM3 million, closes its accounts on 31 December annually since its incorporation in the year 2012. The company was granted pioneer status incentive effective from 1 January 2020. The three years financial information pertaining to the promoted and non-promoted products of Calla Sdn Bhd are as follow: Promoted products: Adjusted income/(loss) Balancing charge Capital allowance a. Non-promoted products: Statutory Income Adjusted loss Donations to state government Qualifying capital expenditure incurred by Calla Sdn Bhd: Office building Factory building Plant and machinery Fixtures and fittings 2020 RM'000 ii. (125,000) 45,000 120,000 (35,000) 5,000 50,000 2021 2022 RM'000 RM'000 500,000 1,000,000 205,000 230,000 (78,000) 5,000 180,000 100,000 10,000 110,000 18,000 Required: With respect to the tax incentives granted to Calla Sdn Bhd, compute the followings: . The income tax payable and amount to be credited to exempt income account for the years of assessment 2020, 2021 and 2022. 150,000 15,000 The amount of investment tax allowance that could be utilised (ITA utilised) in the years of assessment 2020, 2021 and 2022 if Calla Sdn Bhd decided to apply for investment tax allowance incentive instead of pioneer status incentive.

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Income Tax Payable and Amount to be Credited to Exempt Income Account Year of Assessment 2020 2021 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started