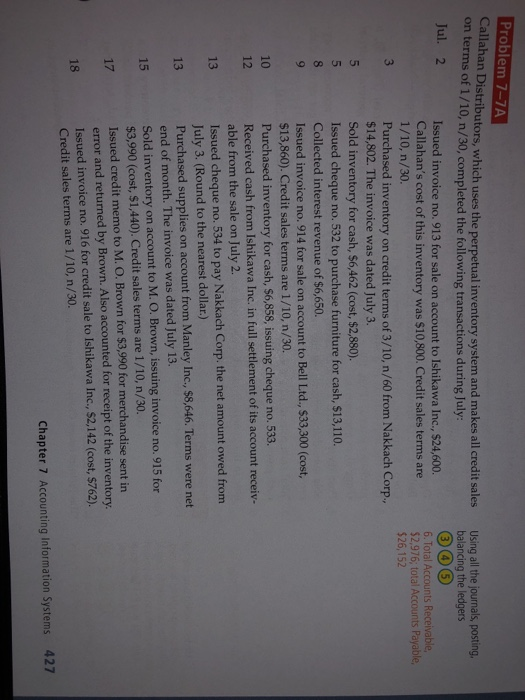

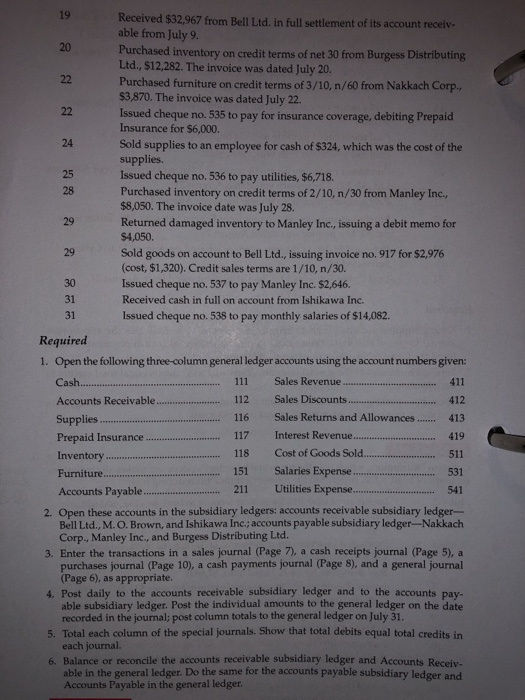

Callaha on terms of 1 /10, n/30, completed the following transactions during July: an Distributors, which uses the perpetual inventory system and makes all credit sales Using all the journals, posting balancing the ledgers Jul. 2 Issued invoice no. 913 for sale on account to Ishikawa Inc., $24,600. Callahan's cost of this inventory was $10,800. Credit sales terms are 1/10, n/30. Purchased inventory on credit terms of 3/10, n/60 from Nakkach Corp., $14,802. The invoice was dated July 3. Sold inventory for cash, $6,462 (cost, $2,880). Issued cheque no. 532 to purchase furniture for cash, $13,110. Collected interest revenue of $6,650. Issued invoice no. 914 for sale on account to Bell Ltd., $33,300 (cost, $13,860). Credit sales terms are 1/10, n/30. Purchased inventory for cash, $6,858, issuing cheque no. 533. Received cash from Ishikawa Inc. in full settlement of its account receiv- able from the sale on July 2. Issued cheque no. 534 to pay Nakkach Corp. the net amount owed from July 3. (Round to the nearest dollar.) Purchased supplies on account from Manley Inc, $8,646. Terms were net end of month. The invoice was dated July 13. Sold inventory on account to M. O. Brown, issuing invoice no. 915 for $3,990 (cost, $1,440). Credit sales terms are 1/10, n/30. Issued credit memo to M. O. Brown for $3,990 for merchandise sent in error and returned by Brown. Also accounted for receipt of the inventory Issued invoice no. 916 for credit sale to Ishikawa Inc, $2,142 (cost, $762). Credit sales terms are 1/10, n/30. 6. Total Accounts Receivable $2,976, total Accounts Payable $26,152 10 1 12 13 13 15 17 18 Chapter 7 Accounting Information Systems 427 Received $32,967 from Bell Ltd. in full settlement of its account receiv- able from July 9. Purchased inventory on credit terms of net 30 from Burgess Distributing Ltd, $12.282. The invoice was dated July 20. Purchased furniture on credit terms of 3/10, n/60 from Nakkach Corp, $3,870. The invoice was dated July 22 Issued cheque no. 535 to pay for insurance coverage, debiting Prepaid Insurance for $6,000. Sold supplies to an employee for cash of $324, which was the cost of the supplies. Issued cheque no. 536 to pay utilities, $6,718. Purchased inventory on credit terms of 2/10, n/30 from Manley Inc., $8,050. The invoice date was July 28. Returned damaged inventory to Manley Inc., issuing a debit memo for Sold goods on account to Bell Ltd., issuing invoice no. 917 for $2,976 (cost, $1,320). Credit sales terms are 1/10, n/30. Issued cheque no. 537 to pay Manley Inc. $2,646. Received cash in full on account from Ishikawa Inc. Issued cheque no. 538 to pay monthly salaries of $14,082. Required 1. Open the following three-column general ledger accounts using the account numbers given: 111 Sales Revenue411 Accounts Receivable.112 Sales Discounts.412 413 419 511 151 Salaries Expense531 Accounts Payatb.l.211 Utilities Expense...541 2. Open these accounts in the subsidiary ledgers: accounts receivable subsidiary ledger- 117 Interest Revenue 118 Cost of Goods Sold.. Prepaid Insurance Furniture.... Bell Ltd., M. O. Brown, and Ishikawa Inc.; accounts payable subsidiary ledger-Nak kach Corp., Manley Inc., and Burgess Distributing Ltd. 3. Enter the transactions in a sales journal (Page 7), a cash receipts journal (Page 5), a purchases journal (Page 10), a cash payments journal (Page 8), and a general journal (Page 6), as appropriate 4. Post daily to the accounts receivable subsidiary ledger and to the accounts pay- able subsidiary ledger. Post the individual amounts to the general ledger on the date recorded in the journal; post column totals to the general ledger on July 31. 5. Total each column of the special journals. Show that total debits equal total credits in each journal. 6. Balance or reconcile the accounts receivable subsidiary ledger and Accounts Receiy- able in the general ledger. Do the same for the accounts payable subsidiary ledger and Accounts Payable in the general ledger