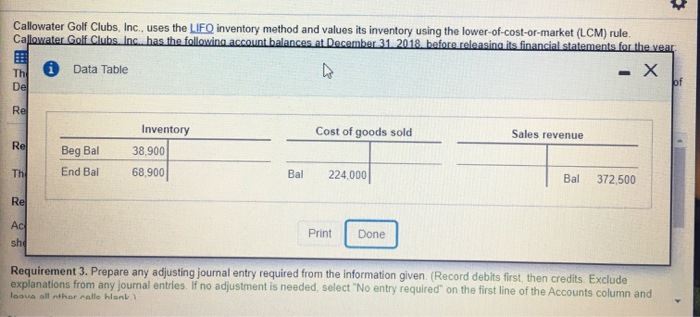

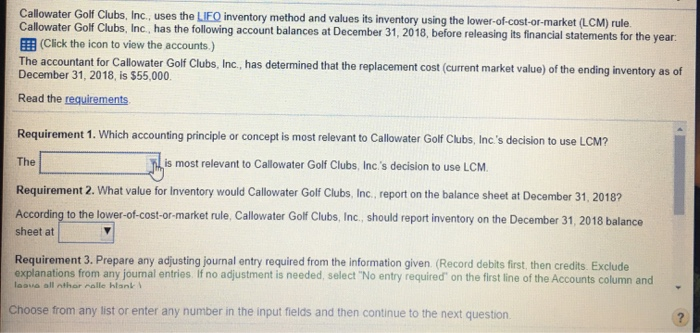

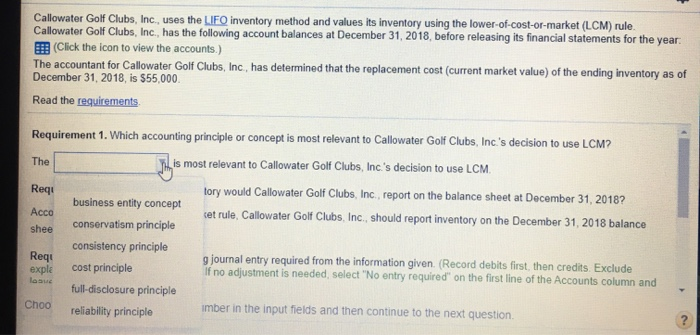

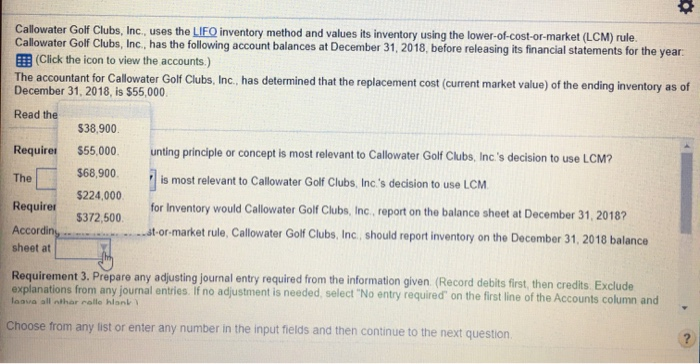

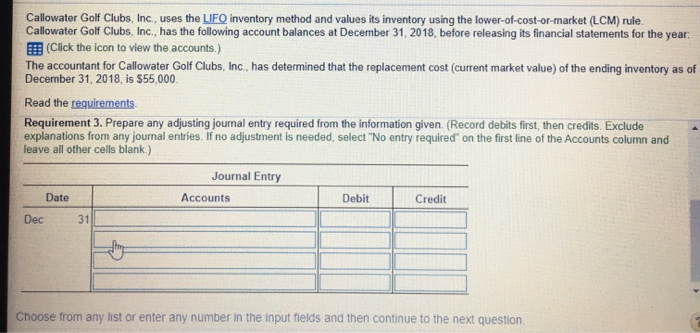

Callowater Golf Clubs, Inc., uses the LIFQ inventory method and values its inventory using the lower-of-cost-or-market (LCM) rule. Callowater Golf Clubs Inc. has the following account balances at December 31, 2018 before releasing its financial statements for the year Th i Data Table 6 - X of Del Rel Cost of goods sold Sales revenue Re Beg Bal Inventory 38,900 68,900 Th End Bal Bal 224.000 Bal 372.500 Re Ac she Print Done Requirement 3. Prepare any adjusting journal entry required from the information given (Record debits first, then credits. Exclude explanations from any journal entries. If no adjustment is needed, select "No entry required" on the first line of the Accounts column and love all other rolle han Callowater Golf Clubs, Inc., uses the LIFO inventory method and values its inventory using the lower-of-cost-or-market (LCM) rule. Callowater Golf Clubs, Inc., has the following account balances at December 31, 2018, before releasing its financial statements for the year: Click the icon to view the accounts.) The accountant for Callowater Golf Clubs, Inc., has determined that the replacement cost (current market value) of the ending inventory as of December 31, 2018, is $55,000 Read the requirements The Requirement 1. Which accounting principle or concept is most relevant to Callowater Golf Clubs, Inc.'s decision to use LCM? is most relevant to Callowater Golf Clubs, Inc.'s decision to use LCM Requirement 2. What value for Inventory would Callowater Golf Clubs, Inc., report on the balance sheet at December 31, 2018? According to the lower-of-cost-or-market rule, Callowater Golf Clubs, Inc., should report inventory on the December 31, 2018 balance sheet at Requirement 3. Prepare any adjusting journal entry required from the information given (Record debits first, then credits. Exclude explanations from any journal entries. If no adjustment is needed, select "No entry required' on the first line of the Accounts column and leave all thor rolle hlank Choose from any list or enter any number in the input fields and then continue to the next question Callowater Golf Clubs, Inc., uses the LJFO inventory method and values its inventory using the lower-of-cost-or-market (LCM) rule. Callowater Golf Clubs, Inc., has the following account balances at December 31, 2018, before releasing its financial statements for the year (Click the icon to view the accounts.) The accountant for Callowater Golf Clubs, Inc, has determined that the replacement cost (current market value) of the ending inventory as of December 31, 2018, is $55,000 Read the requirements The Req Requirement 1. Which accounting principle or concept is most relevant to Callowater Golf Clubs, Inc.'s decision to use LCM? Jis most relevant to Callowater Golf Clubs, Inc.'s decision to use LCM. tory would Callowater Golf Clubs, Inc., report on the balance sheet at December 31, 2018? business entity concept Acco cet rule. Callowater Golf Clubs, Inc., should report inventory on the December 31, 2018 balance conservatism principle consistency principle Reqs g journal entry required from the information given. (Record debits first, then credits. Exclude exple cost principle If no adjustment is needed, select "No entry required" on the first line of the Accounts column and full-disclosure principle Choo reliability principle imber in the input fields and then continue to the next question. shee g o Callowater Golf Clubs, Inc., uses the LIFO inventory method and values its inventory using the lower-of-cost-or-market (LCM) rule. Callowater Golf Clubs, Inc., has the following account balances at December 31, 2018, before releasing its financial statements for the year. (Click the icon to view the accounts.) The accountant for Callowater Golf Clubs, Inc., has determined that the replacement cost current market value) of the ending inventory as of December 31, 2018, is $55,000 Read the $38.900 Requires $55,000 unting principle or concept is most relevant to Callowater Golf Clubs, Inc.'s decision to use LCM? The $68,900 is most relevant to Callowater Golf Clubs, Inc.'s decision to use LCM $224,000 Requires for Inventory would Callowater Golf Clubs, Inc., report on the balance sheet at December 31, 2018? $372,500 According --t-or-market rule, Callowater Golf Clubs, Inc. should report inventory on the December 31, 2018 balance sheet at Requirement 3. Prepare any adjusting journal entry required from the information given (Record debits first, then credits. Exclude explanations from any journal entries. If no adjustment is needed select "No entry required" on the first line of the Accounts column and leave all thar rolle hlon Choose from any list or enter any number in the input fields and then continue to the next question Callowater Golf Clubs, Inc., uses the LIFO inventory method and values its inventory using the lower-of-cost-or-market (LCM) rule. Callowater Golf Clubs, Inc., has the following account balances at December 31, 2018, before releasing its financial statements for the year: Click the icon to view the accounts.) The accountant for Callowater Golf Clubs, Inc, has determined that the replacement cost (current market value) of the ending inventory as of December 31, 2018, is $55,000 Read the requirements Requirement 3. Prepare any adjusting journal entry required from the information given. (Record debits first, then credits. Exclude explanations from any journal entries. If no adjustment is needed, select "No entry required on the first line of the Accounts column and leave all other cells blank.) Journal Entry Date Accounts Debit Credit Dec 31 Choose from any list or enter any number in the input fields and then continue to the next