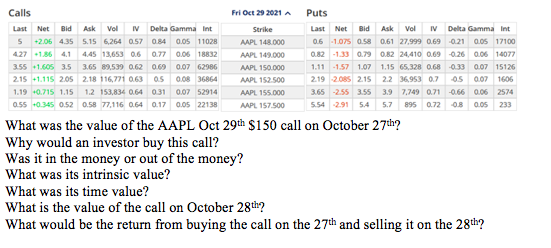

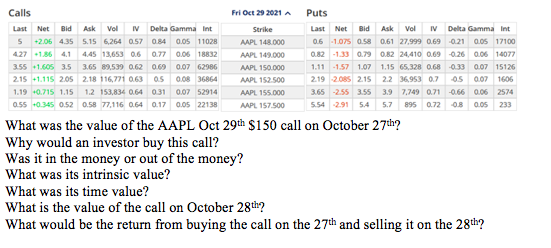

Calls Last Net bid Ask Vol IV Delta Gamma Int 5 +2.06 4.35 5.15 6,264 0.57 0.84 0.05 11028 427 136 41 445 13,653 0.6 0.77 0.06 18832 3.55 +1.605 3.5 3.65 89,599 0.62 0.69 0.07 62986 2.15 +1.115 205 2.18 116,771 063 05 0.08 36864 1.19 0.715 1.15 1.2 153,834 0.64 031 0.07 52914 0.55 +0:345 0.52 0.58 77,116 0.64 0.17 0.05 22138 Fri Oct 29 2021 A Strike AAPL 148.000 AAPL 149.000 AAPL 150.000 AAPL 152.500 AAPL 155.000 AAPL 157.500 Puts Last Net Bid Vol IV Delta Gamma int 0.6 1.075 0.58 0.61 27.999 0.69 0.21 0.05 17100 0.82 -1.33 0.79 0.82 24.410 0.69 0.26 0.06 14077 1.11 -1.57 1.07 1.15 65,328 0.68 0.33 0.07 15126 2.19 2.085 215 22 36,953 02 05 0.07 1606 3.65 -2.55 3.55 3.9 7.749 0.71 0.66 0.06 2574 5.54 2.91 5.4 5.7 895 0.72 0.8 0.05 233 What was the value of the AAPL Oct 29th $150 call on October 27th? Why would an investor buy this call? Was it in the money or out of the money? What was its intrinsic value? What was its time value? What is the value of the call on October 28th? What would be the return from buying the call on the 27th and selling it on the 28th? Calls Last Net bid Ask Vol IV Delta Gamma Int 5 +2.06 4.35 5.15 6,264 0.57 0.84 0.05 11028 427 136 41 445 13,653 0.6 0.77 0.06 18832 3.55 +1.605 3.5 3.65 89,599 0.62 0.69 0.07 62986 2.15 +1.115 205 2.18 116,771 063 05 0.08 36864 1.19 0.715 1.15 1.2 153,834 0.64 031 0.07 52914 0.55 +0:345 0.52 0.58 77,116 0.64 0.17 0.05 22138 Fri Oct 29 2021 A Strike AAPL 148.000 AAPL 149.000 AAPL 150.000 AAPL 152.500 AAPL 155.000 AAPL 157.500 Puts Last Net Bid Vol IV Delta Gamma int 0.6 1.075 0.58 0.61 27.999 0.69 0.21 0.05 17100 0.82 -1.33 0.79 0.82 24.410 0.69 0.26 0.06 14077 1.11 -1.57 1.07 1.15 65,328 0.68 0.33 0.07 15126 2.19 2.085 215 22 36,953 02 05 0.07 1606 3.65 -2.55 3.55 3.9 7.749 0.71 0.66 0.06 2574 5.54 2.91 5.4 5.7 895 0.72 0.8 0.05 233 What was the value of the AAPL Oct 29th $150 call on October 27th? Why would an investor buy this call? Was it in the money or out of the money? What was its intrinsic value? What was its time value? What is the value of the call on October 28th? What would be the return from buying the call on the 27th and selling it on the 28th