Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calvin Sparky - Business Income Galvin Sparky is an electrician operating his own business as a sole proprietorship. In rocent years, he has found himself

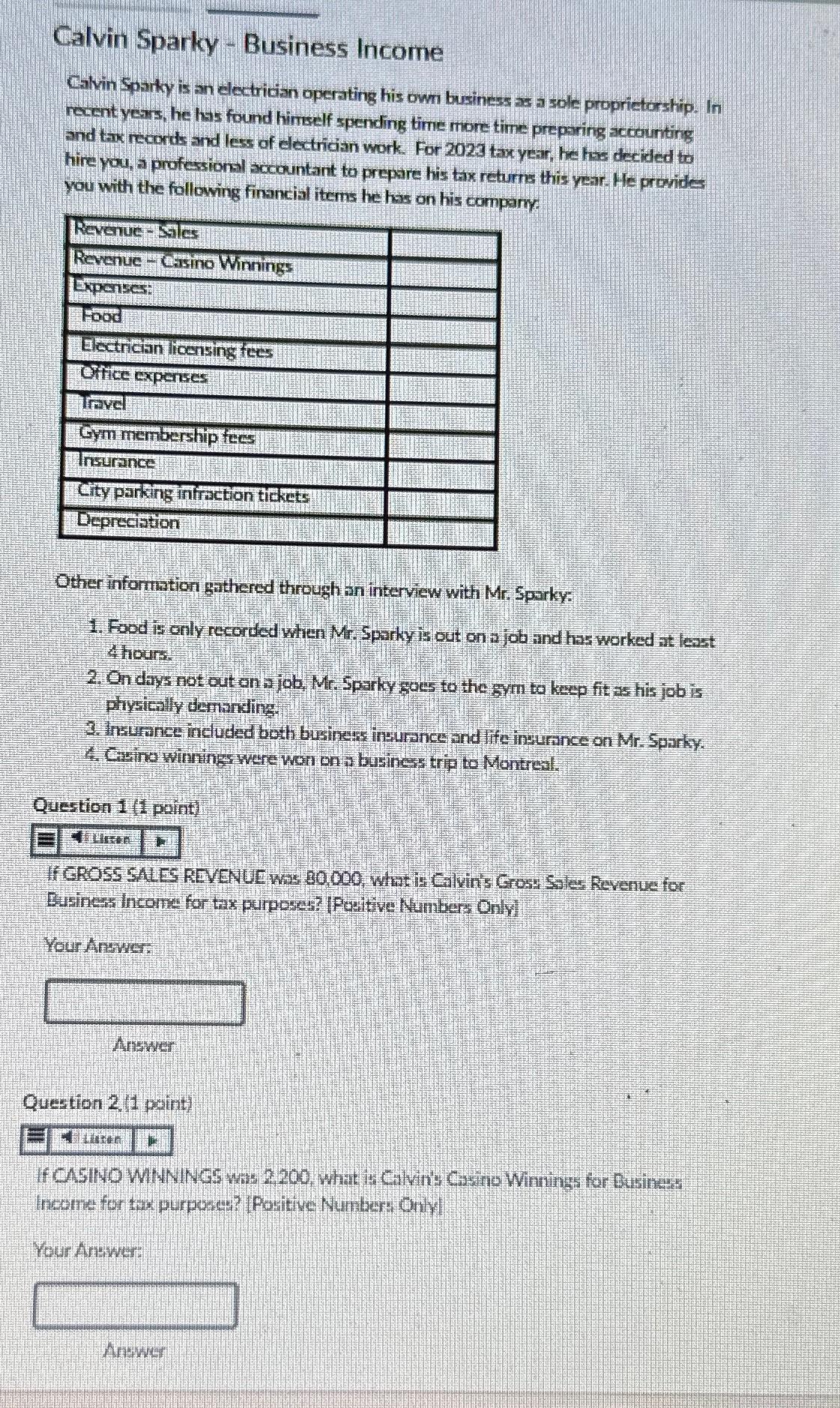

Calvin Sparky Business Income

Galvin Sparky is an electrician operating his own business as a sole proprietorship. In rocent years, he has found himself spending time more time preparing sccounting and tax records and less of electrician work. For tax year, he hes decided to hire you, a professional accountant to prepare his tax returns this year. He provides you with the following financial items he has on his compary

Other informstion sathered through an inerview with Mr Sparky:

Food is only reconded when M Sparky is out on fob and has worked at least hours.

Onday not outon wob Me Sparky goes to the gym to keep fit as his job is physialif dembins

neunet included both business insurance and if e insurnce on Mr Sparky.

Question point

Your Anewer

Answer

Question point

Miliner

Vour Arewer:

Anewer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started