Answered step by step

Verified Expert Solution

Question

1 Approved Answer

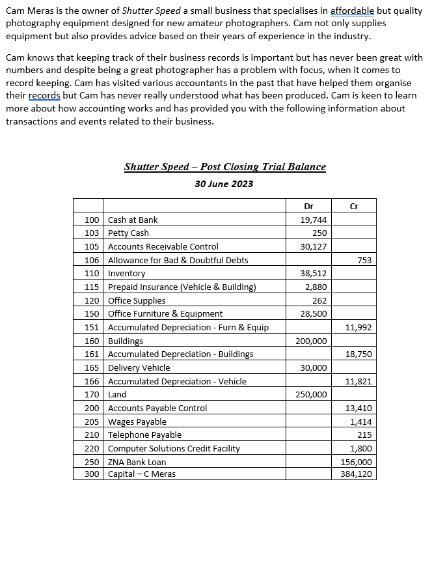

Cam Meras is the owner of Shutter Speed a small business that specialises in affordable but quality photography equipment designed for new amateur photographers.

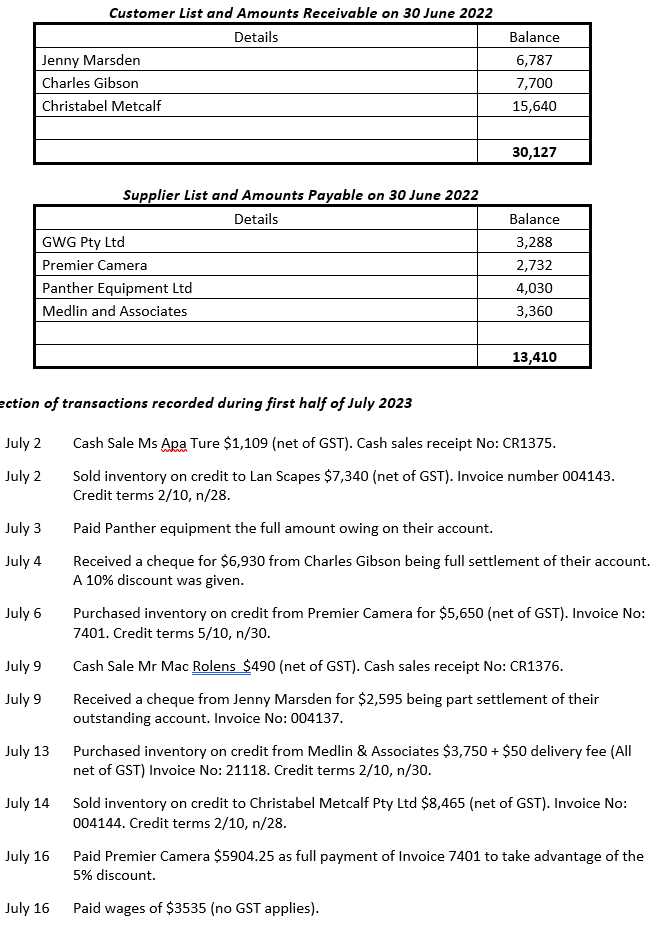

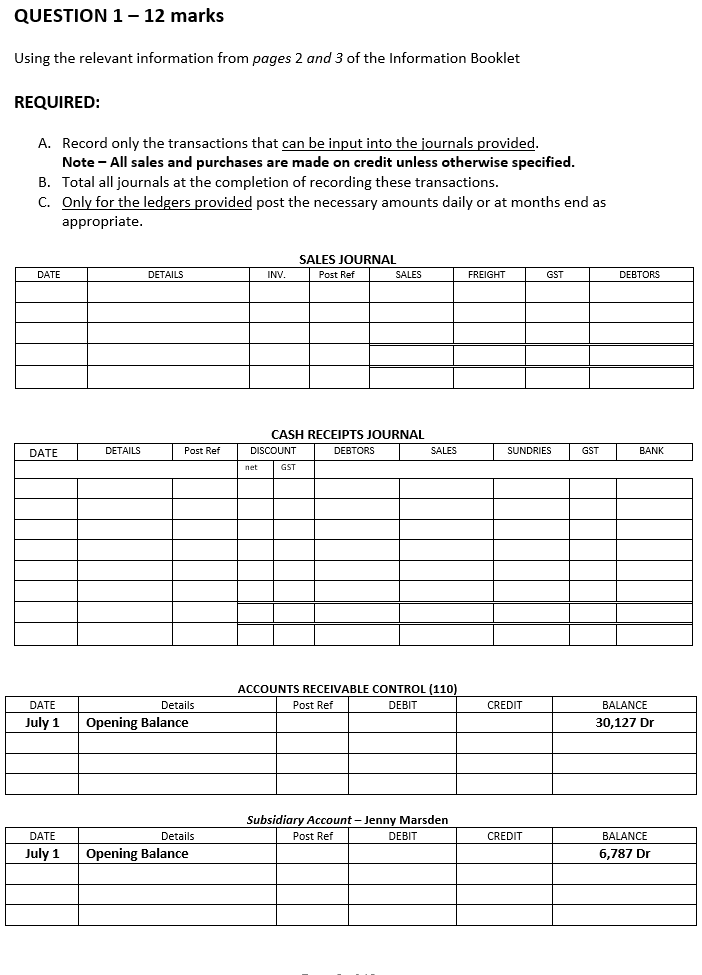

Cam Meras is the owner of Shutter Speed a small business that specialises in affordable but quality photography equipment designed for new amateur photographers. Cam not only supplies equipment but also provides advice based on their years of experience in the industry. Cam knows that keeping track of their business records is important but has never been great with numbers and despite being a great photographer has a problem with focus, when it comes to record keeping. Cam has visited various accountants in the past that have helped them organise their records but Cam has never really understood what has been produced. Cam is keen to learn more about how accounting works and has provided you with the following information about transactions and events related to their business. Shutter Speed - Post Closing Trial Balance 30 June 2023 Dr Cr 100 Cash at Bank 19,744 103 Petty Cash 250 105 Accounts Receivable Control 30,127 106 Allowance for Bad & Doubtful Debts 753 110 Inventory 38,512 115 Prepaid Insurance (Vehicle & Building) 2,880 120 Office Supplies 262 150 Office Furniture & Equipment 28,500 151 Accumulated Depreciation - Furn & Equip 11,992 160 Buildings 200,000 161 Accumulated Depreciation - Buildings 18,750 165 Delivery Vehicle 30,000 166 Accumulated Depreciation - Vehicle 11,8211 170 Land 250,000 200 Accounts Payable Control 13,410 205 Wages Payable 1,414 210 Telephone Payable 220 Computer Solutions Credit Facility 250 ZNA Bank Loan 300 Capital C Meras 215 1,800 156,000 384,120 Customer List and Amounts Receivable on 30 June 2022 Jenny Marsden Charles Gibson Christabel Metcalf Details Supplier List and Amounts Payable on 30 June 2022 GWG Pty Ltd Premier Camera Panther Equipment Ltd Medlin and Associates Details Balance 6,787 7,700 15,640 30,127 Balance 3,288 2,732 4,030 3,360 13,410 ection of transactions recorded during first half of July 2023 July 2 Cash Sale Ms Apa Ture $1,109 (net of GST). Cash sales receipt No: CR1375. July 2 July 3 July 4 July 6 Sold inventory on credit to Lan Scapes $7,340 (net of GST). Invoice number 004143. Credit terms 2/10, n/28. Paid Panther equipment the full amount owing on their account. Received a cheque for $6,930 from Charles Gibson being full settlement of their account. A 10% discount was given. Purchased inventory on credit from Premier Camera for $5,650 (net of GST). Invoice No: 7401. Credit terms 5/10, n/30. July 9 Cash Sale Mr Mac Rolens $490 (net of GST). Cash sales receipt No: CR1376. July 9 July 13 July 14 July 16 Received a cheque from Jenny Marsden for $2,595 being part settlement of their outstanding account. Invoice No: 004137. Purchased inventory on credit from Medlin & Associates $3,750 + $50 delivery fee (All net of GST) Invoice No: 21118. Credit terms 2/10, n/30. Sold inventory on credit to Christabel Metcalf Pty Ltd $8,465 (net of GST). Invoice No: 004144. Credit terms 2/10, n/28. Paid Premier Camera $5904.25 as full payment of Invoice 7401 to take advantage of the 5% discount. July 16 Paid wages of $3535 (no GST applies). QUESTION 1 - 12 marks Using the relevant information from pages 2 and 3 of the Information Booklet REQUIRED: A. Record only the transactions that can be input into the journals provided. Note - All sales and purchases are made on credit unless otherwise specified. B. Total all journals at the completion of recording these transactions. C. Only for the ledgers provided post the necessary amounts daily or at months end as appropriate. DATE DETAILS INV. SALES JOURNAL Post Ref SALES FREIGHT GST DEBTORS CASH RECEIPTS JOURNAL DISCOUNT DEBTORS DATE DETAILS Post Ref net DATE Details July 1 Opening Balance DATE Details July 1 Opening Balance GST SALES SUNDRIES GST BANK ACCOUNTS RECEIVABLE CONTROL (110) Post Ref DEBIT Subsidiary Account - Jenny Marsden Post Ref DEBIT CREDIT BALANCE 30,127 Dr CREDIT BALANCE 6,787 Dr

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Required A Transactions for the Journals Sales Journal DATE DETAILS Port Ref SALES FREIGHT GST DEBTO...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started