Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Camas Sound Center pays $300,000 for a group purchase of land, building, and eg pment. At the time of acquisition, the land has a

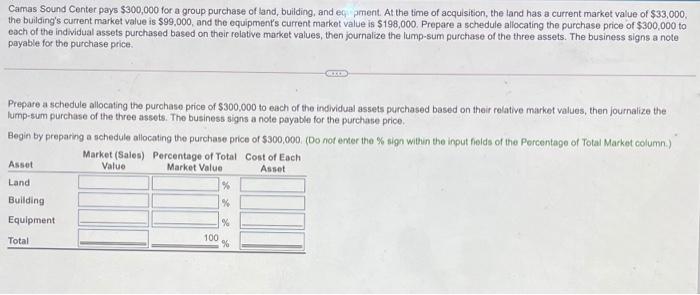

Camas Sound Center pays $300,000 for a group purchase of land, building, and eg pment. At the time of acquisition, the land has a current market value of $33,00, the building's current market value is $99,000, and the equipment's current market value is $198,000. Prepare a schedule allocating the purchase price of $300,000 to each of the individual assets purchased based on their relative market values, then journalize the lump-sum purchase of the three assets. The business signs a note payable for the purchase price. Prepare a schedule allocating the purchase price of $300,000 to each of the individual assets purchased based on their relative market values, then journalize the lump-sum purchase of the three assets. The business signs a note payable for the purchase price. Begin by preparing a schedule allocating the purchase price of $300,000. (Do not enter the % sign within the input fields of the Percentage of Total Market column.) Market (Sales) Percentage of Total Cost of Each Value Asset Market Value Asset Land Building Equipment Total 100

Step by Step Solution

★★★★★

3.60 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution Amount Market Sales Percentage of Total Cost of Each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started