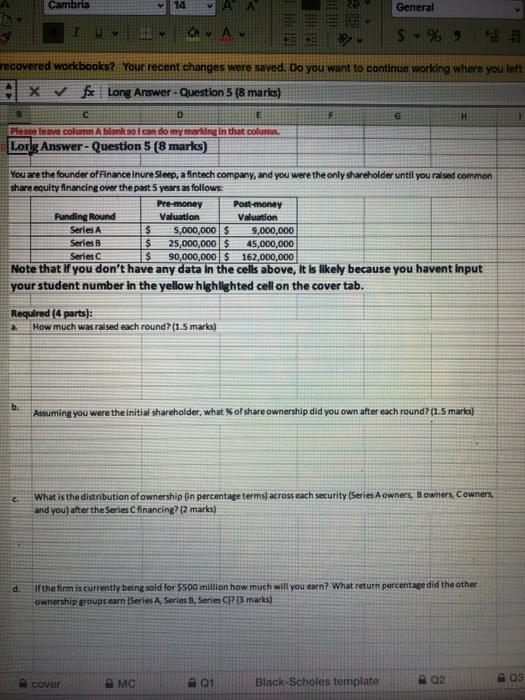

Cambria 14 > General u A $% 5. ! recovered workbooks? Your recent changes were saved. Do you want to continue working where you left Fox Long Answer - Question 5 (8 marks) D E CH Please leave column A blanke so can do my maring in that colum. Lorg Answer - Question 5 (8 marks) G You are the founder of Finance inure Sleep, afintech company, and you were the only shareholder until you raised common share equity financing over the past 5 years as follows: Pre-money Post-money Funding Round Valuation Valuation Series $ 5,000,000 $ 9,000,000 Series $ 25,000,000 $ 45,000,000 Series $ 90,000,000 $ 162,000,000 Note that if you don't have any data in the cells above, it is likely because you havent Input your student number in the yellow highlighted cell on the cover tab. Required (4 parts): How much was raised each round? (1.5 marks) b. Assuming you were the initial shareholder, what of share ownership did you own after each round? (1.5 marks) c What is the distribution of ownership in percentage terms across each security Series A owners, Bowners, Cowners, and you after the Series financing? 12 marks) If the firm is currently being sold for $500 million how much will you earn? What return percentage did the other ownership groups earn Series A Series B, Series ?3. marks) Covor 03 AMC 01 Q2 Black Scholes template Cambria 14 > General u A $% 5. ! recovered workbooks? Your recent changes were saved. Do you want to continue working where you left Fox Long Answer - Question 5 (8 marks) D E CH Please leave column A blanke so can do my maring in that colum. Lorg Answer - Question 5 (8 marks) G You are the founder of Finance inure Sleep, afintech company, and you were the only shareholder until you raised common share equity financing over the past 5 years as follows: Pre-money Post-money Funding Round Valuation Valuation Series $ 5,000,000 $ 9,000,000 Series $ 25,000,000 $ 45,000,000 Series $ 90,000,000 $ 162,000,000 Note that if you don't have any data in the cells above, it is likely because you havent Input your student number in the yellow highlighted cell on the cover tab. Required (4 parts): How much was raised each round? (1.5 marks) b. Assuming you were the initial shareholder, what of share ownership did you own after each round? (1.5 marks) c What is the distribution of ownership in percentage terms across each security Series A owners, Bowners, Cowners, and you after the Series financing? 12 marks) If the firm is currently being sold for $500 million how much will you earn? What return percentage did the other ownership groups earn Series A Series B, Series ?3. marks) Covor 03 AMC 01 Q2 Black Scholes template