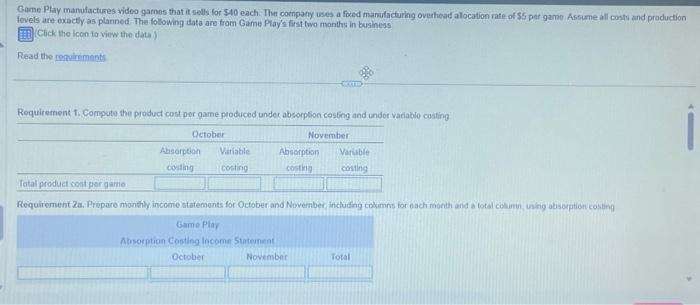

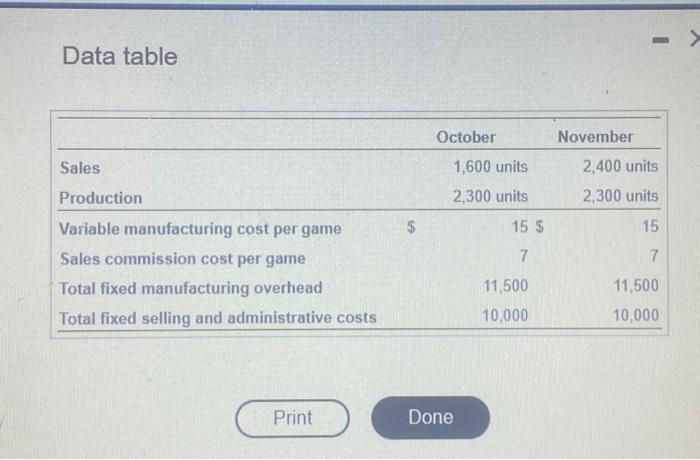

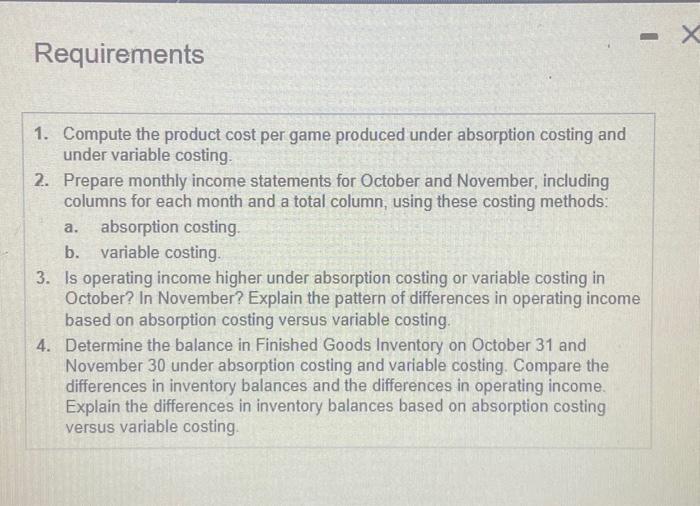

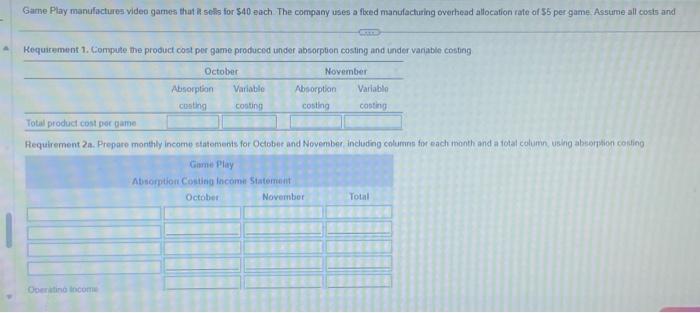

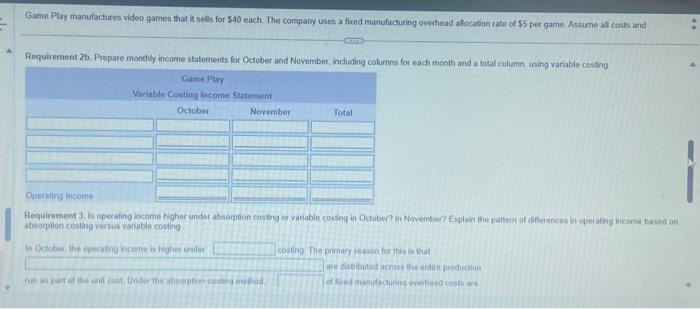

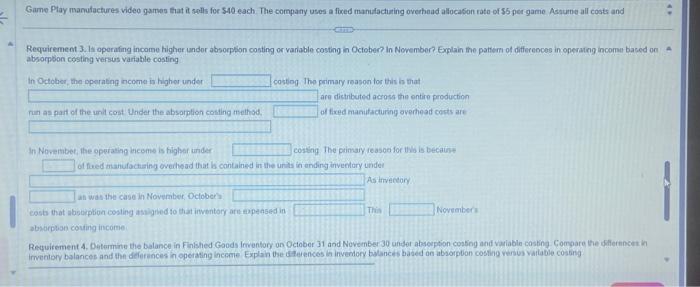

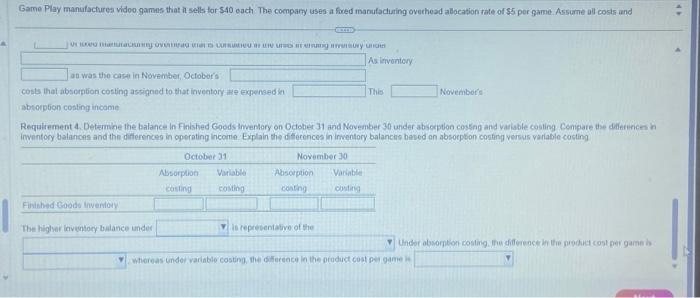

Came Play manufactures videa games that it sells lor 40 each. The company uses a foced manulacturing ovehicad alocation rate of $5 per game Assame all conts and production fevels are exactly as planned The following dato are trom Game Playlt fist foo manths in business Click the icen to view the data ) Read the repilements Requirement 1. Compute the product cost por game produced under absomption cosfing and under variable costing Data table Requirements 1. Compute the product cost per game produced under absorption costing and under variable costing. 2. Prepare monthly income statements for October and November, including columns for each month and a total column, using these costing methods: a. absorption costing. b. variable costing. 3. Is operating income higher under absorption costing or variable costing in October? In November? Explain the pattern of differences in operating income based on absorption costing versus variable costing. 4. Determine the balance in Finished Goods Inventory on October 31 and November 30 under absorption costing and variable costing. Compare the differences in inventory balances and the differences in operating income. Explain the differences in inventory balances based on absorption costing versus variable costing Game Play manufactures video games that i sels for $40 each. The company uses a floced manufacturing overhead allocation rate of $5 per game Assume all costs and Kequirement 1. Gormpute the product cost per game producod under absorpbon costing and under vanable costing Game Ptay manufactures video games that it sells for $40 each. The company uses a fixed manufacturing ovechead alocation rate of 55 per game Acsume al cosh and Requiremeot 26. Prepare monthy income statements for October and November, Including colurnis for each manth and a total column, using variable costhg Requirement J. is operating incame higher under absomption coiting or variable cosing in October? in Noveriber? Expiain the pattain of affierencins in eperating income based an aboorptien costing versus variable costing in Gctaber, the operathg incomer is higher under cosing The primary ieason for this is that are dintibuted acroks the entire prodikcooe ot fiked manufocturion everbead costio ars. Requiremeet 3. Is operafing income higher undor absorption costing or varlable costing in October? in November? Explain the pattem of differeoces in operatng income baced on absorpobon costing versus variable costing In October, the operating income is higher under costing The primary reason for this hy that are dictributed across the entire production run as part of the unit cost Under the absarption cotiling mothod. of fixed manuficturing overheat cents are In Nowembet, the operating inceme is highar under costing the ptimary reason for the is becaine of fued manufactising ovehead that is cantained in the units in ending inverlory under As tirveceary. at was the case in Noveraber Oclober? Costs that absorption cosling asigined to that irmentory art:expensed in This Novenber: absarplan coving income Requirement 4. Datarmine the balance in Finished Goods Imentory on October 31 and November 30 under absesption cossing and variable costing Compare the Giflerencen in costs that absemption costing assigned to that inventory ate expensed k absouption costing income The higlver inventory bialance under is representative of the As isvention This Novembot's