Question

Cameron Enterprises conducted two foreign-currency transactions on September 1, Year 2. In the first transaction, it sold E750,000(E represents Euro) in merchandise to a foreign

Cameron Enterprises conducted two foreign-currency transactions on September 1, Year 2. In the first transaction, it sold E750,000(E represents Euro) in merchandise to a foreign company. Cameron agreed to a note receivable for collection of the receivable. The note receivable was due on September 1, Year 6. The foreign company is well established and there is no risk of default. The note has an interest rate of 10 percent per year, payable at December 31, each year. Both the interest and the note will be paid in Euros. This receivable is not hedged in any way. In the second transaction, Cameron purchased SF 1,200,000 worth of inventory from a country in another foreign country. This amount is payable on November 1, Year 3. There is no interest on this liability and it is not hedged.

Required:

Prepare all the journal entries for Years 2 and 3 for the two transactions. Assume a Decembe 31 year end.

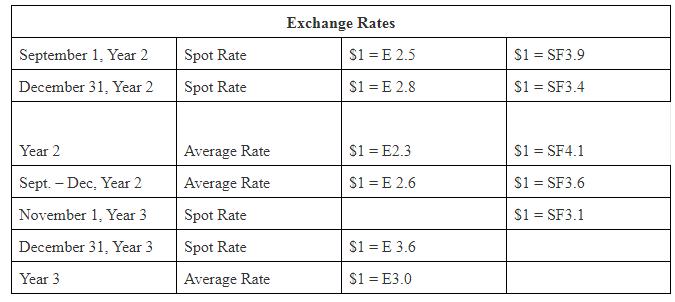

Exchange Rates September 1, Year 2. Spot Rate S1 = E 2.5 S1 = SF3.9 December 31, Year 2 Spot Rate S1 = E 2.8 S1 = SF3.4 Year 2 Average Rate S1 = E2.3 S1 = SF4.1 Sept. Dec, Year 2 Average Rate S1 = E 2.6 S1 = SF3.6 November 1, Year 3 Spot Rate S1 = SF3.1 December 31, Year 3 Spot Rate S1 = E 3.6 Year 3 Average Rate S1 = E3.0

Step by Step Solution

3.51 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

step 1 of 10 Foreign currency transaction loss When goods and services are sold in a foreign currency on the foreign exchange market and the seller of the foreign currency incurs loss from this foreig...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started