Answered step by step

Verified Expert Solution

Question

1 Approved Answer

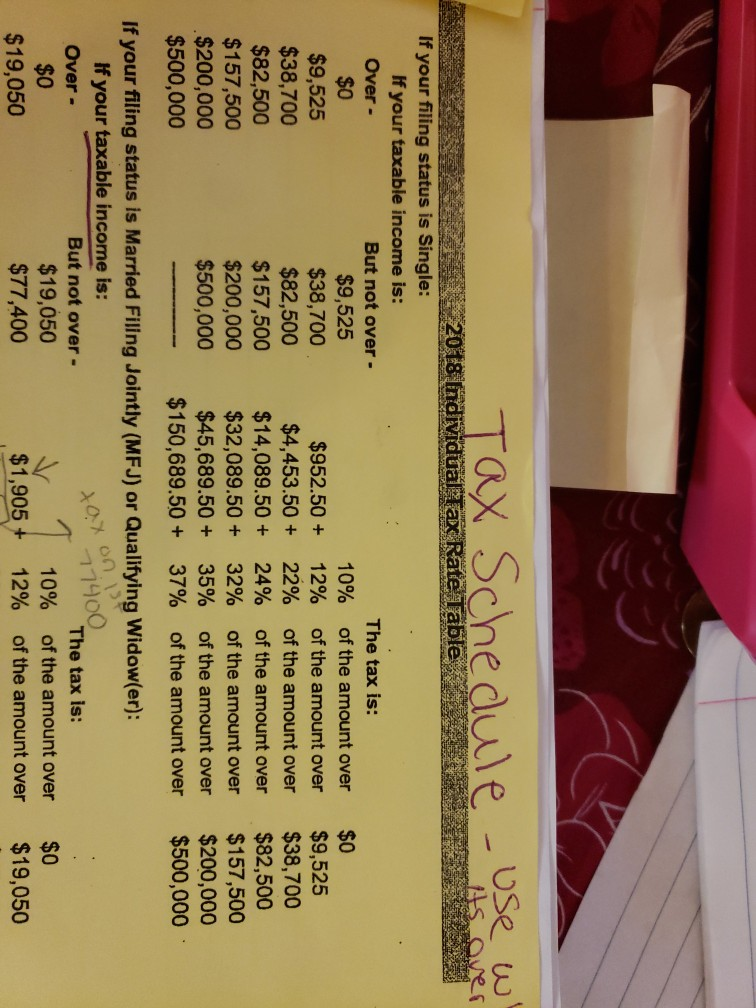

Cameron is single and has taxable income of $93341. determine his tax liability using the tax rate scedule. thank you!! please help me to understand

Cameron is single and has taxable income of $93341. determine his tax liability using the tax rate scedule.

thank you!! please help me to understand what the middle part means of the tax rate schedule (the numbers and percents between "but not over" and "the tax is") thank you!!

Tax Schedule - use weer $0 2018 Individual Tax Rate Table If your filing status is Single: If your taxable income is: Over- But not over- The tax is: $9,525 10% of the amount over $9,525 $38,700 $952.50 + 12% of the amount over $38,700 $82,500 $4,453.50 + 22% of the amount over $82,500 $157,500 $14,089.50 + 24% of the amount over $157,500 $200,000 $32,089.50 + 32% of the amount over $200,000 $500,000 $45,689.50 + 35% of the amount over $500,000 $150,689.50 + 37% of the amount over $0 $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 tayons 77400 If your filing status is Married Filing Jointly (MFJ) or Qualifying Widow(er): If your taxable income is: Over- But not over- The tax is: $19,050 10% of the amount over $19,050 $77,400 $1,905 + 12% of the amount over $0 $0 $19,050Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started