Question

Camila Jurez owns a successful law firm, her core business is corporate law, but occasionally Camila also works with mandates from wealthy clients requesting assistance

Camila Jurez owns a successful law firm, her core business is corporate law, but occasionally Camila also works with mandates from wealthy clients requesting assistance in private legal matters. You are Camilas financial advisor, and she asks you to help her decide which of the private mandates she should accept.

You estimate that Camilas opportunity cost of capital is 15% per effective annual and that she gives up $100,000 in monthly income from corporate work (assume this income is paid at the end of each month) if she accepts a private mandate.

The following questions are independent of each other.

Camila estimates that a private client As mandate would take 3 months to complete. A has offered to pay $108,000 at the beginning (t=0) of the mandate and $200,000 one month after the end of the mandate.

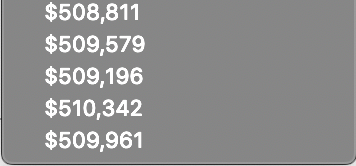

Consider client Cs mandate . A closer review reveals that this mandate is less risky than all other mandates and therefore has a lower opportunity cost of capital of 12.5% effective annual. Therefore, the customer wants to reduce his offer in the final payment. If Camila only wants to work this mandate (that is, she ignores the other opportunities she has), what is the lowest payment she should accept from the client?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started