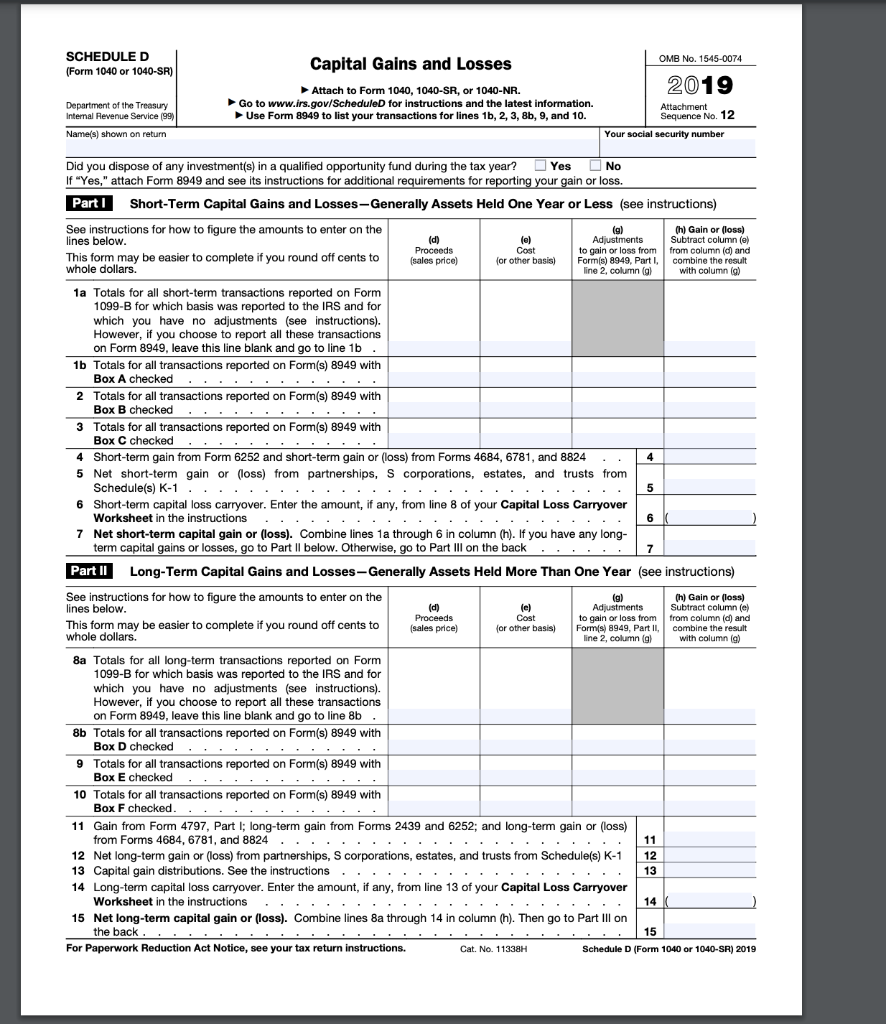

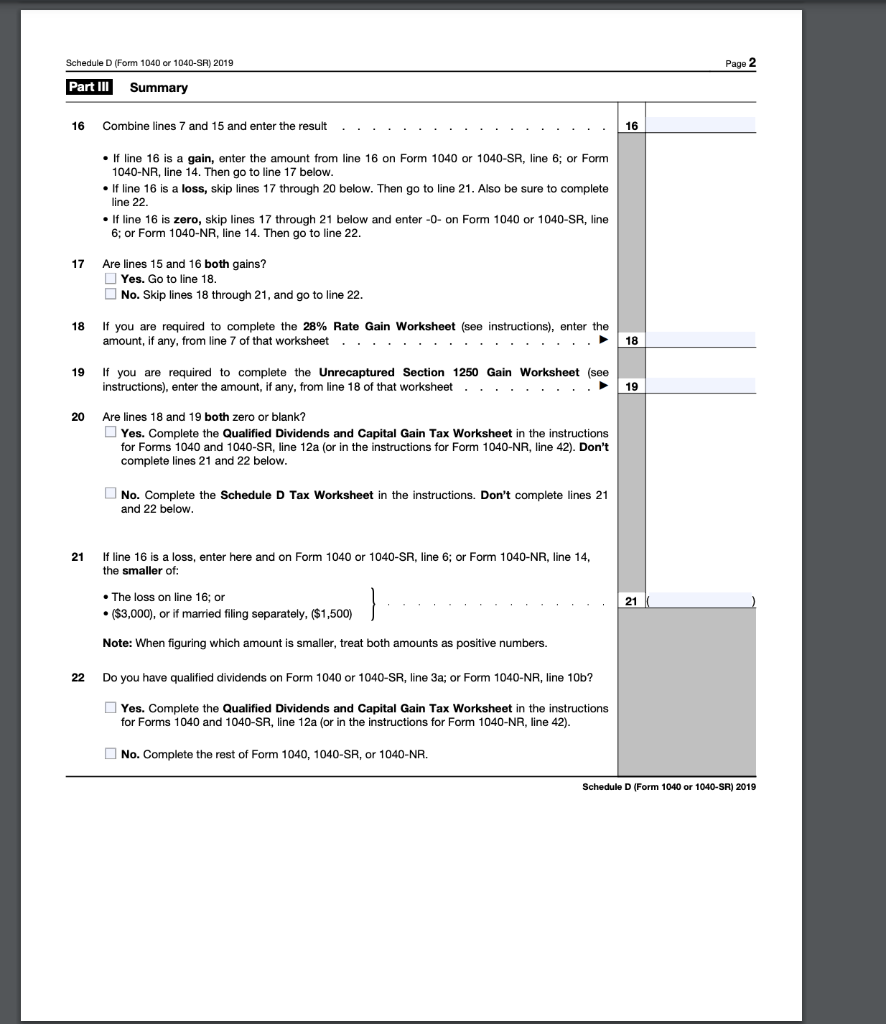

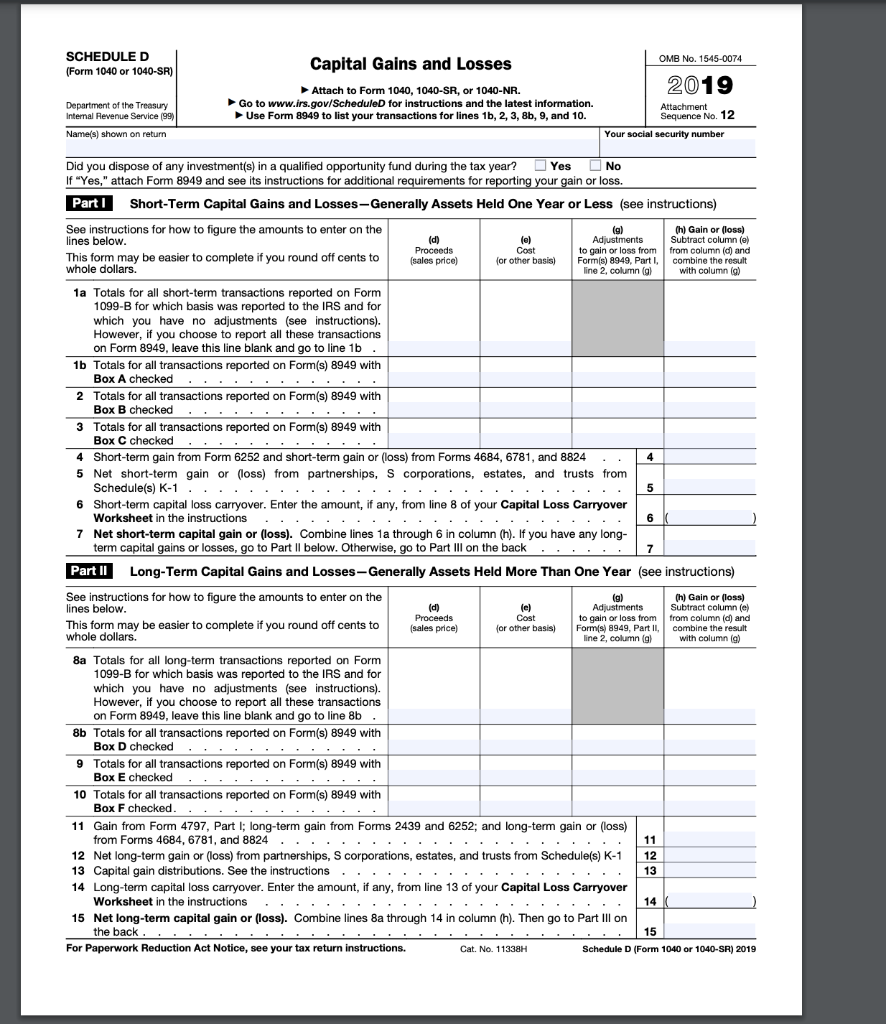

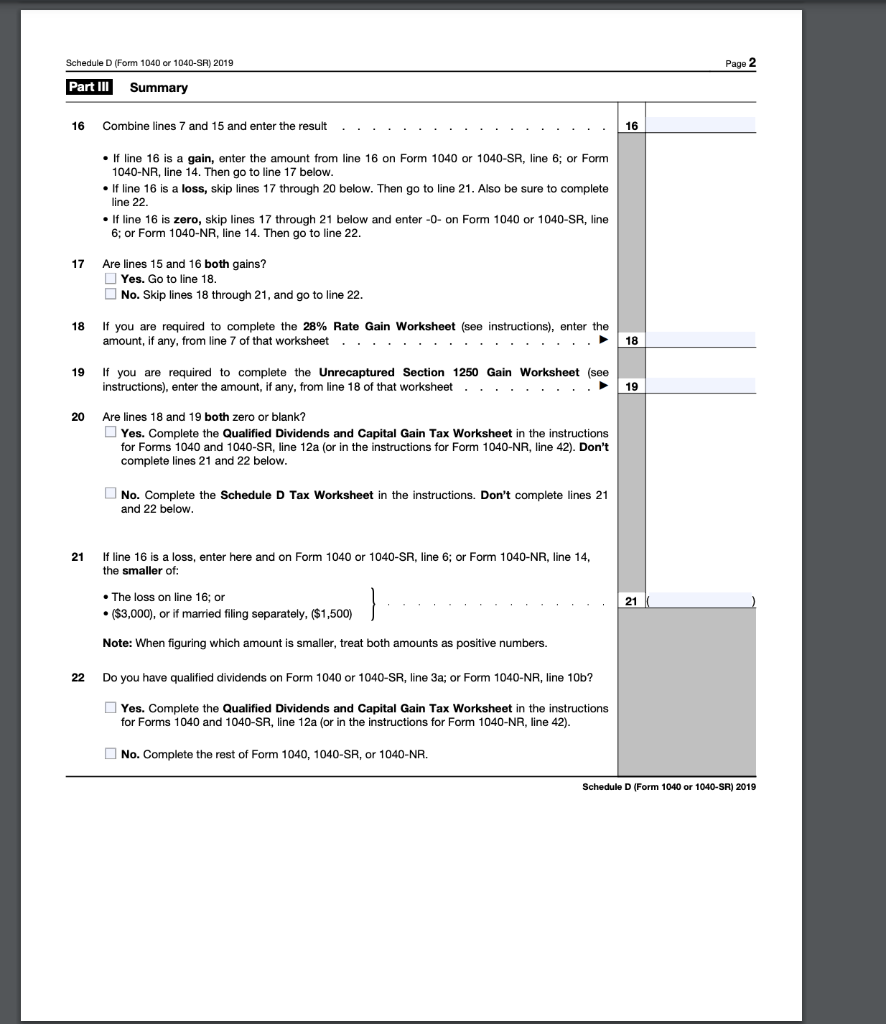

Cammie received 100 NQOs (each option provides a right to purchase 10 shares of MNL stock for $10 per share). She started working for MNL Corporation four years ago (5/1/Y1) when MNL's stock price was $8 per share. Now (8/15/Y5) that MNL's stock price is $40 per share, she intends to exercise all of her options. After acquiring the 1,000 MNL shares with her stock options, she held the shares for over one year and sold (on 10/1/Y6) them at $60 per share. (Leave no answer blank. Enter zero if applicable. Input all amounts as positive values.) Please right click on the attached Adobe document and select open in new window. Then, download the Tax Form and enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, click "Save." Use 2020 tax rules regardless of year on tax form. (Complete Cammie's Schedule D for the year of sale. Also assume that the sale transaction of the MNL Corporation stock was not reported to Cammie on Form 1099-B.) OMB No. 1545-0074 SCHEDULED (Form 1040 or 1040-SR) Capital Gains and Losses Attach to Form 1040, 1040-SR, or 1040-NR. Go to www.irs.gov/Scheduled for instructions and the latest information. Use Form 8949 to list your transactions for lines 1b, 2, 3, 8, 9, and 10 2019 Department of the Treasury Internal Revenue Service (99) Name(s) shown on return Attachment Sequence No. 12 Your social security number Cost Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Yes No If "Yes," attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. Part I Short-Term Capital Gains and Losses-Generally Assets Held One Year or Less (see instructions) See instructions for how to figure the amounts to enter on the (g) th) Gain or loss) lines below. (d) () Adjustments Subtract column (e) Proceeds to gain or loss from from column (d) and This form may be easier to complete if you round off cents to (sales price) for other basis) Form(s) 8949, Part I combine the result whole dollars. line 2 column (g) with column (a) 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b. 1b Totals for all transactions reported on Form(s) 8949 with Box A checked ........ 2 Totals for all transactions reported on Form(s) 8949 with Box B checked 3 Totals for all transactions reported on Form(s) 8949 with Box C checked 4 Short-term gain from Form 6252 and short-term gain or loss) from Forms 4684, 6781, and 8824 4 5 Net short-term gain or loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 5 6 Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover Worksheet in the instructions 6 7 Net short-term capital gain or (loss). Combine lines 1a through 6 in column (h). If you have any long- term capital gains or losses, go to Part II below. Otherwise, go to Part Ill on the back 7 Part II Long-Term Capital Gains and Losses - Generally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the (h) Gain or loss) lines below. Adjustments Subtract column (e) Proceeds This form may be easier to complete if you round off cents to to gain or loss from from column (d) and (sales price) for other basis) Forms) 8949, Part II, combine the result whole dollars. line 2, column (g) with column (9) 8a Totals for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b. 8b Totals for all transactions reported on Form(s) 8949 with Box D checked... 9 Totals for all transactions reported on Form(s) 8949 with Box E checked 10 Totals for all transactions reported on Form(s) 8949 with Box F checked. 11 Gain from Form 4797, Part 1; long-term gain from Forms 2439 and 6252; and long-term gain or loss) from Forms 4684, 6781, and 8824 11 12 Net long-term gain or loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 12 13 Capital gain distributions. See the instructions 13 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions 14 15 Net long-term capital gain or loss). Combine lines 8a through 14 in column (h). Then go to Part III on the back 15 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11338H Schedule D (Form 1040 or 1040-SR) 2019 D (g) (d) (e) Cost te::..... Schedule D (Form 1040 or 1040-SR) 2019 Page 2 Part III Summary 16 Combine lines 7 and 15 and enter the result 16 If line 16 is a gain, enter the amount from line 16 on Form 1040 or 1040-SR, line 6; or Form 1040-NR, line 14. Then go to line 17 below. If line 16 is a loss, skip lines 17 through 20 below. Then go to line 21. Also be sure to complete line 22. If line 16 is zero, skip lines 17 through 21 below and enter-O-on Form 1040 or 1040-SR, line 6; or Form 1040-NR, line 14. Then go to line 22. 17 Are lines 15 and 16 both gains? Yes. Go to line 18. No. Skip lines 18 through 21, and go to line 22. 18 If you are required to complete the 28% Rate Gain Worksheet (see instructions), enter the amount, if any, from line 7 of that worksheet .... 18 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, if any, from line 18 of that worksheet 19 20 Are lines 18 and 19 both zero or blank? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 12a (or in the instructions for Form 1040-NR, line 42). Don't complete lines 21 and 22 below. No. Complete the Schedule D Tax Worksheet in the instructions. Don't complete lines 21 and 22 below. 21 If line 16 is a loss, enter here and on Form 1040 or 1040-SR, line 6; or Form 1040-NR, line 14, the smaller of: The loss on line 16; or ($3,000), or if married filing separately, ($1,500) } 21 Note: When figuring which amount is smaller, treat both amounts as positive numbers. 22 Do you have qualified dividends on Form 1040 or 1040-SR, line 3a; or Form 1040-NR, line 10b? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 12a (or in the instructions for Form 1040-NR, line 42). No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Schedule D (Form 1040 or 1040-SR) 2019 D