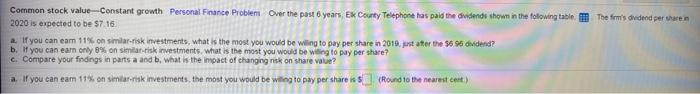

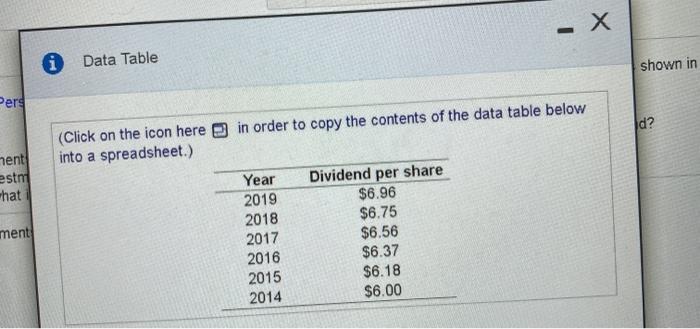

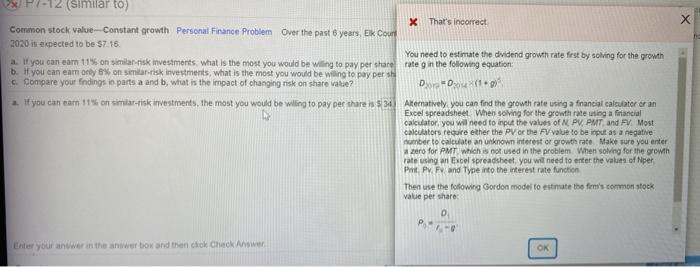

Cammon stock value-Constant growth Personal Finance Problemi Over the past 6 years, Ex County Telephone has paid the widende shown in the following table The femis dividend per en 2020 is expected to be 57.16 2. If you can eam 11% on smar-risk investments, what is the most you would be willing to pay per share in 2010. stater the 56.96 dividend? b. you can earn only 8% on similar risk investments, what is the most you would be willing to pay per share? c. Compare your findings in parts a and b, what is the impact of changing risk on share value? a. If you can earn 11% on similar investments, the most you would be willing to pay per share is s Round to the nearest cent) i Data Table shown in Pers id? (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) ment est what ment Year 2019 2018 2017 2016 2015 2014 Dividend per share $6.96 $6.75 $6.56 $6.37 $6.18 $6.00 X P7-12 (similar to) X That's incorrect Common stock value-Constant growth Personal Finance Problem Over the past 6 years, Ek Court 2020 is expected to be 57.16. You need to estimate the dividend growth rate fest by solving for the growth If you can earn 115 on similar risk investments what is the most you would be willing to pay per share rate in the following equation b. If you can eam only 8% on similar risk investments, what is the most you would be willing to pay per si c. Compare your findings in parts a and b, what is the impact of changing risk on share value? D- DX(1 2. If you can earn 11% on similar-tisk investments, the most you would be willing to pay per share as $ 34 Alternatively you can find the growth rate using a financial calculator er an Excel spreadsheet When solving for the growth rate using a financial calculator, you will need to input the values of PV, PMT and FV. Most calculators require ether the PV or the FV value to be input as a negative number to calculate an unknown interest or growth rate. Make sure you enter zero for PMT which is not used in the problem. When solving for the growth rate using an Excel spreadsheet, you will need to enter the values of per Priit Pv. Fv and Tyne into the interest rate function Then use the following Gordon model to estimate the firm's common stock value per share P.- Enter your answer in the answer box and then chok Check OK