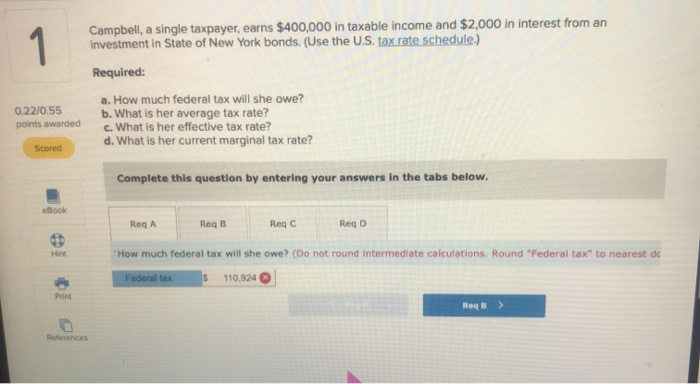

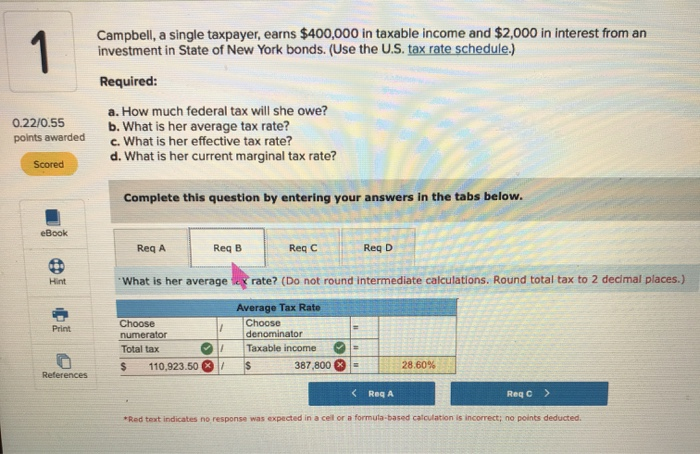

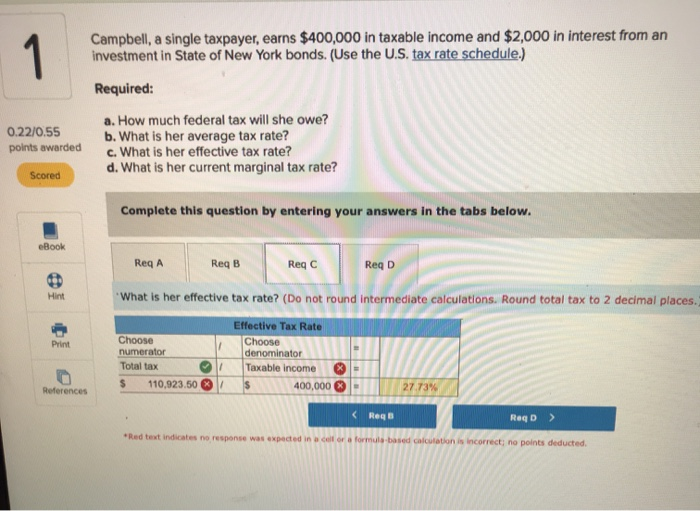

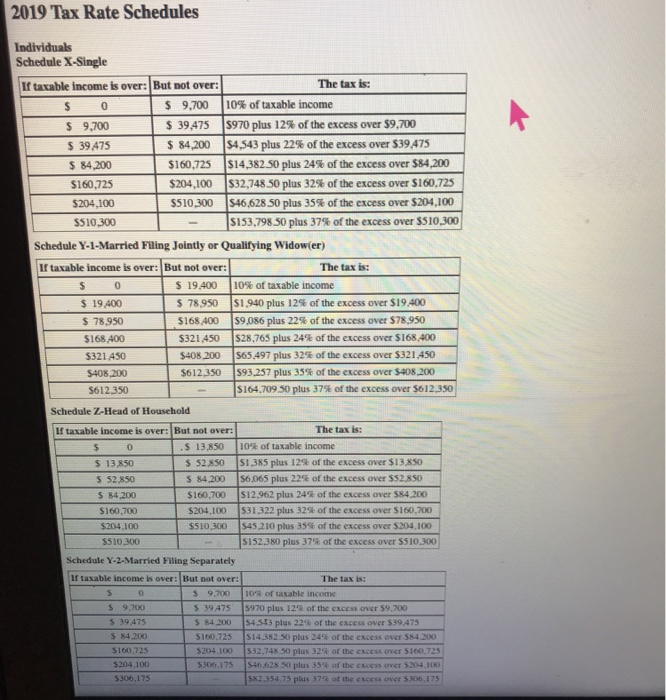

Campbell, a single taxpayer, earns $400,000 in taxable income and $2,000 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule.) Required: 0.22/0.55 points awarded a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Scored Complete this question by entering your answers in the tabs below. eBook REGA Reg B ReqC Reg D How much federal tax will she owe? (Do not round intermediate calculations. Round "Federal tax" to nearest de Federal tax S 110,924 Print Re > References Campbell, a single taxpayer, earns $400,000 in taxable income and $2,000 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule.) Required: 0.22/0.55 points awarded a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Scored Complete this question by entering your answers in the tabs below. eBook Req A Req B ReqC Reg D Hint What is her average rate? (Do not round Intermediate calculations. Round total tax to 2 decimal places.) Print Choose numerator Total tax $ 110,923.50 Average Tax Rate Choose denominator Taxable income S 387,800 1 / 28.60% References *Red text indicates no response was expected in a ceilor a formula-based calculation is incorrect, no points deducted Campbell, a single taxpayer, earns $400,000 in taxable income and $2,000 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule.) Required: 0.22/0.55 points awarded a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Scored Complete this question by entering your answers in the tabs below. eBook Req A ReqB Reg B Reac Read ReqD Hint What is her effective tax rate? (Do not round intermediate calculations. Round total tax to 2 decimal places. Print Choose numerator Total tax $ 110,923.50 Effective Tax Rate Choose denominator Taxable income 400,000 References Red text indicates no response was expected in a formuls-based calculation is incorrect; no points deducted. 2019 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,700 10% of taxable income $ 9,700 $ 39,475 5970 plus 12% of the excess over 59,700 S 39475 $ 84,200 $4,543 plus 22% of the excess over $39,475 $ 84,200 $160,725 514,382.50 plus 24% of the excess over $84,200 $160,725 $204,100 $32,748.50 plus 32% of the excess over $160,725 $204,100 $510,300 $46,628 50 plus 35% of the excess over $204,100 $510300 5153,798 50 plus 37% of the excess over $510,300 Schedule Y-1-Married Filing Jointly or Qualifying Widower) If taxable income is over: But not over: The tax is: 5 0 $ 19,400 10% of taxable income $ 19 400 $ 78,950 $1.940 plus 12% of the excess over $19.400 $ 78,950 $168.400 $9.086 plus 22% of the excess over $78,950 $168.400 $321450 $28.765 plus 24% of the excess over $168,400 $321 450 $408.200 565.497 plus 32% of the excess over $321.450 $408.200 $612,350 593.257 plus 35% of the excess over $408.200 S612.350 $164.709.50 plus 37% of the excess over $612,350 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: $ 0 .5 13.850 10% of taxable income $ 1350 $ 52.850 $1,385 plus 125 of the excess over $13.850 S 84.200 56,065 plus 225 of the excess over $52.850 $160,700 $12.962 plus 245 of the excess over $84.200 $160.700 S204,100 $31.322 plus 325 of the excess over $160,700 5510 300 545.210 plus 35% of the excess over $204.100 - $152.380 plus 37% of the excess over 5510,300 Schedule Y-2-Married Filing Separately S52 SO S4200 5204100 $510200 If taxable income is over: But not over: 3 0 5 9.700 5 9,700 5 19 475 59475 54200 S4200 S160 725 S160.72 5204 100 5204.100 $300,175 The tax is: 107 of taxable income 5970 plus 12% of the excess over 59,700 54513 plus 224 of the excess over 539.475 51432 50 plus 245 of the excess over 5 200 52.74 50 plus 325 of the excess over 100.725 S-1662 50 plus 35 of the excess over 5304100 2.354.75 plus 37 of the excess over 5306,175 5306,175