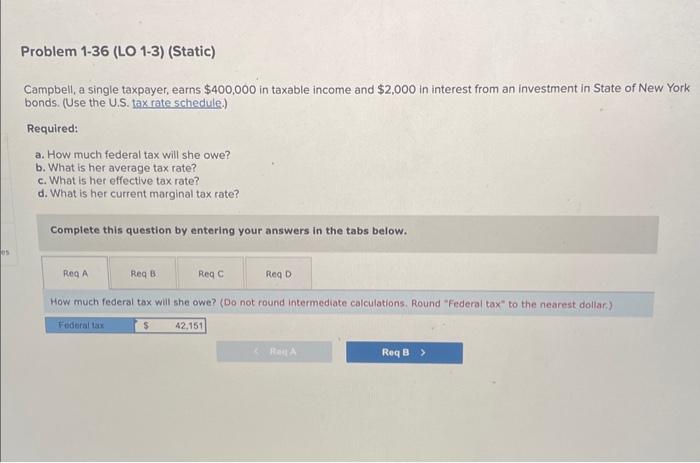

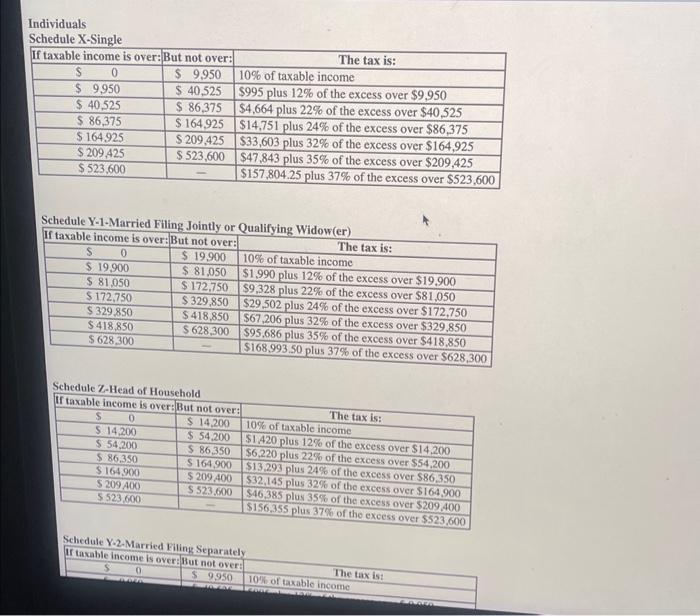

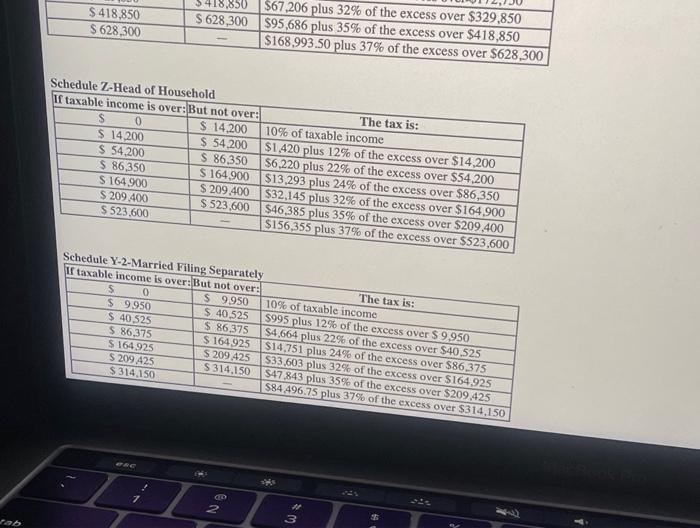

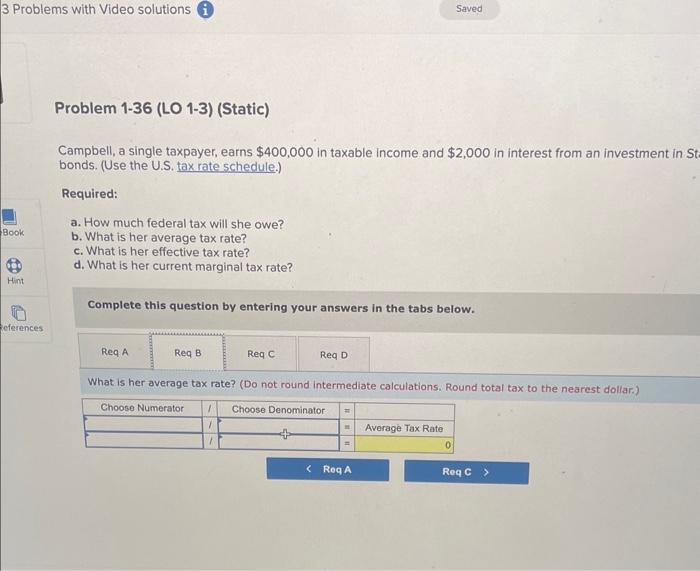

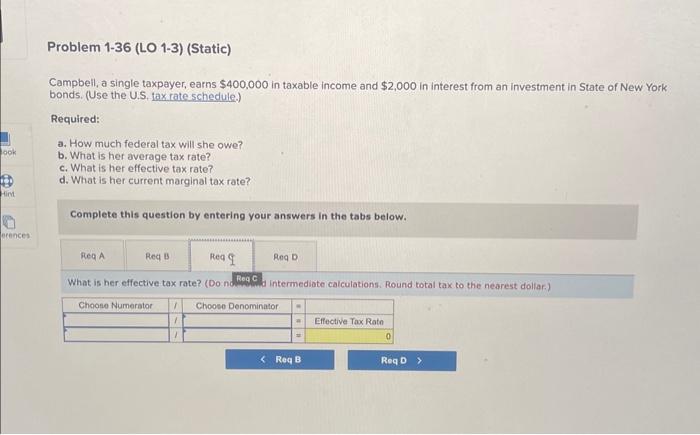

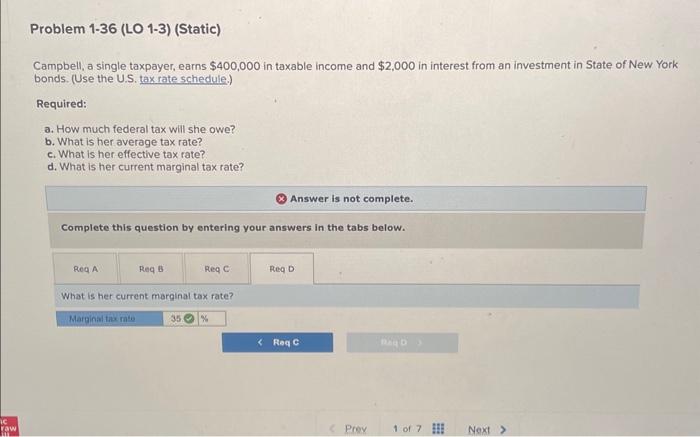

Campbell, a single taxpayer, earns $400,000 in taxable income and $2,000 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule.) Required: a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Complete this question by entering your answers in the tabs below. How much federal tax will she owe? (Do not round intermediate calculations. Round "Federal tax" to the nearest dollar.) Schedule X.Sinole Schedule Y-1-Married Filing Inintl.. n. n....... \begin{tabular}{|c|c|c|} \hline$418,850 & $628,300 & $95,686 plus 35% of the excess over $418,850 \\ \hline$628,300 & - & $168,993.50 plus 37% of the excess over $628,300 \\ \hline \end{tabular} Schedule Z-Head of Household \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$0 & $14,200 & 10% of taxable income \\ \hline$14,200 & $54,200 & $1,420 plus 12% of the excess over $14,200 \\ \hline$54,200 & $86,350 & $6,220 plus 22% of the excess over $54,200 \\ \hline$86,350 & $164,900 & $13,293 plus 24% of the excess over $86,350 \\ \hline$164,900 & $209,400 & $32,145 plus 32% of the excess over $164,900 \\ \hline$209,400 & $523,600 & $46,385 plus 35% of the excess over $209,400 \\ \hline$523,600 & - & $156,355 plus 37% of the excess over $523,600 \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately Campbell, a single taxpayer, earns $400,000 in taxable income and $2,000 in interest from an investment in bonds. (Use the U.S. tax rate schedule.) Required: a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Complete this question by entering your answers in the tabs below. What is her average tax rate? (Do not round intermediate calculations. Round total tax to the nearest dollar.) Campbell, a single taxpayer, earns $400,000 in taxable income and $2,000 in interest from an investment in State of New York bonds. (Use the U.S, tax rate schedule.) Required: a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Complete this question by entering your answers in the tabs below. What is her effective tax rate? (Do nd ReqC intermediate calculations. Round total tax to the nearest doliar.) Campbell, a single taxpayer, earns $400,000 in taxable income and $2,000 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule.) Required: a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Answer is not complete. Complete this question by entering your answers in the tabs below. What is her current marginal tax fate