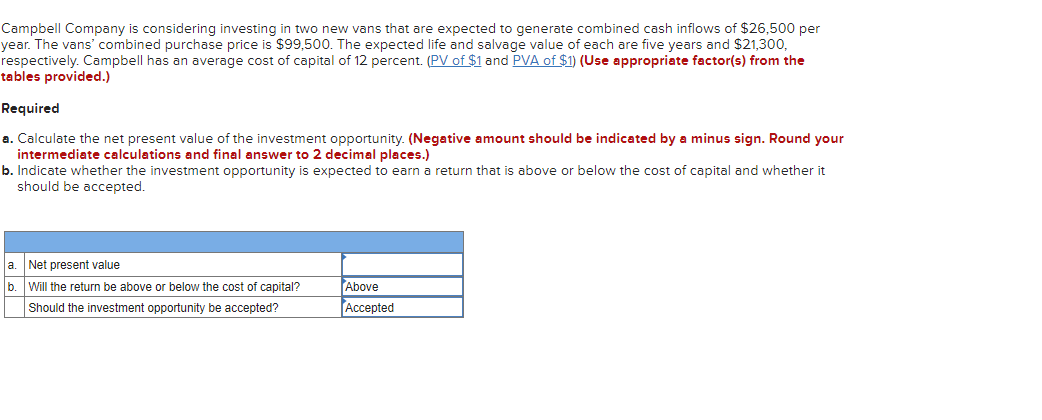

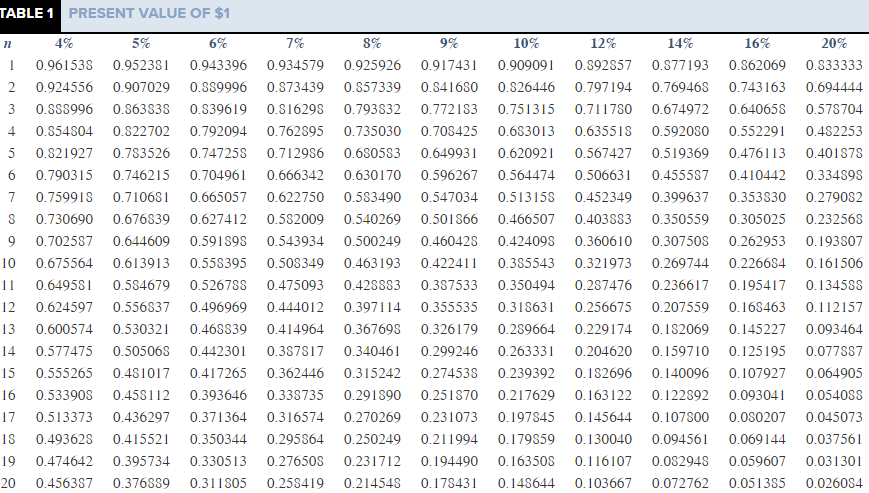

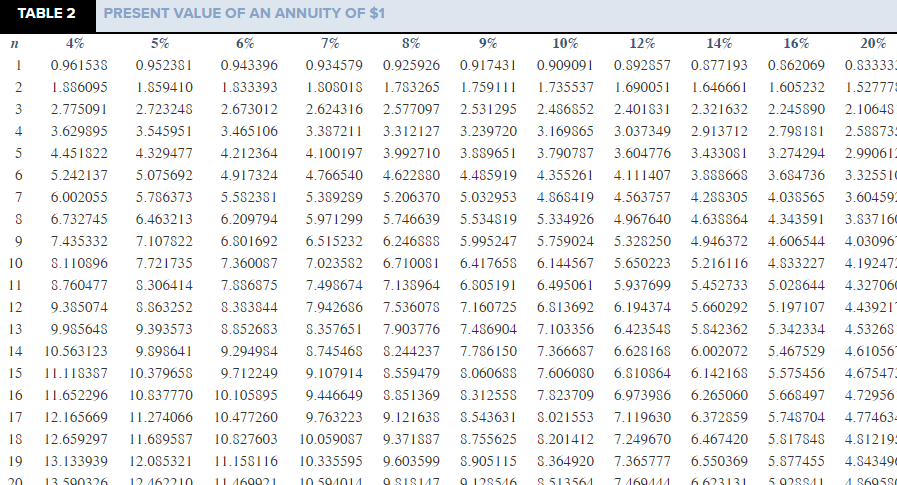

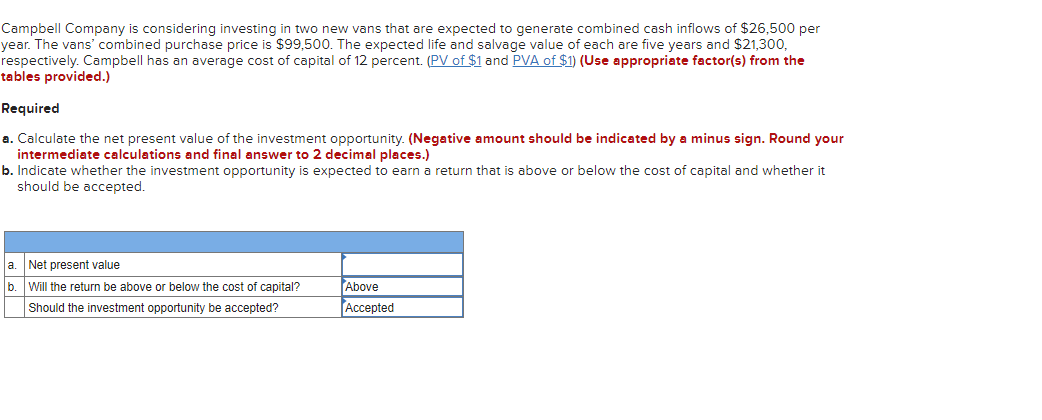

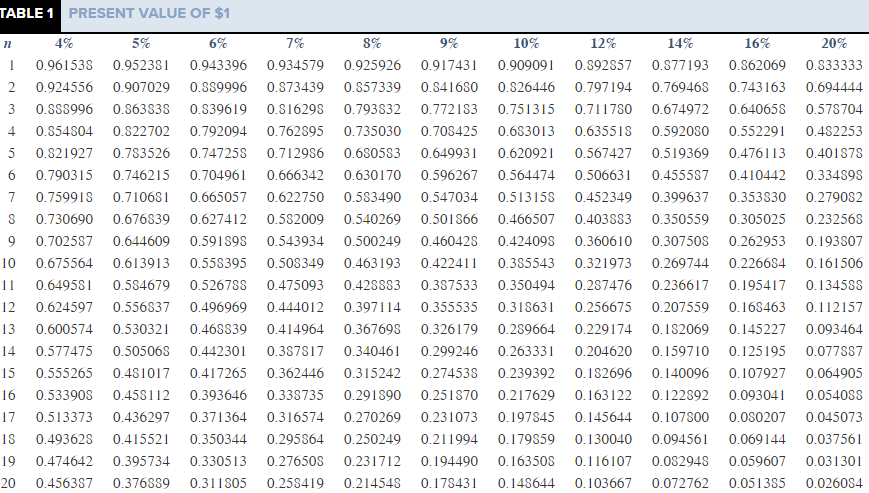

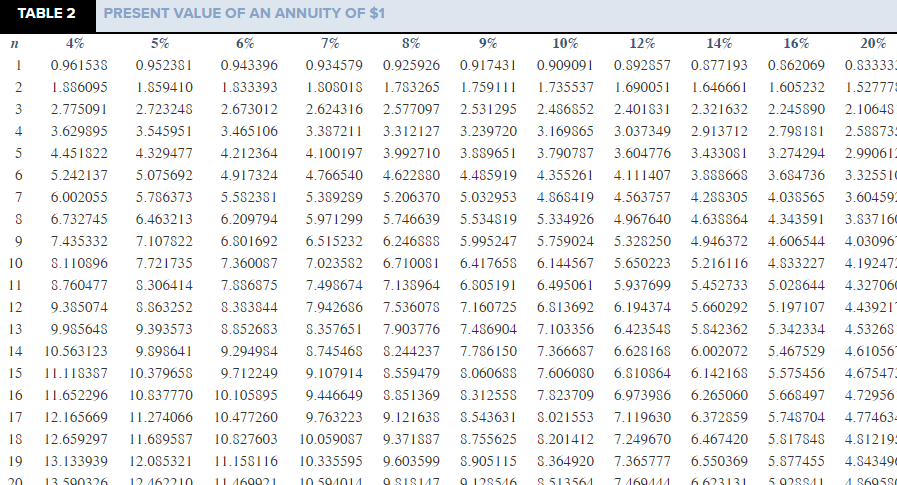

Campbell Company is considering investing in two new vans that are expected to generate combined cash inflows of $26,500 per year. The vans' combined purchase price is $99,500. The expected life and salvage value of each are five years and $21,300, respectively. Campbell has an average cost of capital of 12 percent. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required a. Calculate the net present value of the investment opportunity. (Negative amount should be indicated by a minus sign. Round your intermediate calculations and final answer to 2 decimal places.) b. Indicate whether the investment opportunity is expected to earn a return that is above or below the cost of capital and whether it should be accepted. a. Net present value b. Will the return be above or below the cost of capital? Should the investment opportunity be accepted? Above Accepted TABLE 1 PRESENT VALUE OF $1 12 1 2 3 4 5 6 7 S 9 10 4% 5% 6% 0.961535 0.952381 0.943396 0.924556 0.907029 0.889996 O.SS5996 0.863838 0.839619 0.854804 0.522702 0.792094 0.821927 0.783526 0.747255 0.790315 0.746215 0.704961 0.759918 0.710681 0.665057 0.730690 0.676839 0.627412 0.702587 0.644609 0.591898 0.675564 0.613913 0.558395 0.649581 0.584679 0.526785 0.624597 0.556837 0.496969 0.600574 0.530321 0.468839 0.577475 0.505068 0.442301 0.555265 0.481017 0.417265 0.53390S 0.458112 0.393646 0.513373 0.436297 0.371364 0.493628 0.415521 0.350344 0.474642 0.395734 0.330513 0.456387 0.376889 0.311 805 7% 8% 9% 10% 12% 0.934579 0.925926 0.917431 0.909091 0.892857 0.873439 0.857339 0.841680 0.526446 0.797194 0.816295 0.793832 0.772153 0.751315 0.711750 0.762895 0.735030 0.708425 0.683013 0.635518 0.712986 0.650583 0.649931 0.620921 0.567427 0.666342 0.630170 0.596267 0.564474 0.506631 0.622750 0.583490 0.547034 0.513158 0.452349 0.582009 0.540269 0.501866 0.466507 0.403883 0.543934 0.500249 0.460428 0.424098 0.360610 0.508349 0.463193 0.422411 0.385543 0.321973 0.475093 0.428883 0.387533 0.350494 0.287476 0.444012 0.397114 0.355535 0.318631 0.256675 0.414964 0.367698 0.326179 0.289664 0.229174 0.387817 0.340461 0.299246 0.263331 0.204620 0.362446 0.315242 0.274538 0.239392 0.182696 0.338735 0.291890 0.251870 0.217629 0.163122 0.316574 0.270269 0.231073 0.197845 0.145644 0.295864 0.250249 0.211994 0.179859 0.130040 0.276508 0.231712 0.194490 0.163508 0.116107 0.258419 0.214548 0.178431 0.148644 0.103667 14% 16% 20% 0.877193 0.862069 0.833333 0.769468 0.743163 0.694444 0.674972 0.640658 0.578704 0.592080 0.552291 0.482253 0.519369 0.476113 0.401878 0.455587 0.410442 0.33489S 0.399637 0.353830 0.279082 0.350559 0.305025 0.232568 0.307508 0.262953 0.193807 0.269744 0.226684 0.161506 0.236617 0.195417 0.13458S 0.207559 0.168463 0.112157 0.182069 0.145227 0.093464 0.159710 0.125195 0.077887 0.140096 0.107927 0.064905 0.122892 0.093041 0.0540SS 0.107800 0.080207 0.045073 0.094561 0.069144 0.037561 0.082948 0.059607 0.031301 0.072762 0.051385 0.026084 11 12 13 14 15 16 17 18 19 20 TABLE 2 PRESENT VALUE OF AN ANNUITY OF $1 12 1 2 3 4 5 6 7 S 9 4% 0.961535 1.886095 2.775091 3.629895 4.451822 5.242137 6.002055 6.732745 7.435332 8.110896 8.760477 9.385074 9.985648 10.563123 11.118387 11.652296 12.165669 12.659297 13.133939 13 500326 5% 0.952381 1.859410 2.723248 3.545951 4.329477 5.075692 5.786373 6.463213 7.107822 7.721735 8.306414 S.563252 9.393573 9.898641 10.379655 10.837770 11.274066 11.689587 12.085321 6% 0.943396 1.833393 2.673012 3.465106 4.212364 4.917324 5.582381 6.209794 6.S01692 7.360087 7.586875 8.383844 8.852683 9.294984 9.712249 10.105895 10.477260 10.827603 11.158116 10 7% 8% 9% 10% 12% 14% 16% 0.934579 0.925926 0.917431 0.909091 0.892857 0.877193 0.862069 1. SOSOIS 1.783265 1.759111 1.735537 1.690051 1.646661 1.605232 2.624316 2.577097 2.531295 2.486852 2.401831 2.321632 2.245890 3.387211 3.312127 3.239720 3.169865 3.037349 2.913712 2.798181 4.100197 3.992710 3.889651 3.790787 3.604776 3.433081 3.274294 4.766540 4.622SSO 4.485919 4.355261 4.111407 3.SS5668 3.684736 5.389289 5.206370 5.032953 4.868419 4.563757 4.288305 4.038565 5.971299 5.746639 5.534819 5.334926 4.967640 4.638564 4.343591 6.515232 6.246SSS 5.995247 5.759024 5.328250 4.946372 4.606544 7.023582 6.710081 6.417658 6.144567 5.650223 5.216116 4.833227 7.498674 7.138964 6.805191 6.495061 5.937699 5.452733 5.028644 7.942686 7.536078 7.160725 6.813692 6.194374 5.660292 5.197107 8.357651 7.903776 7.486904 7.103356 6.423548 5.842362 5.342334 8.745468 8.244237 7.786150 7.366687 6.628168 6.002072 5.467529 9.107914 8.559479 8.06068S 7.606080 6.810864 6.142168 5.575456 9.446649 8.351369 8.312558 7.823709 6.973986 6.265060 5.668497 9.763223 9.121638 8.543631 8.021553 7.119630 6.372859 5.748704 10.059087 9.371887 8.755625 8.201412 7.249670 6.467420 5.817848 10.335595 9.603599 8.905115 8.364920 7.365777 6.550369 5.877455 10 50014 O SIS147 S513564 7169444 6623131 592SSA 20% 0.83333 1.52777 2.10648 2.58873 2.990611 3.325510 3.60459 3.837160 4.03096 4.19247 4.327060 4.43921 4.53268 4.61056 4.67547 4.72956 4.77463 4.81219 4.84349 11 12 13 14 15 16 17 18 19 20 12162210 11169921 0128546 1 S6958