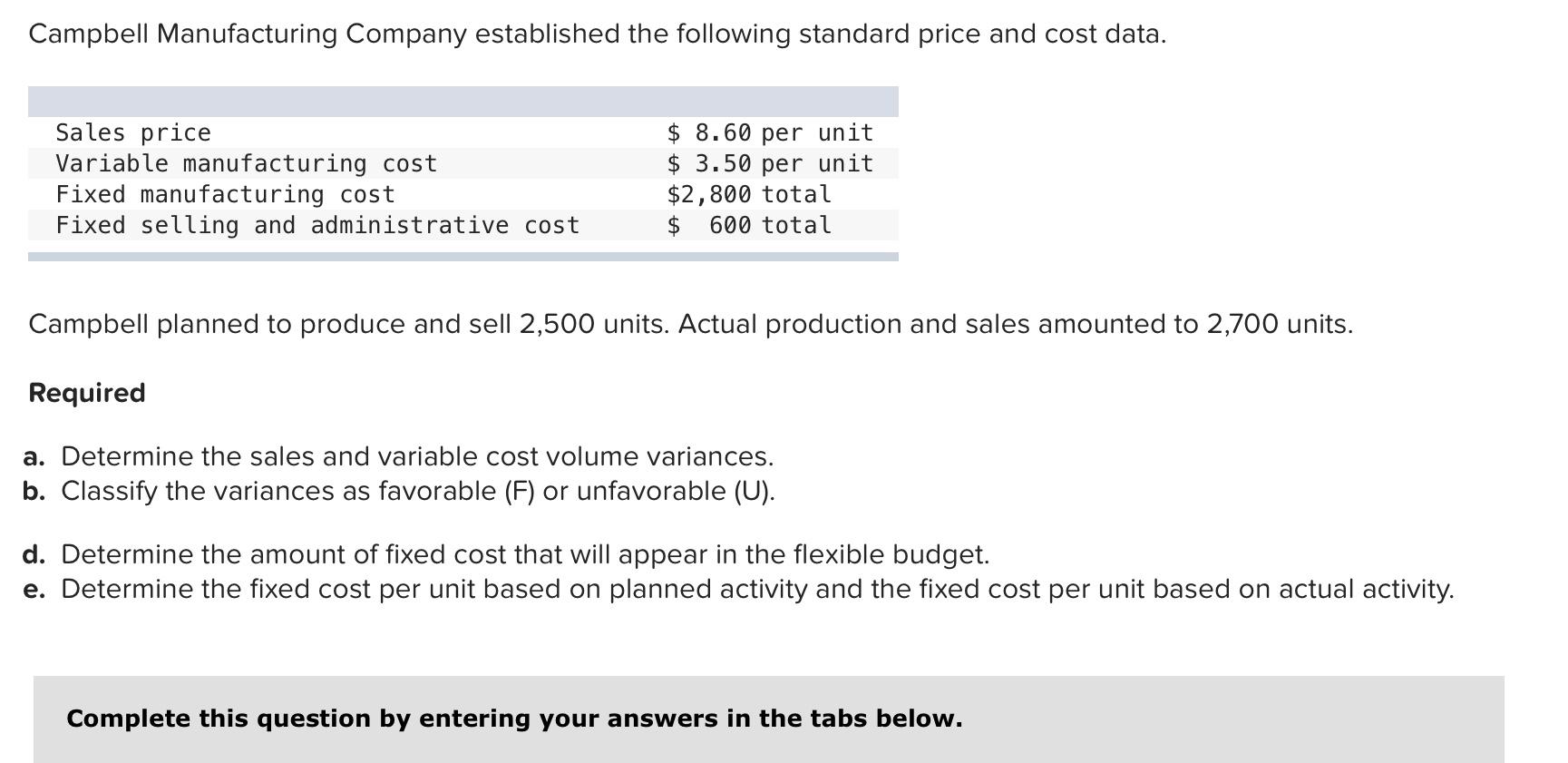

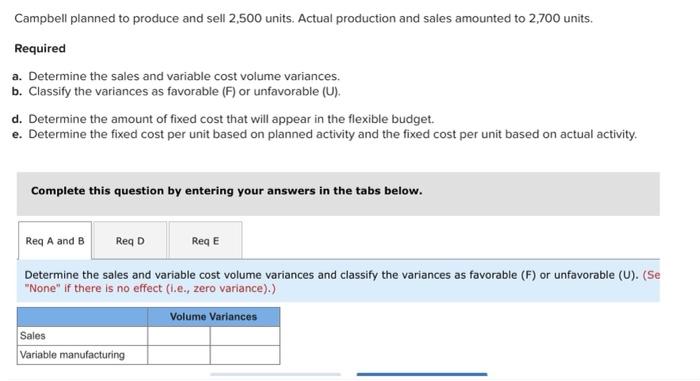

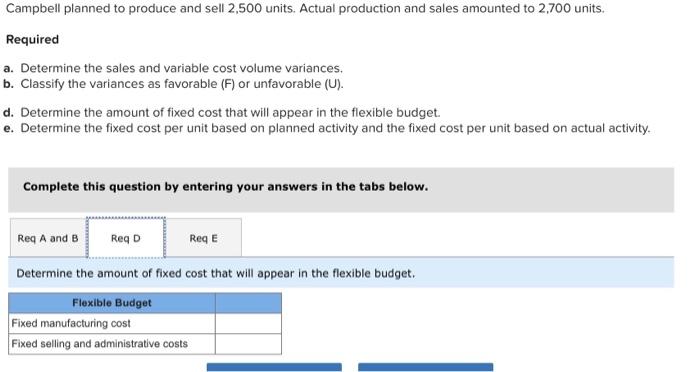

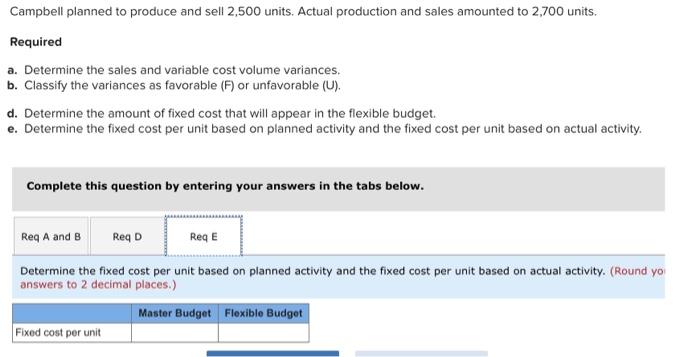

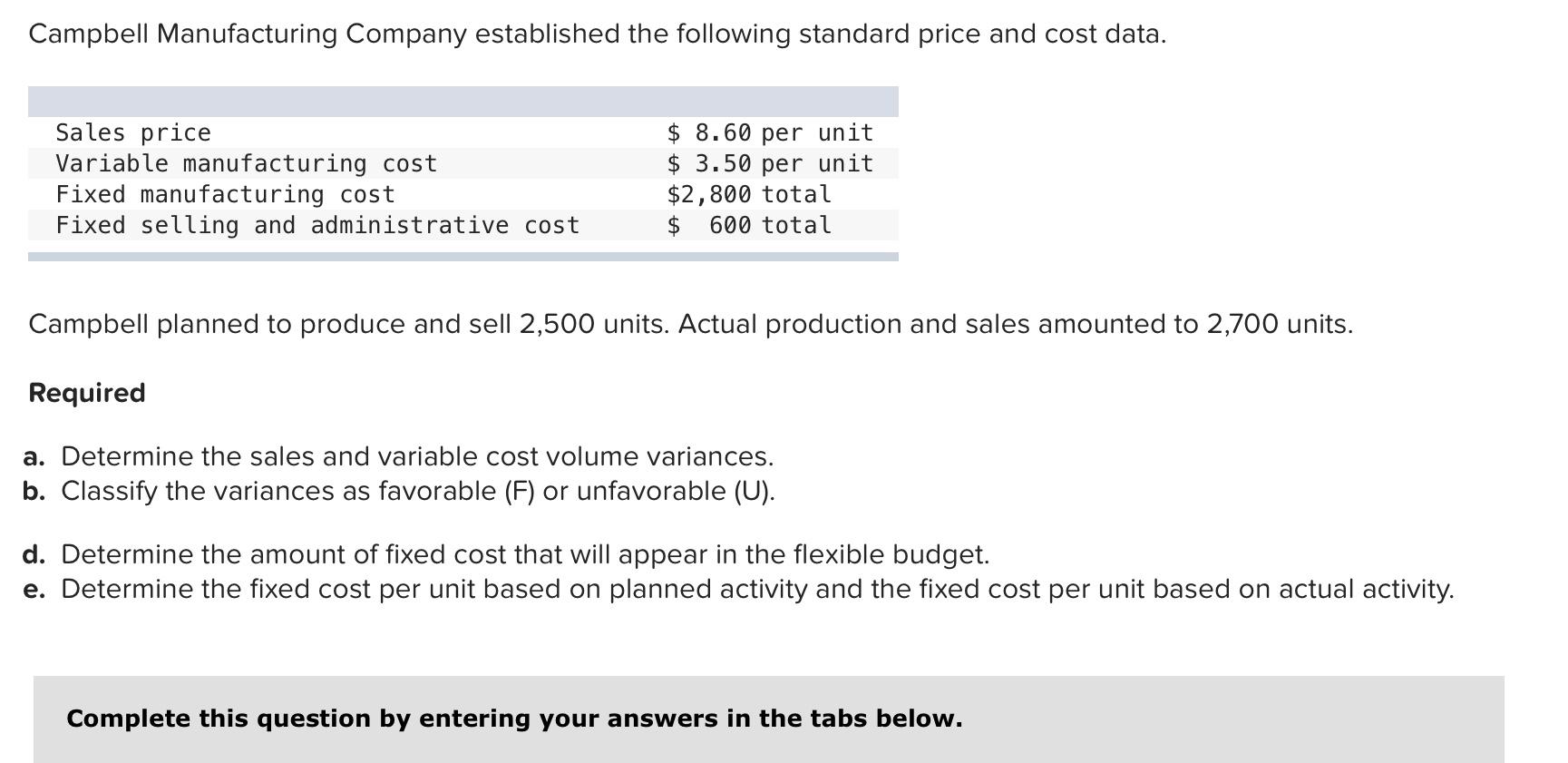

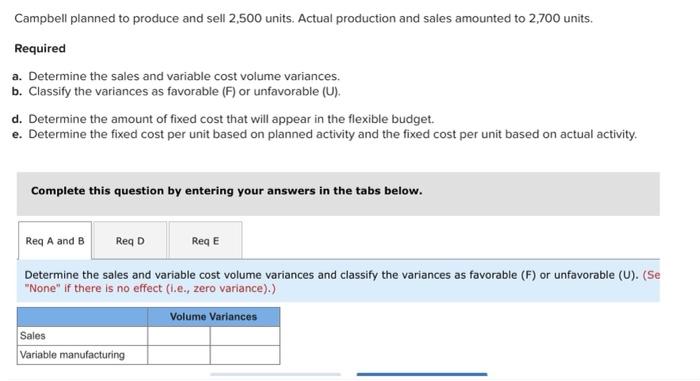

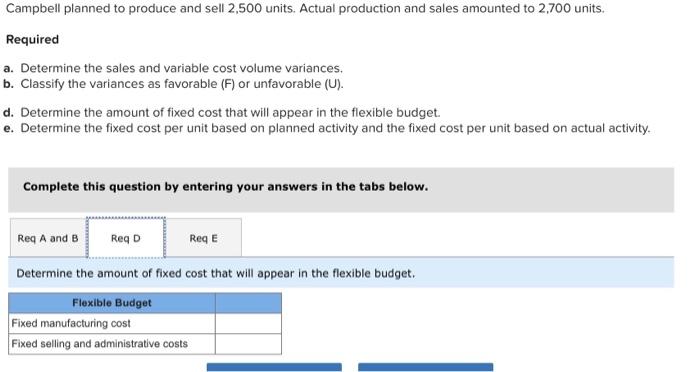

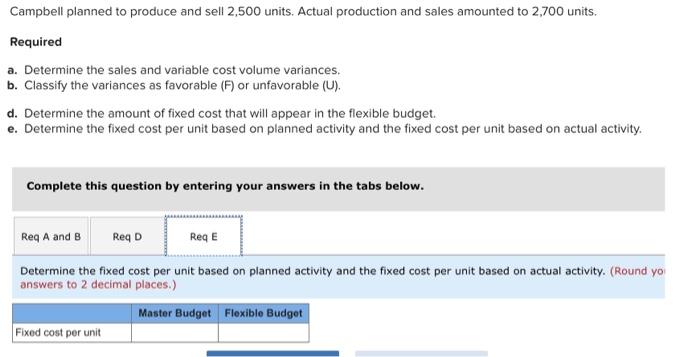

Campbell Manufacturing Company established the following standard price and cost data. Sales price Variable manufacturing cost Fixed manufacturing cost Fixed selling and administrative cost $ 8.60 per unit $ 3.50 per unit $2,800 total $ 600 total Campbell planned to produce and sell 2,500 units. Actual production and sales amounted to 2,700 units. Required a. Determine the sales and variable cost volume variances. b. Classify the variances as favorable (F) or unfavorable (U). d. Determine the amount of fixed cost that will appear in the flexible budget. e. Determine the fixed cost per unit based on planned activity and the fixed cost per unit based on actual activity. Complete this question by entering your answers in the tabs below. Campbell planned to produce and sell 2,500 units. Actual production and sales amounted to 2,700 units. Required a. Determine the sales and variable cost volume variances. b. Classify the variances as favorable (F) or unfavorable (U). d. Determine the amount of fixed cost that will appear in the flexible budget. e. Determine the fixed cost per unit based on planned activity and the fixed cost per unit based on actual activity. Complete this question by entering your answers in the tabs below. Req A and B ReqD ReqE Determine the sales and variable cost volume variances and classify the variances as favorable (F) or unfavorable (U). (Se "None" if there is no effect (1.e., zero variance).) Volume Variances Sales Variable manufacturing Campbell planned to produce and sell 2,500 units. Actual production and sales amounted to 2,700 units. Required a. Determine the sales and variable cost volume variances, b. Classify the variances as favorable (F) or unfavorable (U). d. Determine the amount of fixed cost that will appear in the flexible budget. e. Determine the fixed cost per unit based on planned activity and the fixed cost per unit based on actual activity. Complete this question by entering your answers in the tabs below. Req A and B ReqD ReqE Determine the amount of fixed cost that will appear in the flexible budget. Flexible Budget Fixed manufacturing cost Fixed selling and administrative costs Campbell planned to produce and sell 2,500 units. Actual production and sales amounted to 2,700 units. Required a. Determine the sales and variable cost volume variances. b. Classify the variances as favorable (F) or unfavorable (U). d. Determine the amount of fixed cost that will appear in the flexible budget. e. Determine the fixed cost per unit based on planned activity and the fixed cost per unit based on actual activity. Complete this question by entering your answers in the tabs below. Reg A and B ReqD Reg E Determine the fixed cost per unit based on planned activity and the fixed cost per unit based on actual activity. (Round yo answers to 2 decimal places.) Master Budget Flexible Budget Fixed cost per unit