Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can a derivative security's value be determined by an underlying single stock (e.g., IBM, MMM, GE)? If no, explain. Can a derivative security's value

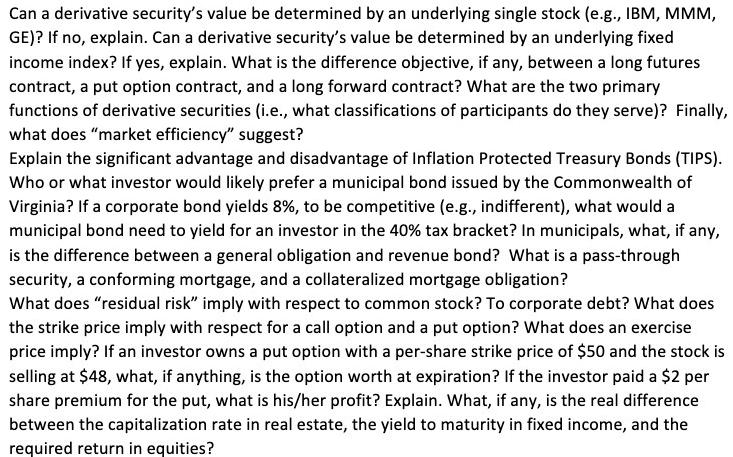

Can a derivative security's value be determined by an underlying single stock (e.g., IBM, MMM, GE)? If no, explain. Can a derivative security's value be determined by an underlying fixed income index? If yes, explain. What is the difference objective, if any, between a long futures contract, a put option contract, and a long forward contract? What are the two primary functions of derivative securities (i.e., what classifications of participants do they serve)? Finally, what does "market efficiency" suggest? Explain the significant advantage and disadvantage of Inflation Protected Treasury Bonds (TIPS). Who or what investor would likely prefer a municipal bond issued by the Commonwealth of Virginia? If a corporate bond yields 8%, to be competitive (e.g., indifferent), what would a municipal bond need to yield for an investor in the 40% tax bracket? In municipals, what, if any, is the difference between a general obligation and revenue bond? What is a pass-through security, a conforming mortgage, and a collateralized mortgage obligation? What does "residual risk" imply with respect to common stock? To corporate debt? What does the strike price imply with respect for a call option and a put option? What does an exercise price imply? If an investor owns a put option with a per-share strike price of $50 and the stock is selling at $48, what, if anything, is the option worth at expiration? If the investor paid a $2 per share premium for the put, what is his/her profit? Explain. What, if any, is the real difference between the capitalization rate in real estate, the yield to maturity in fixed income, and the required return in equities?

Step by Step Solution

★★★★★

3.49 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

Derivative securities derive their value from an underlying asset or assets The value of a derivative security can be determined by an underlying single stock such as IBM MMM or GE The value of a deri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started