Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can any one help please urgent 274 Q1. a) From the following information prepare statement of cash flows using indirect nu.. following common approach w.r.t

can any one help please urgent

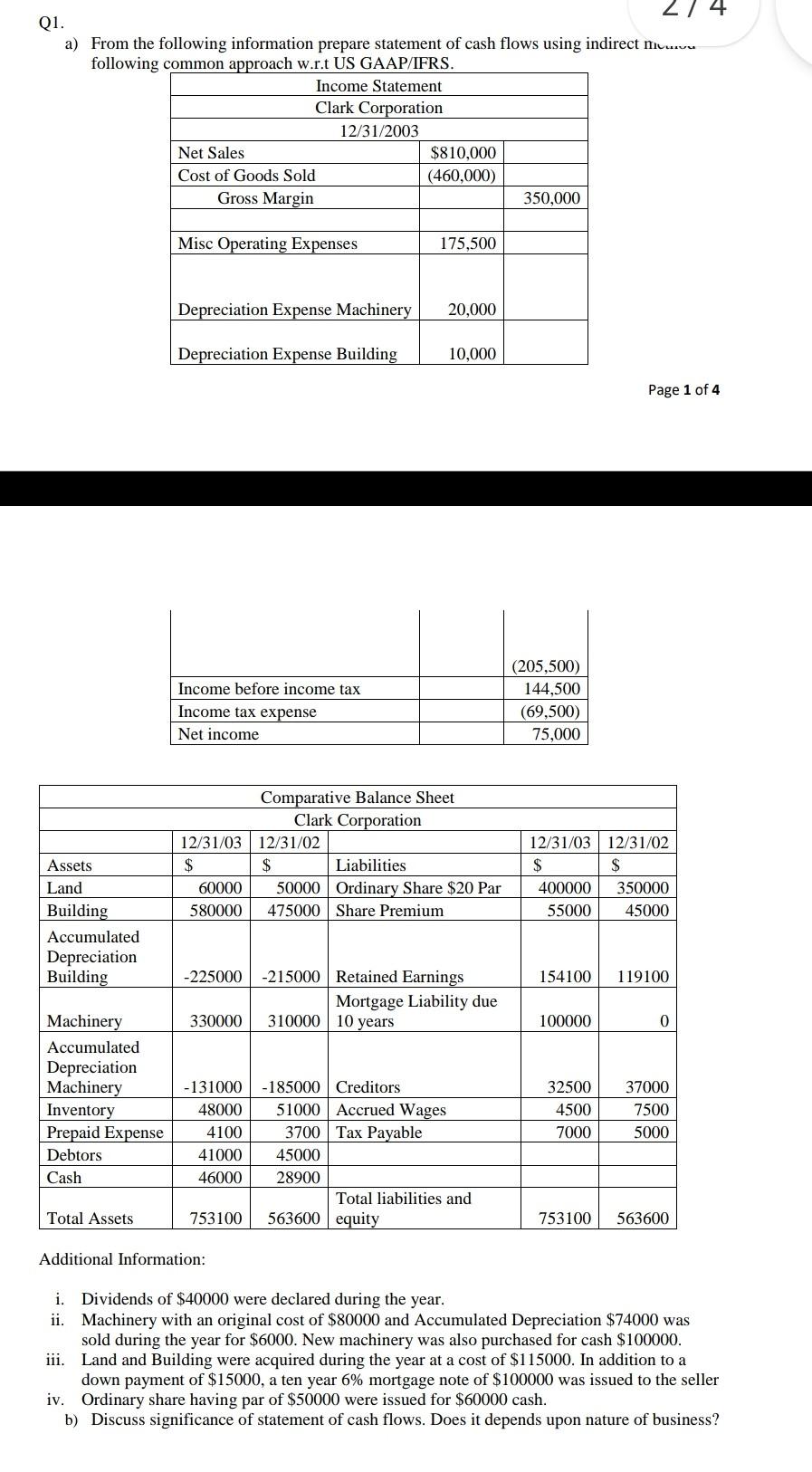

274 Q1. a) From the following information prepare statement of cash flows using indirect nu.. following common approach w.r.t US GAAP/IFRS. Income Statement Clark Corporation 12/31/2003 Net Sales $810,000 Cost of Goods Sold (460,000) Gross Margin 350,000 Misc Operating Expenses 175,500 Depreciation Expense Machinery 20,000 Depreciation Expense Building 10,000 Page 1 of 4 Income before income tax Income tax expense Net income (205,500) 144,500 (69,500) 75,000 12/31/03 $ 60000 580000 Comparative Balance Sheet Clark Corporation 12/31/02 $ Liabilities 50000 Ordinary Share $20 Par 475000 Share Premium 12/31/03 12/31/02 $ $ 400000 350000 55000 45000 Assets Land Building Accumulated Depreciation Building -225000 154100 119100 -215000 Retained Earnings Mortgage Liability due 310000 10 years 330000 100000 0 Machinery Accumulated Depreciation Machinery Inventory Prepaid Expense Debtors Cash -131000 48000 4100 41000 46000 32500 4500 7000 37000 7500 5000 -185000 Creditors 51000 Accrued Wages 3700 Tax Payable 45000 28900 Total liabilities and 563600 equity Total Assets 753100 753100 563600 Additional Information: i. Dividends of $40000 were declared during the year. ii. Machinery with an original cost of $80000 and Accumulated Depreciation $74000 was sold during the year for $6000. New machinery was also purchased for cash $100000. iii. Land and Building were acquired during the year at a cost of $115000. In addition to a down payment of $15000, a ten year 6% mortgage note of $100000 was issued to the seller iv. Ordinary share having par of $50000 were issued for $60000 cash. b) Discuss significance of statement of cash flows. Does it depends upon nature of business

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started