Answered step by step

Verified Expert Solution

Question

1 Approved Answer

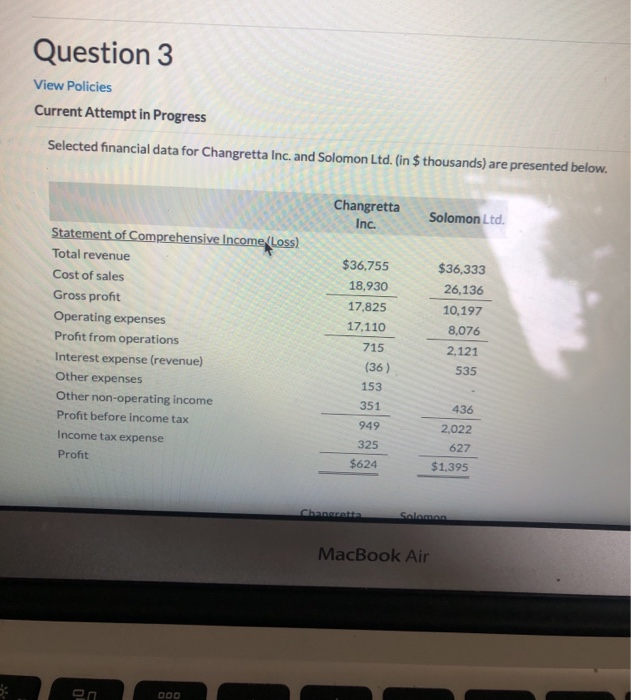

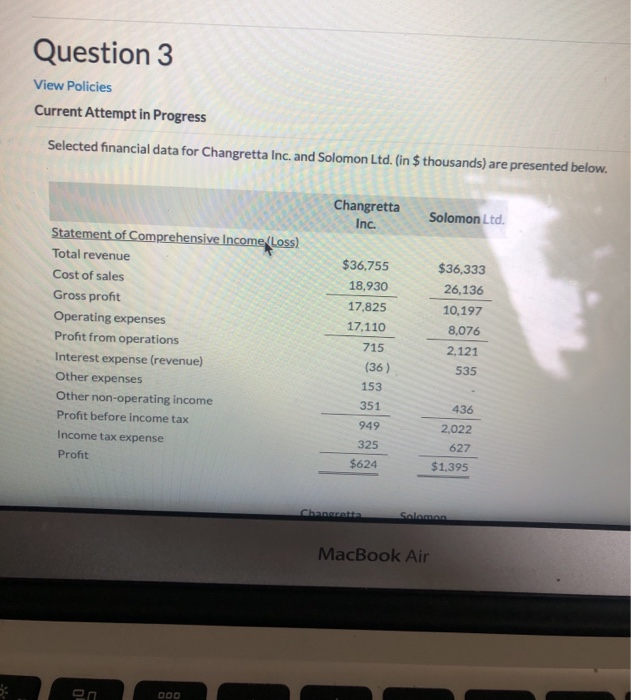

can anyone answe this question with all the values ASAP? Question 3 View Policies Current Attempt in Progress Selected financial data for Changretta Inc. and

can anyone answe this question with all the values ASAP?

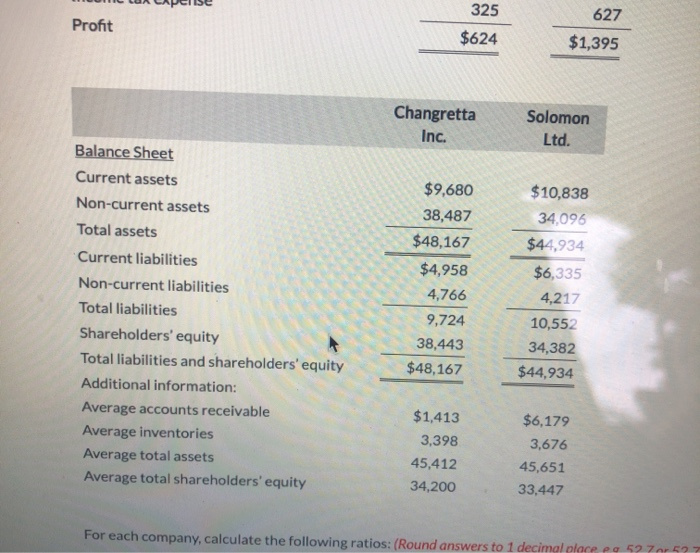

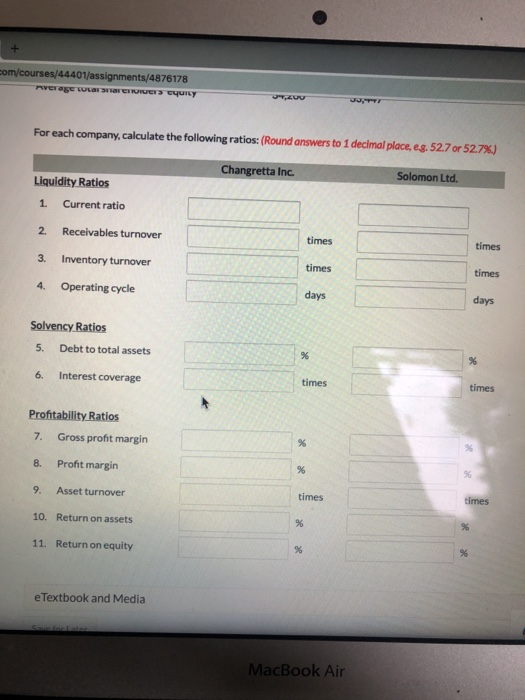

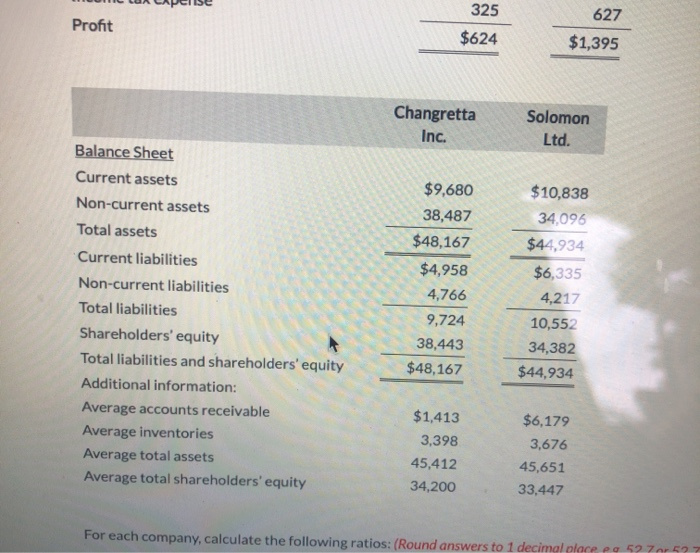

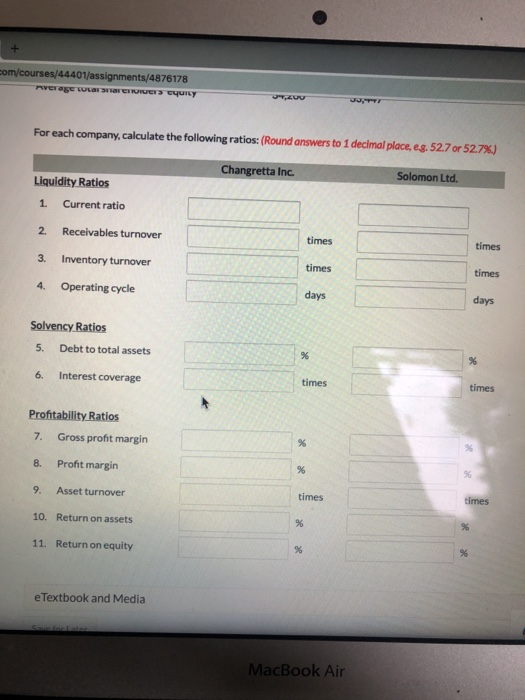

Question 3 View Policies Current Attempt in Progress Selected financial data for Changretta Inc. and Solomon Ltd. (in $ thousands) are presented below. Changretta Inc. Solomon Ltd. Statement of Comprehensive Income (Loss) Total revenue Cost of sales Gross profit Operating expenses Profit from operations Interest expense (revenue) Other expenses Other non-operating income Profit before income tax Income tax expense Profit $36,755 18,930 17,825 17.110 715 (36) 153 351 949 325 $624 $36,333 26,136 10,197 8.076 2,121 535 436 2.022 627 $1,395 Chan Salaman MacBook Air 00 DOO 627 Profit 325 $624 $1,395 Changretta Inc. Solomon Ltd. Balance Sheet Current assets Non-current assets Total assets Current liabilities Non-current liabilities Total liabilities Shareholders' equity Total liabilities and shareholders' equity Additional information: Average accounts receivable Average inventories Average total assets Average total shareholders' equity $9,680 38,487 $48,167 $4,958 4,766 9,724 38,443 $48,167 $10,838 34,096 $44,934 $6,335 4,217 10,552 34,382 $44,934 $1,413 3,398 45,412 34,200 $6,179 3,676 45,651 33,447 For each company, calculate the following ratios: (Round answers to 1 decimal place po 52 70-5? com/courses/44401/assignments/4876178 rease cuva aeroes cury JU For each company, calculate the following ratios: (Round answers to 1 decimal place, eg. 52.7 or 52.7%) Changretta Inc Solomon Ltd. Liquidity Ratios 1 Current ratio 2. Receivables turnover times times 3. Inventory turnover times times 4. Operating cycle days days Solvency Ratios 5. Debt to total assets % % 6. Interest coverage times times Profitability Ratios 7. Gross profit margin % 8. Profit margin % % 9. Asset turnover times times 10. Return on assets % 11. Return on equity % e Textbook and Media MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started