can anyone answer these please? i will make sure to thumbs up :)

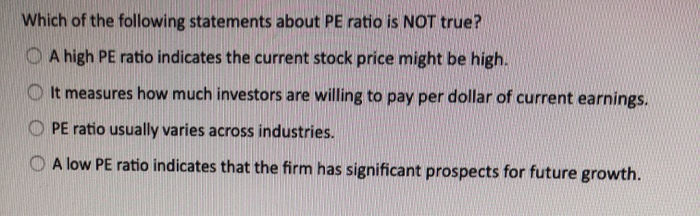

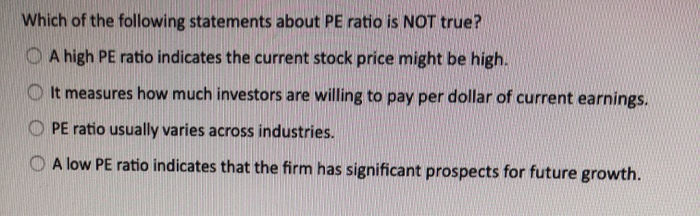

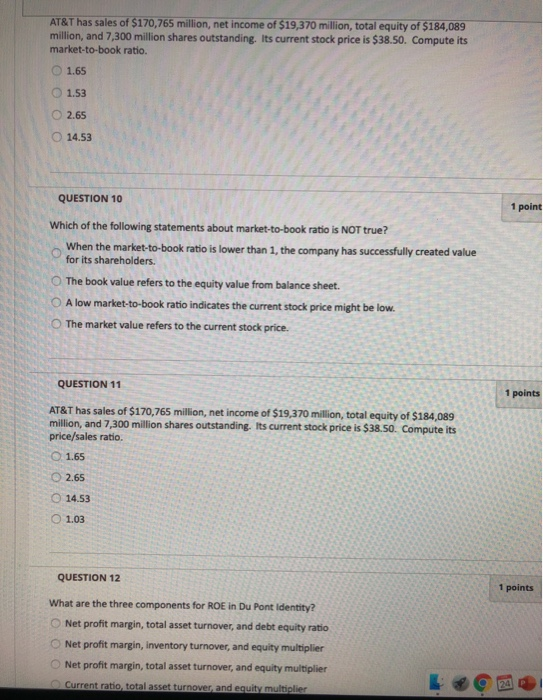

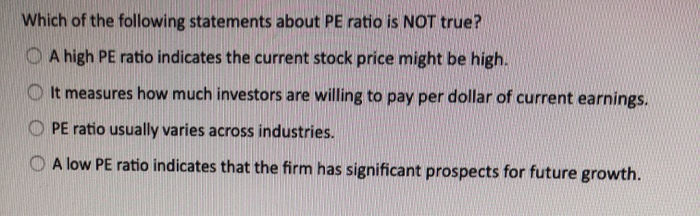

Which of the following statements about PE ratio is NOT true? O A high PE ratio indicates the current stock price might be high. O It measures how much investors are willing to pay per dollar of current earnings. OPE ratio usually varies across industries. O A low PE ratio indicates that the firm has significant prospects for future growth. AT&T has sales of $170,765 million, net income of $19,370 million, total equity of $184,089 million, and 7,300 million shares outstanding. Its current stock price is $38.50. Compute its market-to-book ratio. 1.65 1.53 2.65 14.53 QUESTION 10 1 point Which of the following statements about market-to-book ratio is NOT true? When the market-to-book ratio is lower than 1, the company has successfully created value for its shareholders. The book value refers to the equity value from balance sheet. A low market-to-book ratio indicates the current stock price might be low. The market value refers to the current stock price. QUESTION 11 1 points AT&T has sales of $170,765 million, net income of $19,370 million, total equity of $184,089 million, and 7,300 million shares outstanding. Its current stock price is $38.50. Compute its price/sales ratio. O 1.65 2.65 14.53 1.03 QUESTION 12 1 points What are the three components for ROE in Du Pont Identity? Net profit margin, total asset turnover, and debt equity ratio Net profit margin, inventory turnover, and equity multiplier Net profit margin, total asset turnover, and equity multiplier Current ratio, total asset turnover and equity multiplier Question Completion Status: QUESTION 12 What are the three components for ROE in Du Pont Identity? Net profit margin, total asset turnover, and debt equity ratio Net profit margin, inventory turnover, and equity multiplier Net profit margin, total asset turnover, and equity multiplier Current ratio, total asset turnover, and equity multiplier QUESTION 13 UPS Inc. has the net profit margin of 6.67% and the total asset turnover ratio of 1.44. Compute its return on assets using Du Pont Identity. 9.60% 13.20% 4.63% 6.82% QUESTION 14 What is PE ratio? It is net income / number of shares. It is price / sales per share. It is price / earnings per share. O It is price / book equity per share. QUESTION 15 What is market-to-book ratio? It is price / sales per share. It is net income / number of shares. It is price / book equity per share. It is price / earnings per share