can anyone answer this question?

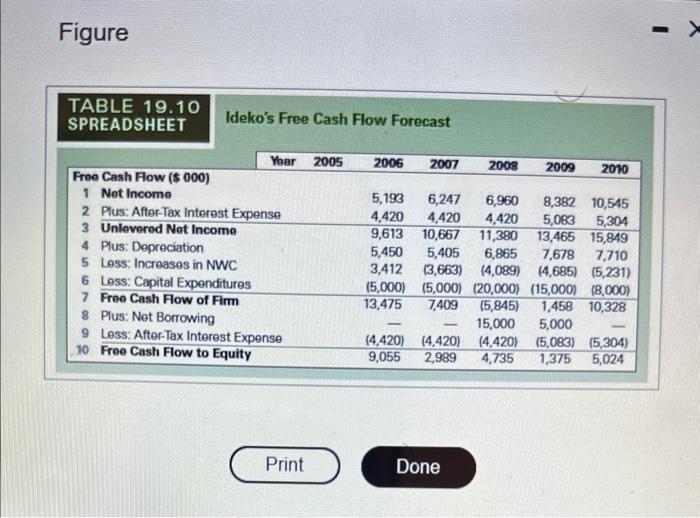

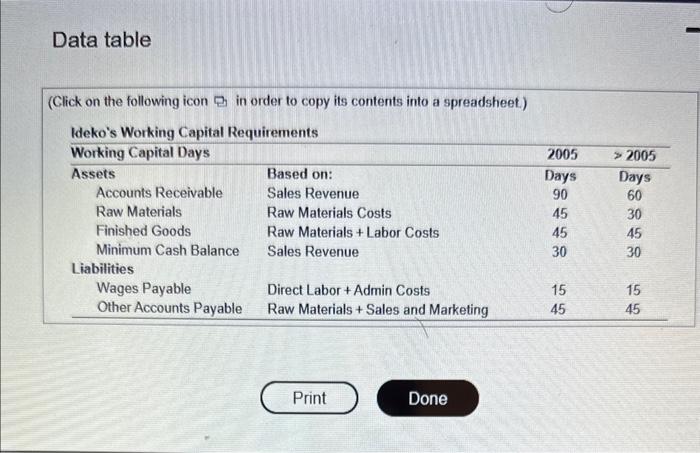

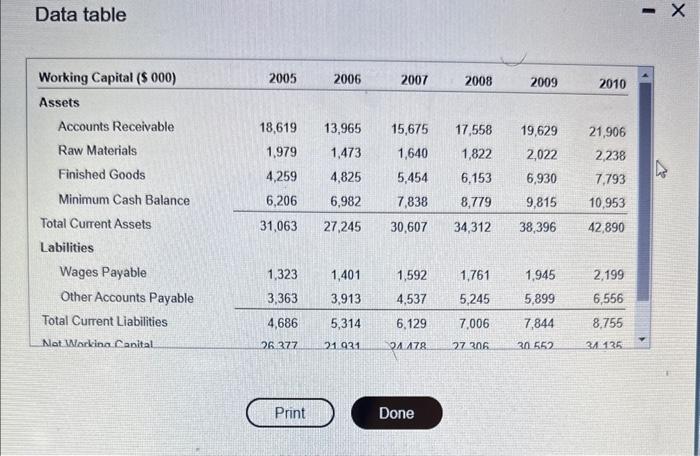

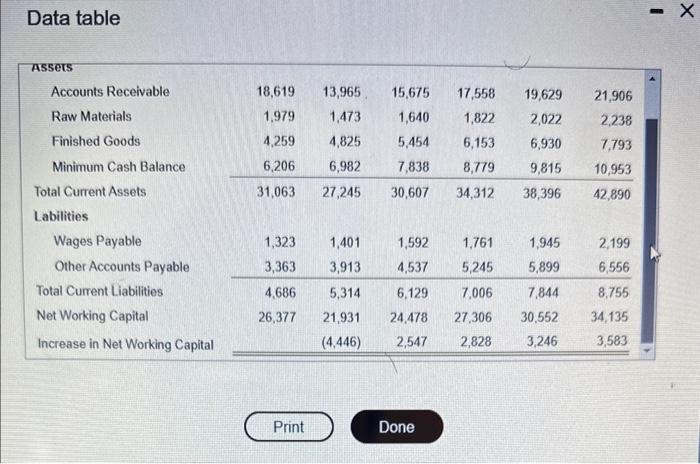

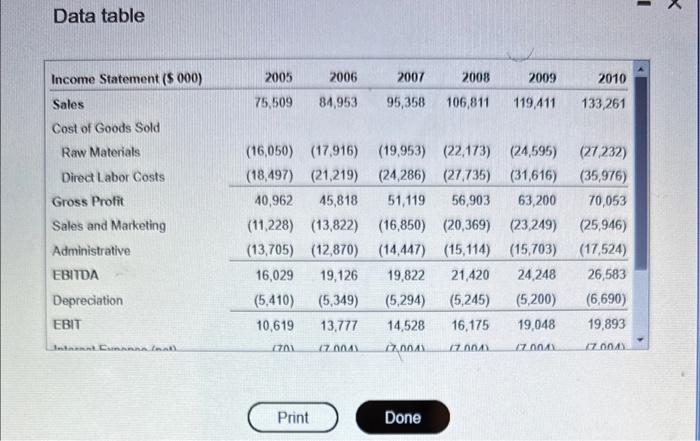

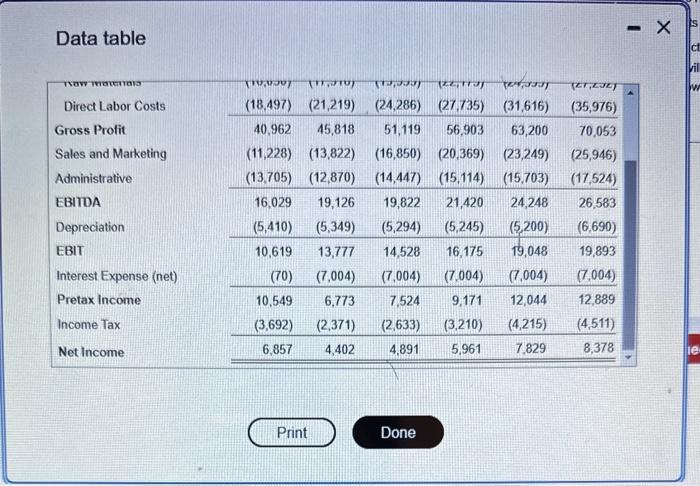

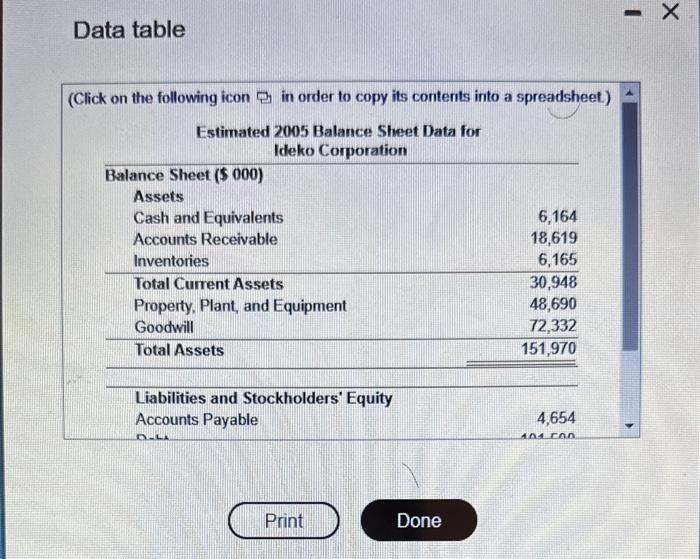

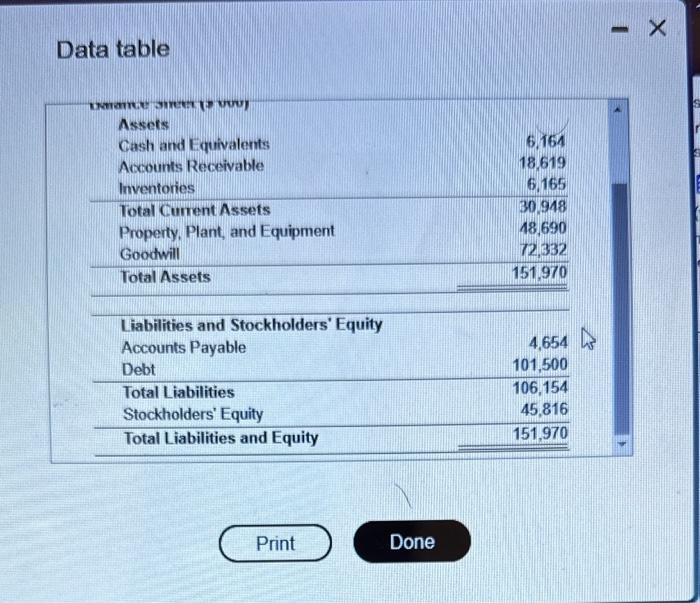

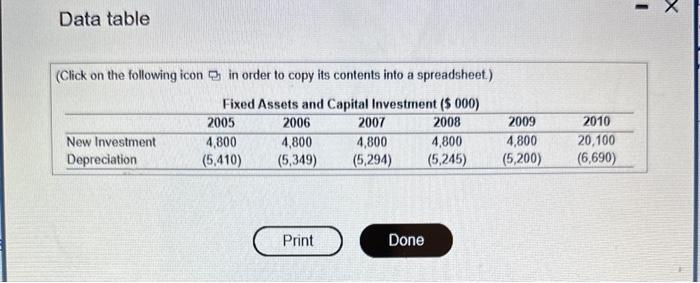

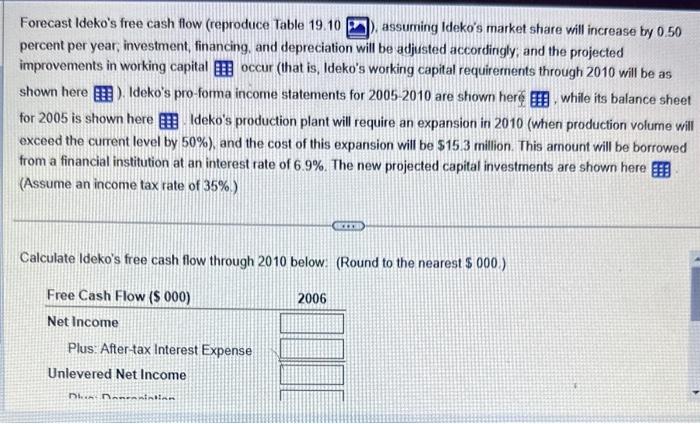

Forecast Ideko's free cash flow (reproduce Table 19.10 .1. assurning Ideko's market share will increase by 0.50 percent per year, investment, financing, and depreciation will be adjusted accordingly, and the projected improvements in working capital occur (that is, Ideko's working capital requirements through 2010 will be as shown here I. Ideko's pro-fomma income statements for 2005-2010 are shown here, while its balance sheet for 2005 is shown here Ideko's production plant will require an expansion in 2010 (when production volume will exceed the current level by 50%, and the cost of this exparision will be $15.3 million. This amount will be borrowed from a financial institution at an interest rate of 6.9%. The new projected capital investments are shown here (Assume an income tax rate of 35% ) Calculate Ideko's free cash flow through 2010 below: (Round to the nearest $000 ) Figure Ideko's Free Cash Flow Forecast Data table (Click on the following icon pe in order to copy its contents into a spreadsheet.) Data table Data table Data table Data table Data table (Click on the following icon th in order to copy its contents into a spreadsheet) Data table Data table (Click on the following icon y in order to copy its contents into a spreadsheet.) Forecast Ideko's free cash flow (reproduce Table 19.10 .1. assurning Ideko's market share will increase by 0.50 percent per year, investment, financing, and depreciation will be adjusted accordingly, and the projected improvements in working capital occur (that is, Ideko's working capital requirements through 2010 will be as shown here I. Ideko's pro-fomma income statements for 2005-2010 are shown here, while its balance sheet for 2005 is shown here Ideko's production plant will require an expansion in 2010 (when production volume will exceed the current level by 50%, and the cost of this exparision will be $15.3 million. This amount will be borrowed from a financial institution at an interest rate of 6.9%. The new projected capital investments are shown here (Assume an income tax rate of 35% ) Calculate Ideko's free cash flow through 2010 below: (Round to the nearest $000 ) Figure Ideko's Free Cash Flow Forecast Data table (Click on the following icon pe in order to copy its contents into a spreadsheet.) Data table Data table Data table Data table Data table (Click on the following icon th in order to copy its contents into a spreadsheet) Data table Data table (Click on the following icon y in order to copy its contents into a spreadsheet.)