Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can anyone answer tis question with all the values? ignments/4876178 Due Jul 1 by 11:59pm Points 10 Submitting an external tool Available after M Question

can anyone answer tis question with all the values?

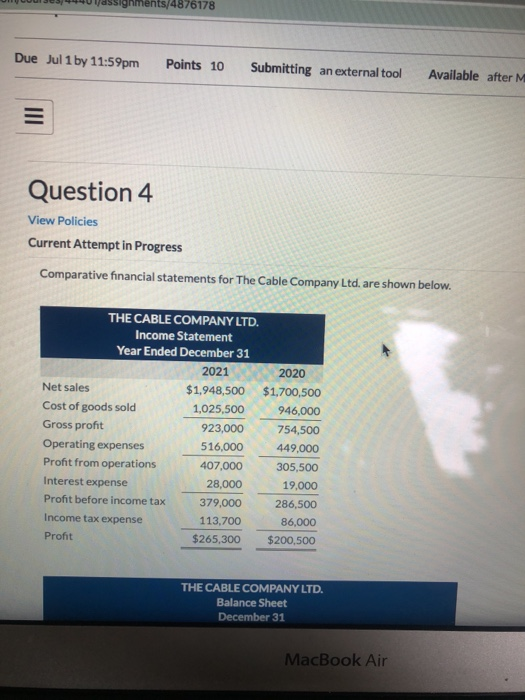

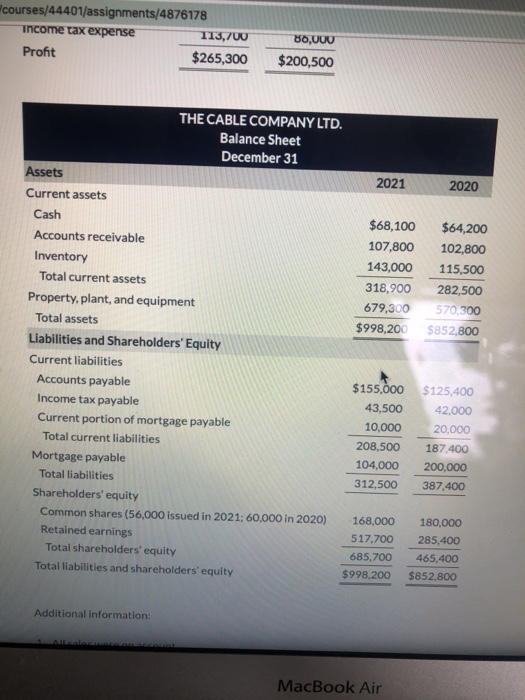

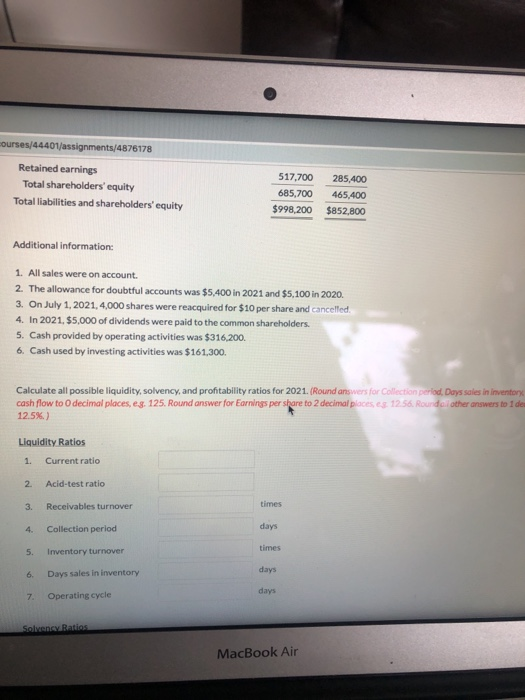

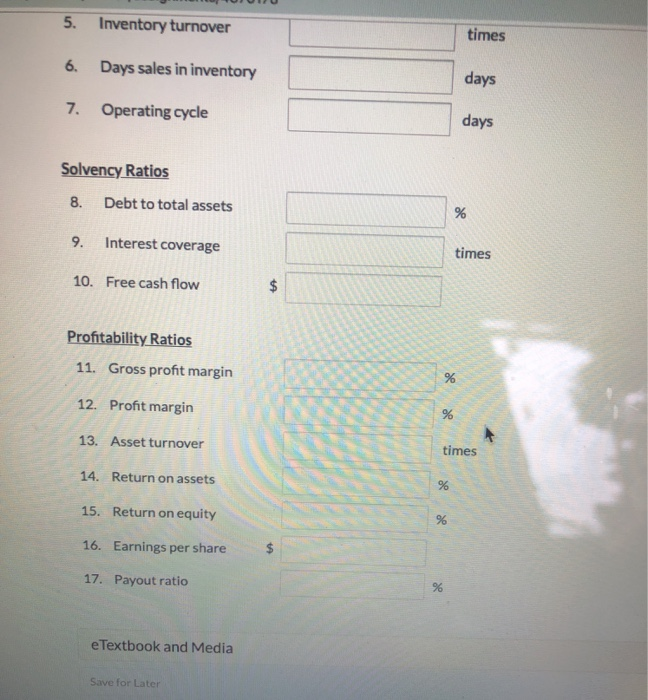

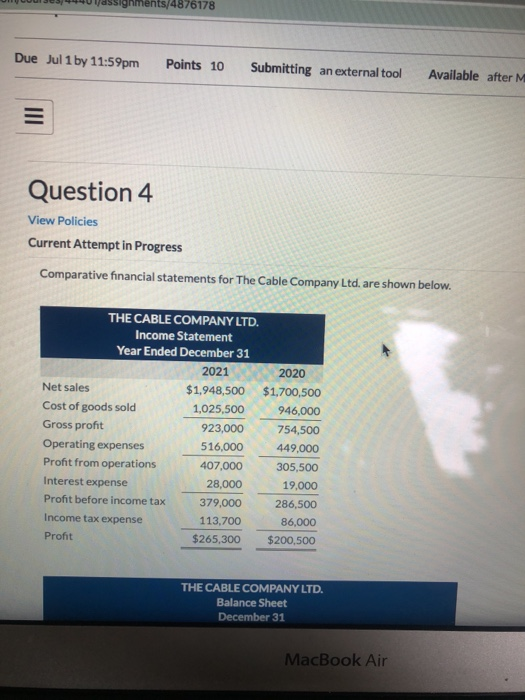

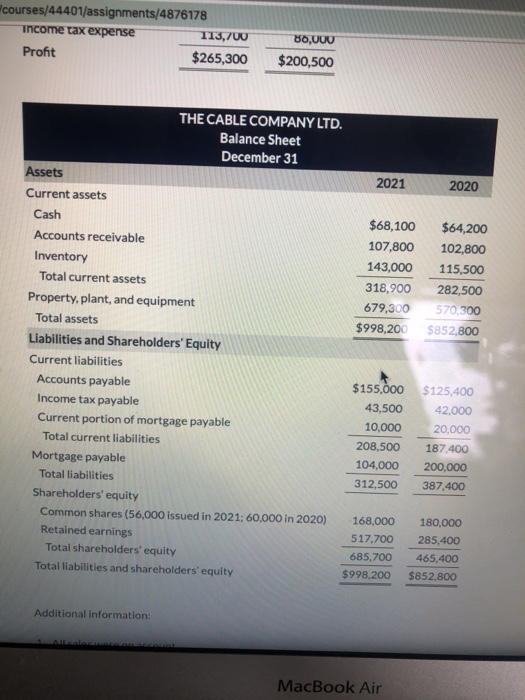

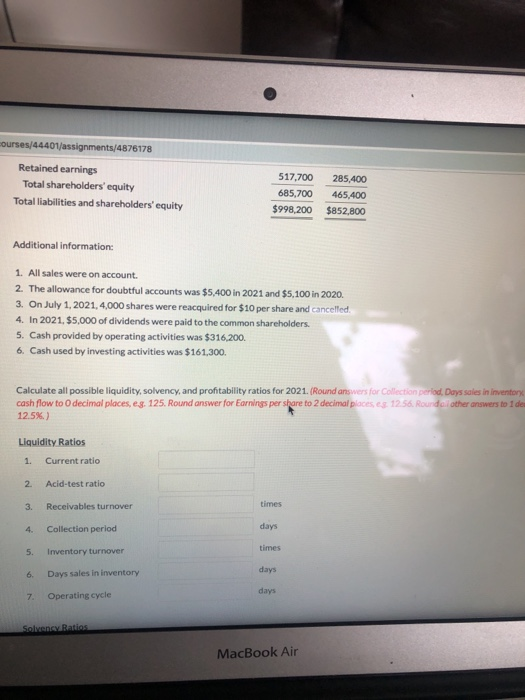

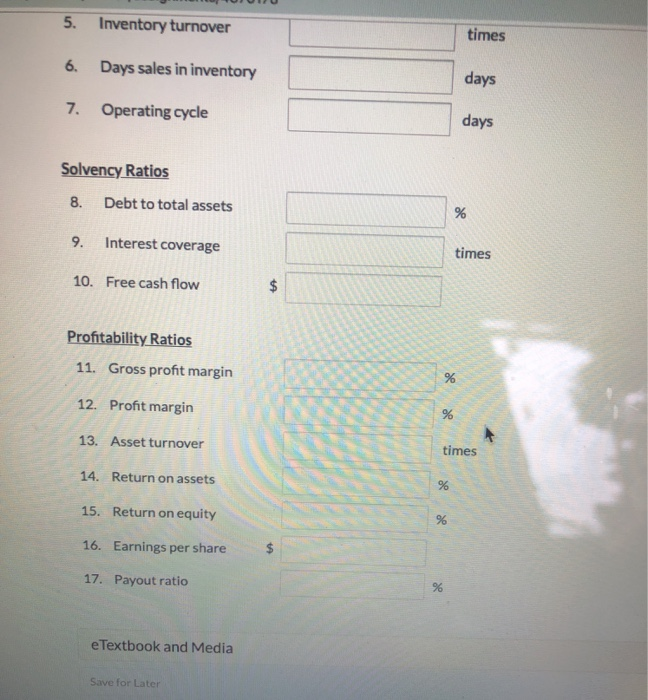

ignments/4876178 Due Jul 1 by 11:59pm Points 10 Submitting an external tool Available after M Question 4 View Policies Current Attempt in Progress Comparative financial statements for The Cable Company Ltd. are shown below. THE CABLE COMPANY LTD. Income Statement Year Ended December 31 2021 2020 Net sales $1,948,500 $1,700,500 Cost of goods sold 1,025,500 946,000 Gross profit 923,000 754,500 Operating expenses 516,000 449,000 Profit from operations 407,000 305,500 Interest expense 28,000 19,000 Profit before income tax 379,000 286,500 Income tax expense 113,700 86,000 Profit $265,300 $200,500 THE CABLE COMPANY LTD. Balance Sheet December 31 MacBook Air courses/44401/assignments/4876178 Income tax expense 113,700 Profit $265,300 80,000 $200,500 2021 2020 $68,100 107,800 143,000 318,900 679,300 $998,200 $64,200 102,800 115,500 282,500 570,300 $852,800 THE CABLE COMPANY LTD. Balance Sheet December 31 Assets Current assets Cash Accounts receivable Inventory Total current assets Property, plant, and equipment Total assets Liabilities and Shareholders' Equity Current liabilities Accounts payable Income tax payable Current portion of mortgage payable Total current liabilities Mortgage payable Total liabilities Shareholders' equity Common shares (56,000 issued in 2021; 60,000 in 2020) Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $155.000 43,500 10,000 208,500 104,000 312,500 $125,400 42.000 20.000 187.400 200,000 387,400 168,000 517.700 685.700 $998,200 180,000 285,400 465,400 $852,800 Additional information: MacBook Air courses/44401/assignments/4876178 Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 517,700 685,700 $998.200 285,400 465,400 $852,800 Additional information: 1. All sales were on account 2. The allowance for doubtful accounts was $5,400 in 2021 and $5,100 in 2020. 3. On July 1, 2021, 4,000 shares were reacquired for $10 per share and cancelled. 4. In 2021. $5,000 of dividends were paid to the common shareholders. 5. Cash provided by operating activities was $316,200. 6. Cash used by investing activities was $161,300. Calculate all possible liquidity, solvency, and profitability ratios for 2021. (Round answers for Collection period, Days sales in inventory cash flow to decimal places, eg. 125. Round answer for Earnings per share to 2 decimal places, es 12.56. Rounda.rother answers to 1 de 12.5%) Liquidity Ratios 1. Current ratio 2 Acid-test ratio 3. Receivables turnover times Collection period days 5. Inventory turnover times 6. days Days sales in inventory days 7. Operating cycle Solvency Ratins MacBook Air 5. Inventory turnover times 6. Days sales in inventory days 7. Operating cycle days Solvency Ratios 8. Debt to total assets % 9. Interest coverage times 10. Free cash flow $ Profitability Ratios 11. Gross profit margin de 12. Profit margin % 13. Asset turnover times 14. Return on assets % 15. Return on equity % 16. Earnings per share $ 17. Payout ratio 96 e Textbook and Media Save for Later

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started