Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CAN ANYONE ASSITS ME TO SOLVE THE B i and ii ? please its an emergency !! Q1. (a) AAA Corporation (AAA) and BBB Corporation

CAN ANYONE ASSITS ME TO SOLVE THE B i and ii ? please its an emergency !!

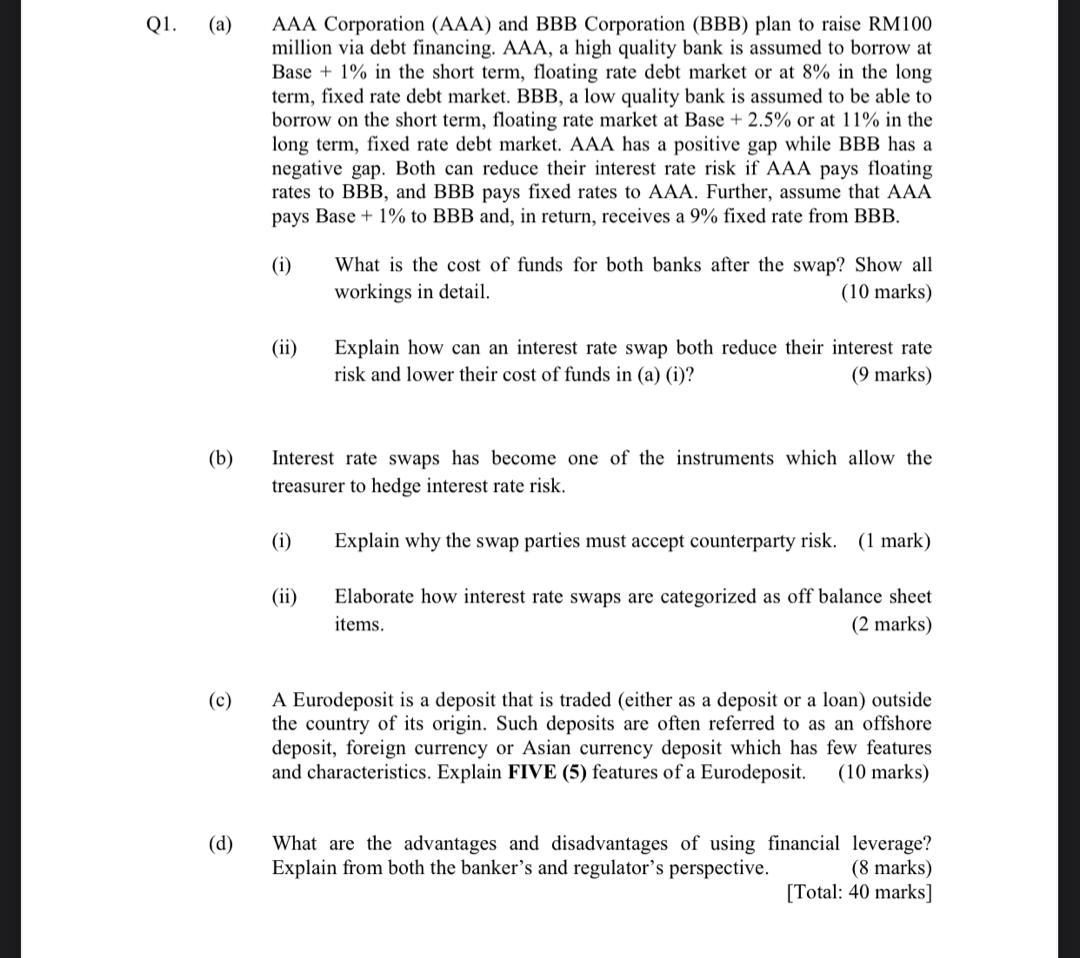

Q1. (a) AAA Corporation (AAA) and BBB Corporation (BBB) plan to raise RM100 million via debt financing. AAA, a high quality bank is assumed to borrow at Base + 1% in the short term, floating rate debt market or at 8% in the long term, fixed rate debt market. BBB, a low quality bank is assumed to be able to borrow on the short term, floating rate market at Base + 2.5% or at 11% in the long term, fixed rate debt market. AAA has a positive gap while BBB has a negative gap. Both can reduce their interest rate risk if AAA pays floating rates to BBB, and BBB pays fixed rates to AAA. Further, assume that AAA pays Base + 1% to BBB and, in return, receives a 9% fixed rate from BBB. What is the cost of funds for both banks after the swap? Show all workings in detail. (10 marks) Explain how can an interest rate swap both reduce their interest rate risk and lower their cost of funds in (a) (i)? (9 marks) (b) Interest rate swaps has become one of the instruments which allow the treasurer to hedge interest rate risk. (i) Explain why the swap parties must accept counterparty risk. (1 mark) Elaborate how interest rate swaps are categorized as off balance sheet items. (2 marks) (c) A Eurodeposit is a deposit that is traded (either as a deposit or a loan) outside the country of its origin. Such deposits are often referred to as an offshore deposit, foreign currency or Asian currency deposit which has few features and characteristics. Explain FIVE (5) features of a Eurodeposit. (10 marks) (d) What are the advantages and disadvantages of using financial leverage? Explain from both the banker's and regulator's perspective. (8 marks) [Total: 40 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started