Can anyone explain how ROA was calculated?

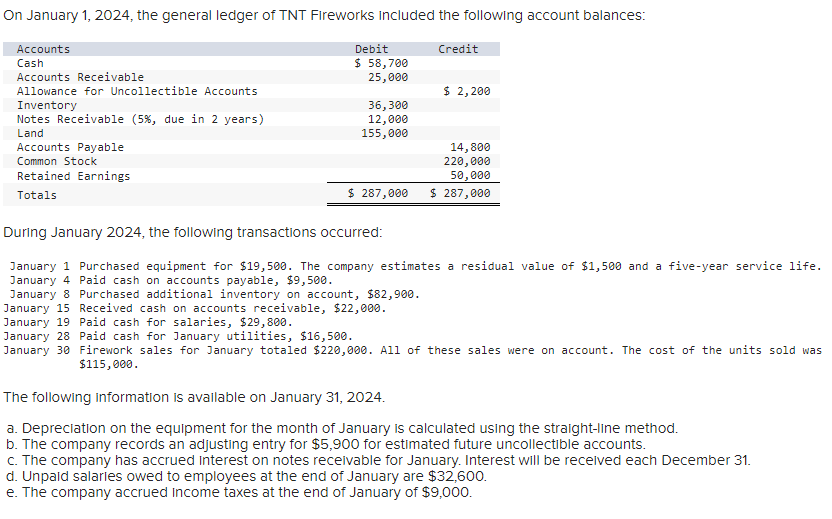

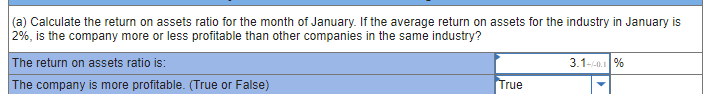

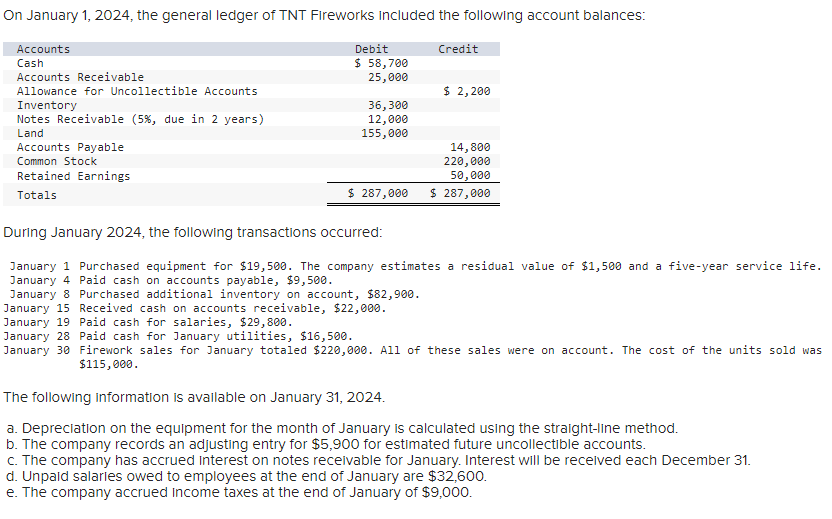

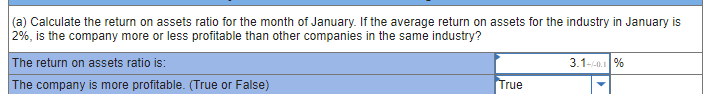

On January 1, 2024, the general ledger of TNT Fireworks included the following account balances: During January 2024 , the following transactions occurred: January 1 Purchased equipment for $19,500. The company estimates a residual value of $1,500 and a five-year service life. January 4 Paid cash on accounts payable, $9,500. January 8 Purchased additional inventory on account, $82,900. January 15 Received cash on accounts receivable, $22,000. January 19 Paid cash for salaries, $29,800. January 28 Paid cash for January utilities, $16,500. January 30 Firework sales for January totaled $220,000. All of these sales were on account. The cost of the units sold was $115,000 The following information is avallable on January 31,2024. a. Depreciation on the equipment for the month of January is calculated using the straight-IIne method. b. The company records an adjusting entry for $5,900 for estimated future uncollectible accounts. c. The company has accrued interest on notes recelvable for January. Interest will be recelved each December 31. d. Unpard salarles owed to employees at the end of January are $32,600. e. The company accrued income taxes at the end of January of $9,000. (a) Calculate the return on assets ratio for the month of January. If the average return on assets for the industry in January is 2%, is the company more or less profitable than other companies in the same industry? On January 1, 2024, the general ledger of TNT Fireworks included the following account balances: During January 2024 , the following transactions occurred: January 1 Purchased equipment for $19,500. The company estimates a residual value of $1,500 and a five-year service life. January 4 Paid cash on accounts payable, $9,500. January 8 Purchased additional inventory on account, $82,900. January 15 Received cash on accounts receivable, $22,000. January 19 Paid cash for salaries, $29,800. January 28 Paid cash for January utilities, $16,500. January 30 Firework sales for January totaled $220,000. All of these sales were on account. The cost of the units sold was $115,000 The following information is avallable on January 31,2024. a. Depreciation on the equipment for the month of January is calculated using the straight-IIne method. b. The company records an adjusting entry for $5,900 for estimated future uncollectible accounts. c. The company has accrued interest on notes recelvable for January. Interest will be recelved each December 31. d. Unpard salarles owed to employees at the end of January are $32,600. e. The company accrued income taxes at the end of January of $9,000. (a) Calculate the return on assets ratio for the month of January. If the average return on assets for the industry in January is 2%, is the company more or less profitable than other companies in the same industry