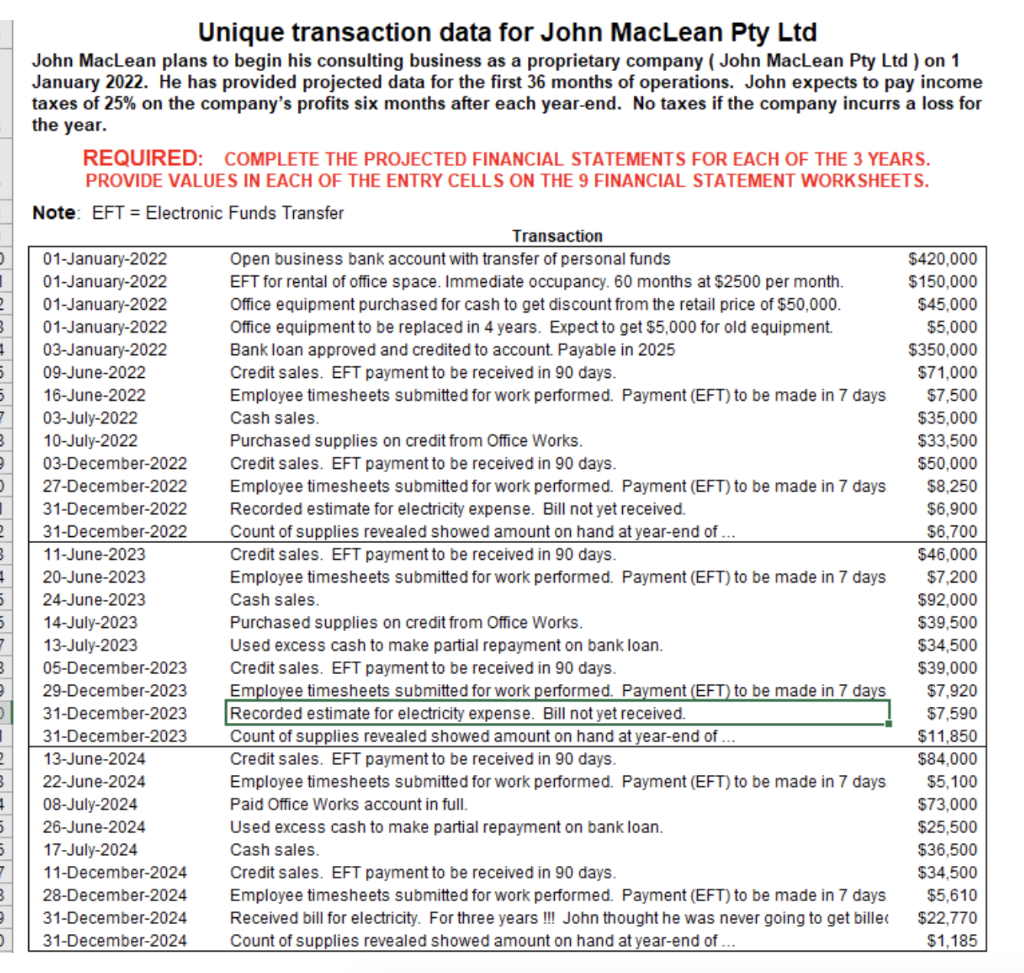

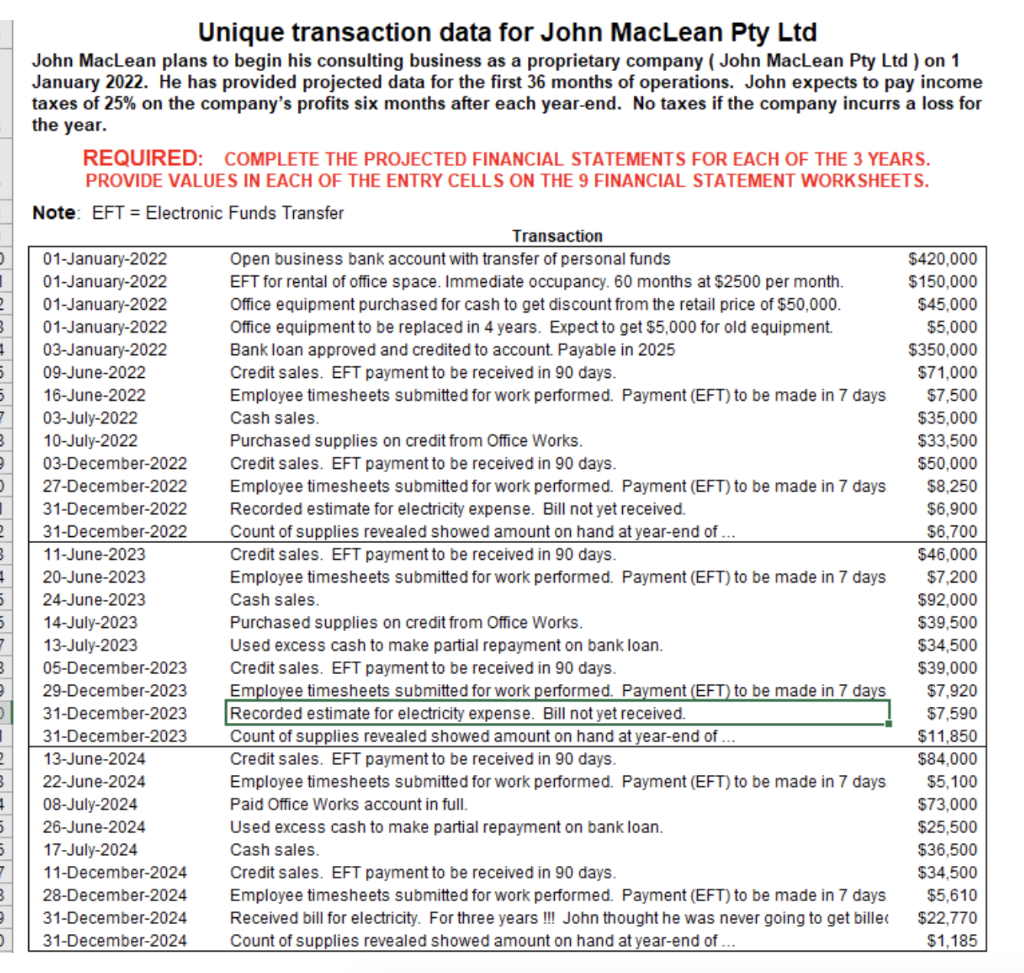

Can anyone find balance sheet and income statement for 2022 and 2023?

t 100 m Unique transaction data for John MacLean Pty Ltd John MacLean plans to begin his consulting business as a proprietary company (John MacLean Pty Ltd) on 1 January 2022. He has provided projected data for the first 36 months of operations. John expects to pay income taxes of 25% on the company's profits six months after each year-end. No taxes if the company incurrs a loss for the year. REQUIRED: COMPLETE THE PROJECTED FINANCIAL STATEMENTS FOR EACH OF THE 3 YEARS. PROVIDE VALUES IN EACH OF THE ENTRY CELLS ON THE 9 FINANCIAL STATEMENT WORKSHEETS. Note: EFT = Electronic Funds Transfer Transaction 01-January-2022 Open business bank account with transfer of personal funds $420,000 01-January-2022 EFT for rental of office space. Immediate occupancy. 60 months at $2500 per month $150,000 01-January-2022 Office equipment purchased for cash to get discount from the retail price of $50,000. $45,000 01-January-2022 Office equipment to be replaced in 4 years. Expect to get $5,000 for old equipment. $5.000 03-January-2022 Bank loan approved and credited to account. Payable in 2025 $350,000 09-June-2022 Credit sales. EFT payment to be received in 90 days. $71,000 16-June-2022 Employee timesheets submitted for work performed. Payment (EFT) to be made in 7 days $7,500 Cash sales. $35,000 10-July-2022 Purchased supplies on credit from Office Works. $33,500 03-December-2022 Credit sales. EFT payment to be received in 90 days. $50,000 27-December-2022 Employee timesheets submitted for work performed. Payment (EFT) to be made in 7 days $8.250 31-December-2022 Recorded estimate for electricity expense. Bill not yet received. $6,900 31-December-2022 Count of supplies revealed showed amount on hand at year-end of .. $6,700 11-June-2023 Credit sales. EFT payment to be received in 90 days. $46,000 20-June-2023 Employee timesheets submitted for work performed. Payment (EFT) to be made in 7 days $7,200 24-June-2023 Cash sales. $92,000 14-July-2023 Purchased supplies on credit from Office Works. $39,500 13-July-2023 Used excess cash to make partial repayment on bank loan. $34,500 05-December 2023 Credit sales. EFT payment to be received in 90 days. $39,000 29-December 2023 Employee timesheets submitted for work performed. Payment (EFT) to be made in 7 days $7,920 31-December-2023 Recorded estimate for electricity expense. Bill not yet received. $7,590 31-December-2023 Count of supplies revealed showed amount on hand at year-end of... $11,850 13-June-2024 Credit sales. EFT payment to be received in 90 days. $84,000 22-June-2024 08-July-2024 Paid Office Works account in full. $73,000 26-June-2024 Used excess cash to make partial repayment on bank loan. $25,500 17-July-2024 Cash sales. $36,500 11-December-2024 Credit sales. EFT payment to be received in 90 days. $34,500 28-December-2024 Employee timesheets submitted for work performed. Payment (EFT) to be made in 7 days $5,610 31-December-2024 Received bill for electricity. For three years !!! John thought he was never going to get bille $22,770 31-December-2024 Count of supplies revealed showed amount on hand at year-end of ... $1,185 it 10 mt 10 mm