Can anyone help me fill these in please !!!

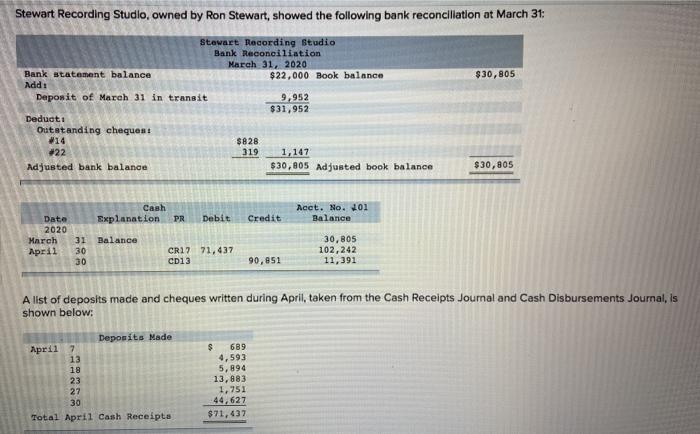

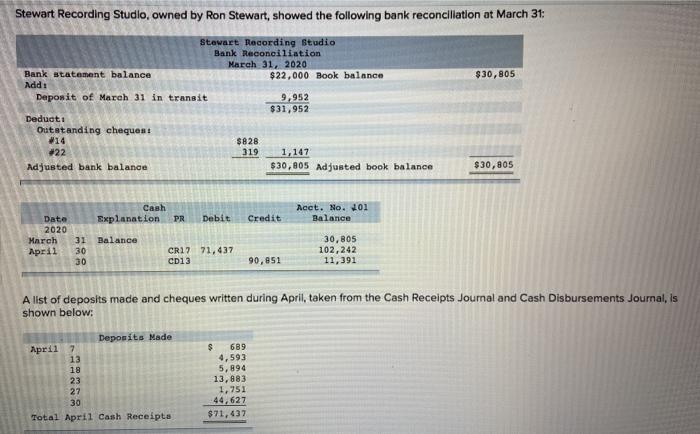

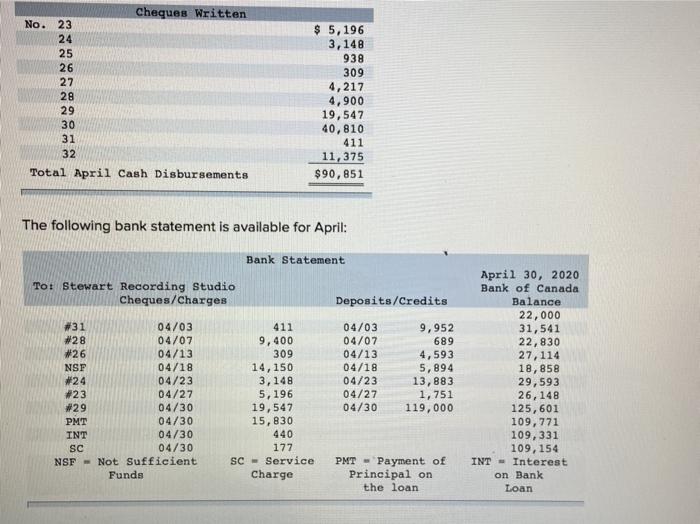

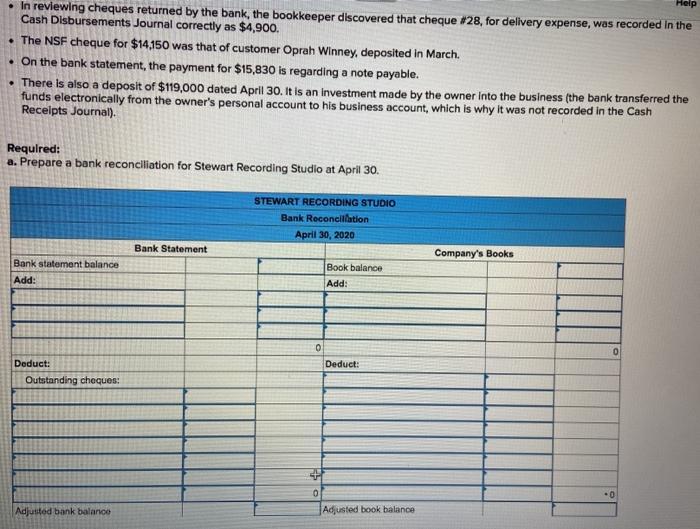

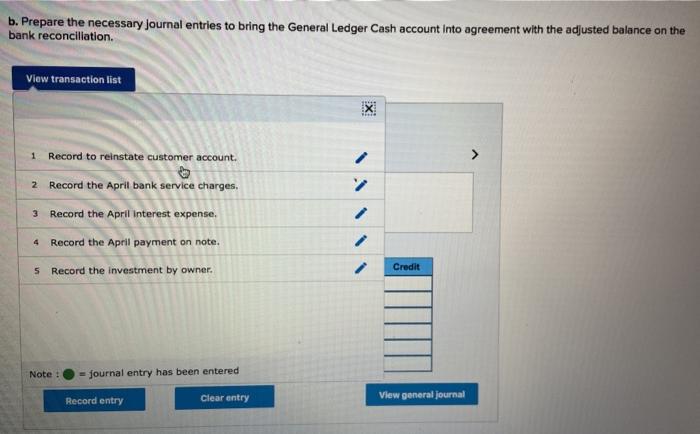

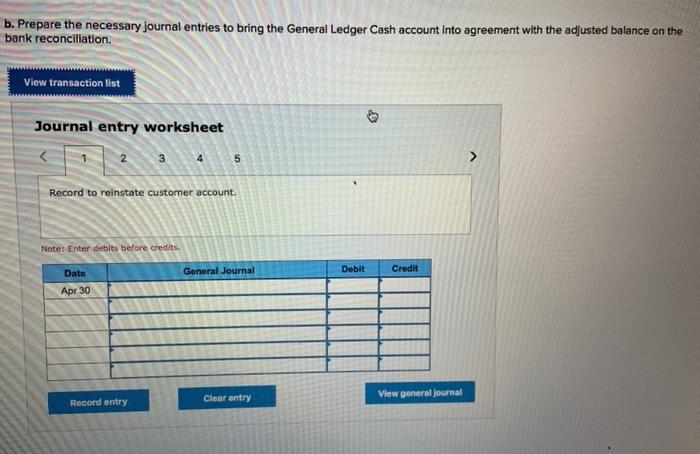

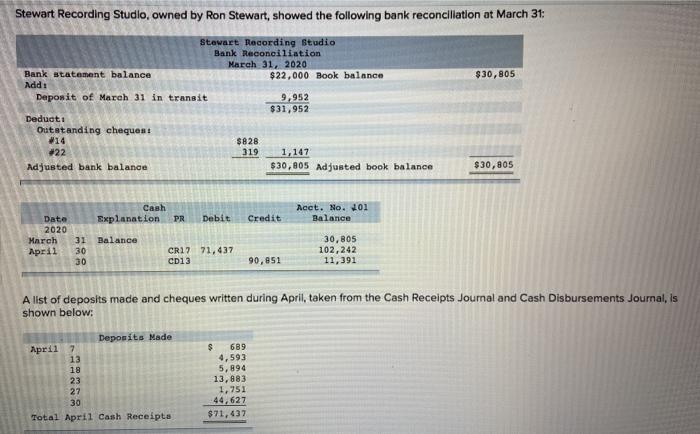

Stewart Recording Studio, owned by Ron Stewart, showed the following bank reconciliation at March 31: Stewart Recording Studio Bank Reconciliation March 31, 2020 Bank statement balance $22,000 Book balance $30,805 Add: Deponit of March 31 in transit 9,952 $31,952 Deduoti Outstanding cheques : 714 $828 #22 1,147 Adjusted bank balance $30,805 Adjusted book balance $30,805 319 Cash Explanation Acct. No. 201 Balance PR Debit Credit Date 2020 March April Balance 31 30 30 CR17 71,437 CD13 30,805 102,242 11,391 90,851 A list of deposits made and cheques written during April, taken from the Cash Receipts Journal and Cash Disbursements Journal, is shown below: Deponits Made April 7 13 18 23 27 30 Total April Cash Receipta $ 689 4,593 5,894 13,883 1.751 44,627 $71,437 Cheques Written No. 23 24 25 26 27 28 29 30 31 32 $ 5,196 3,148 938 309 4,217 4,900 19,547 40,810 411 11,375 $90,851 Total April Cash Disbursements The following bank statement is available for April: Bank Statement To: Stewart Recording Studio Cheques/Charges #31 04/03 #28 04/07 #26 04/13 NSF 04/18 #24 04/23 #23 04/27 #29 04/30 PMT 04/30 INT 04/30 SC 04/30 NSF - Not Sufficient Funds 411 9,400 309 14, 150 3, 148 5, 196 19,547 15,830 440 177 SC Service Charge Deposits/Credits 04/03 9,952 04/07 689 04/13 4,593 04/18 5,894 04/23 13,883 04/27 1,751 04/30 119,000 April 30, 2020 Bank of Canada Balance 22,000 31,541 22,830 27, 114 18,858 29,593 26,148 125,601 109,771 109, 331 109, 154 INT - Interest on Bank Loan PMT - Payment of Principal on the loan Help In reviewing cheques returned by the bank, the bookkeeper discovered that cheque #28, for delivery expense, was recorded in the Cash Disbursements Journal correctly as $4,900. The NSF cheque for $14,150 was that of customer Oprah Winney, deposited in March. On the bank statement, the payment for $15,830 is regarding a note payable. There is also a deposit of $119,000 dated April 30. It is an investment made by the owner into the business (the bank transferred the funds electronically from the owner's personal account to his business account, which is why it was not recorded in the Cash Receipts Journal). Required: a. Prepare a bank reconciliation for Stewart Recording Studio at April 30. STEWART RECORDING STUDIO Bank Reconciliation April 30, 2020 Bank Statement Company's Books Bank statement balance Add: Book balance Add: 0 Deduct: Deduct: Outstanding cheques + 0 Adjusted book balance .0 Adjusted bank balance b. Prepare the necessary Journal entries to bring the General Ledger Cash account Into agreement with the adjusted balance on the bank reconciliation View transaction list X 1 > 1 Record to reinstate customer account. 2 Record the April bank service charges, 3 Record the April Interest expense. 4 Record the April payment on note. S Record the investment by owner. Credit Note : - Journal entry has been entered Record entry Clear entry View general journal b. Prepare the necessary journal entries to bring the General Ledger Cash account Into agreement with the adjusted balance on the bank reconciliation View transaction list Journal entry worksheet 2 3 4 5 Record to reinstate customer account. Note: Enter debits before credits Date General Journal Debit Credit Apr 30 Record entry Clear entry View general Journal