Answered step by step

Verified Expert Solution

Question

1 Approved Answer

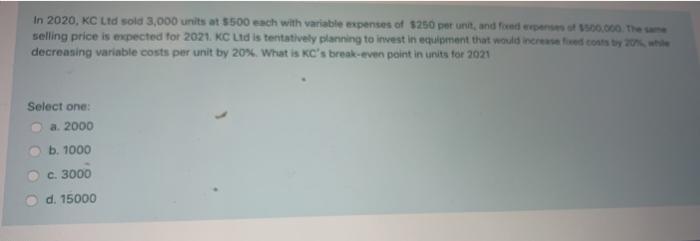

can anyone help me please fast In 2020, KC Ltd sold 3,000 units at 5500 each with variable expenses of $250 per unit, and feeder

can anyone help me please fast

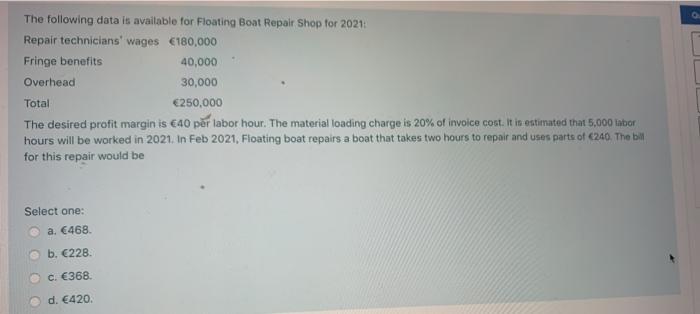

In 2020, KC Ltd sold 3,000 units at 5500 each with variable expenses of $250 per unit, and feeder 100.000 the selling price is expected for 2021. KC ud is tentatively planning to invest in equipment that would increased by while decreasing variable costs per unit by 20%. What is KC's break-even point in units for 2021 Select one: a 2000 b. 1000 c. 3000 d. 15000 The following data is available for Floating Boat Repair Shop for 2021: Repair technicians' wages 180,000 Fringe benefits 40,000 Overhead 30,000 Total 250,000 The desired profit margin is 40 per labor hour. The material loading charge is 20% of invoice cost. It is estimated that 5,000 labor hours will be worked in 2021. In Feb 2021, Floating boat repairs a boat that takes two hours to repair and uses parts of 240. The bill for this repair would be Select one: a. 468 b. 228. c. 368 d. 420

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started