Can anyone help me solve it? I already solved the first 3 bullets one (Show in excel file ). So now i just want some one help me solve the next 2 bullets and you dont need to care about the 2 last bullet

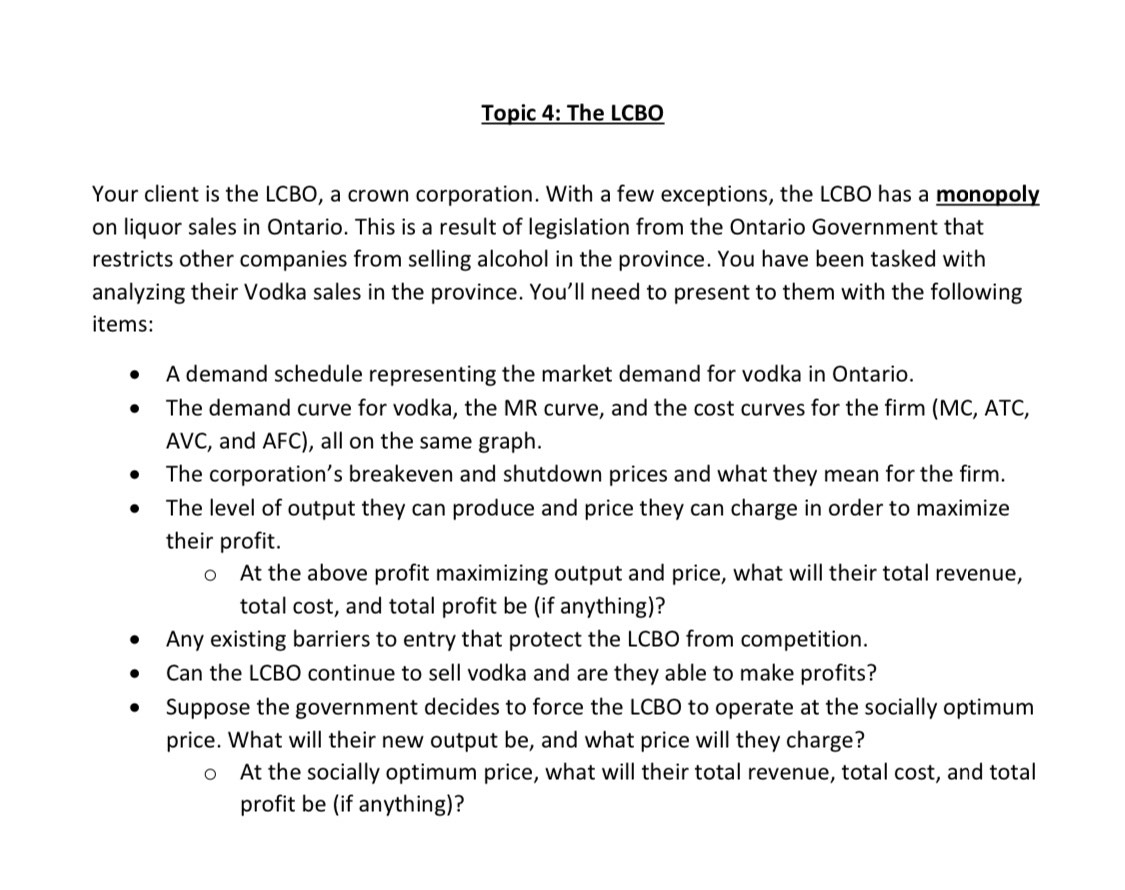

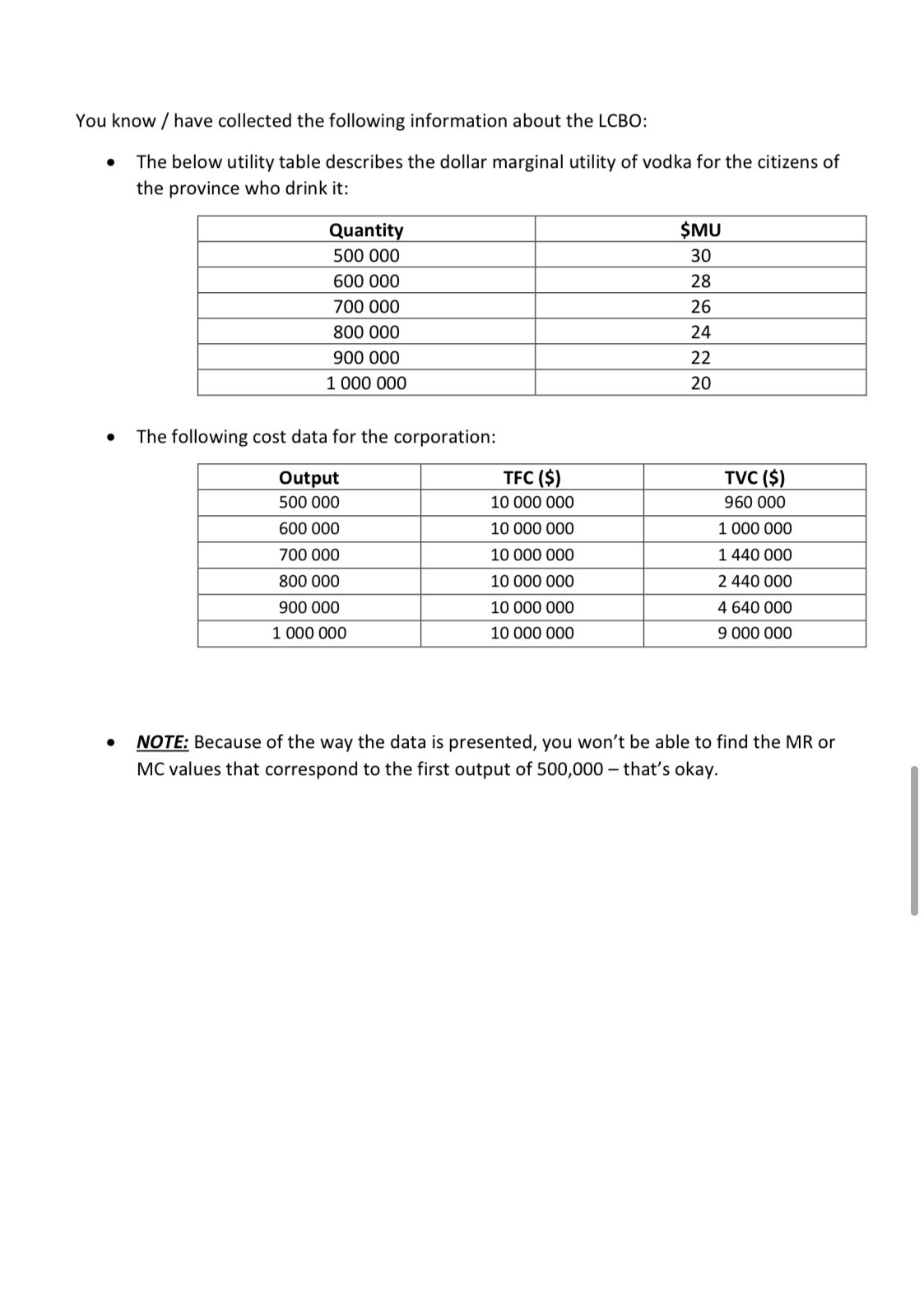

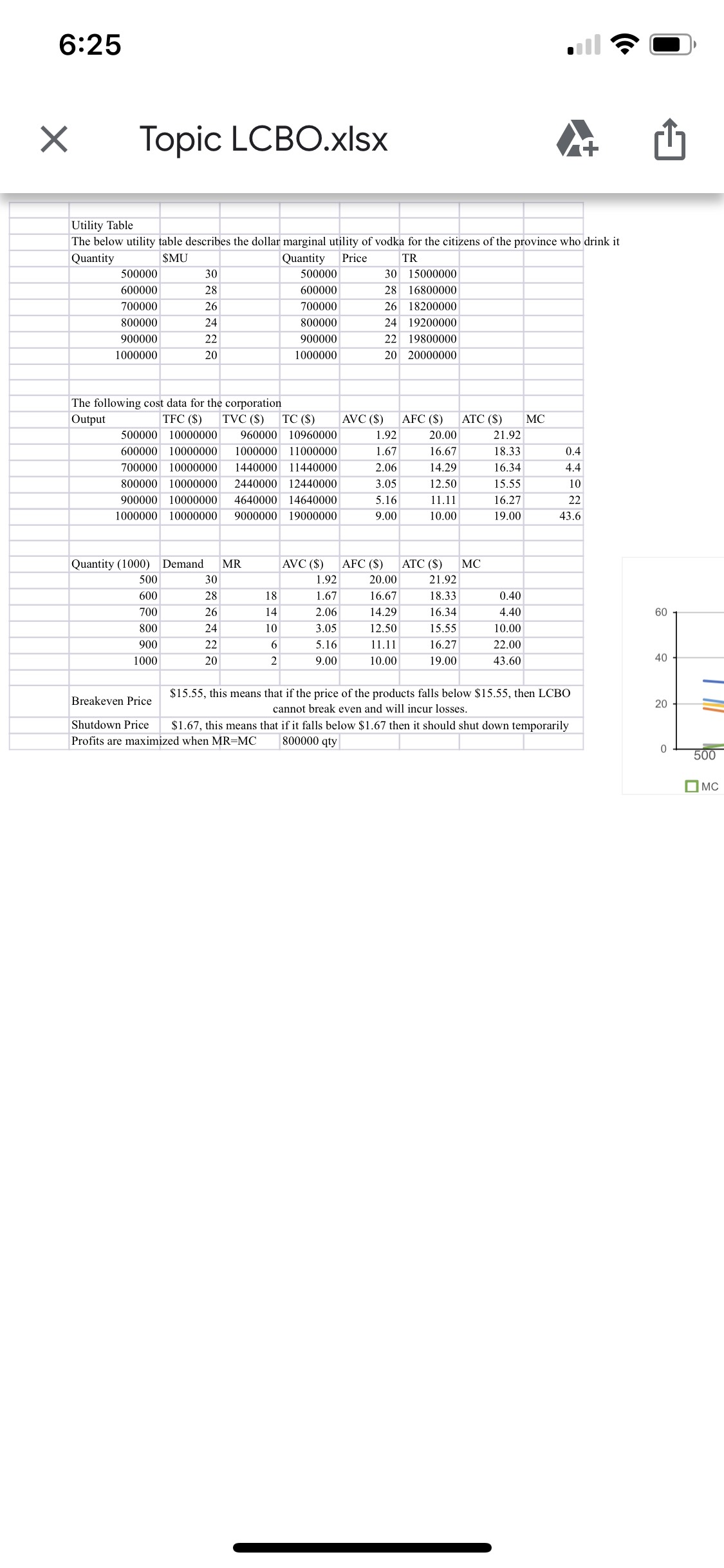

Toglc 4: The LCBO Your client is the LCBO, a crown corporation. With a few exceptions, the LCBO has a monopoly on liquor sales in Ontario. This is a result of legislation from the Ontario Government that restricts other companies from selling alcohol in the province. You have been tasked with analyzing their Vodka sales in the province. You'll need to present to them with the following items: :- A demand schedule representing the market demand for vodka in Ontario. 0 The demand curve for vodka, the MR curve, and the cost curves for the firm (MC, ATC, AVC, and AFC), all on the same graph. 0 The corporation's breakeven and shutdown prices and what they mean for the firm. 0 The level of output they can produce and price they can charge in order to maximize their profit. 0 At the above profit maximizing output and price, what will their total revenue, total cost, and total profit be (if anything)? 0 Any existing barriers to entry that protect the LCBO from competition. 0 Can the LCBO continue to sell vodka and are they able to make profits? 0 Suppose the government decides to force the LCBO to operate at the socially optimum price. What will their new output be, and what price will they charge? 0 At the socially optimum price, what will their total revenue, total cost, and total profit be (if anything)? You know / have collected the following information about the LCBO: o The below utility table describes the dollar marginal utility of vodka for the citizens of the province who drink it: 500 000 ' _ o The following cost data for the corporation: mm- TFC (S) TVC (S) 500 000 10 000 000 960 000 600 000 10 000 000 1 000 000 0 NOTE: Because of the way the data is presented, you won't be able to find the MR or MC values that correspond to the first output of 500,000 that's okay. 6:25 X Topic LCBO.xIsx Utility Table The below utility table describes the dollar marginal utility of vodka for the citizens of the province who drink it Quantity SMU Quantity Price TR 500000 30 500000 30 15000000 600000 28 600000 28 16800000 700000 26 700000 26 18200000 800000 24 800000 24 19200000 900000 22 900000 22 19800000 1000000 20 1000000 20 20000000 The following cost data for the corporation Output TFC ($) TVC ($) TC ($) AVC ($) AFC ($) ATC ($) MC 500000 10000000 960000 10960000 1.92 20.00 21.92 600000 10000000 1000000 11000000 1.67 16.67 18.33 0.4 700000 10000000 1440000 11440000 2.06 14.29 16.34 4.4 800000 10000000 2440000 12440000 3.05 12.50 15.55 10 900000 10000000 4640000 14640000 5.16 11.11 16.27 22 1000000 10000000 9000000 19000000 9.00 10.00 19.00 43.6 Quantity (1000) Demand MR AVC ($) AFC ($) ATC ($) MC 500 30 1.92 20.00 21.92 600 28 18 1.67 16.67 18.33 0.40 700 26 14 2.06 14.29 16.34 4.40 60 800 24 10 3.05 12.50 15.55 10.00 900 22 5.16 11.11 16.27 22.00 1000 20 2 9.00 10.00 19.00 43.60 40 Breakeven Price $15.55, this means that if the price of the products falls below $15.55, then LCBO cannot break even and will incur losses. 20 Shutdown Price $1.67, this means that if it falls below $1.67 then it should shut down temporarily Profits are maximized when MR=MC 800000 qty 0 MC