Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CAN ANYONE HELP ME TO ANSWER Q1 a and b plsss !!! Q1. (a) Oliver John is actively trading shares in the New York Stock

CAN ANYONE HELP ME TO ANSWER Q1 a and b plsss !!!

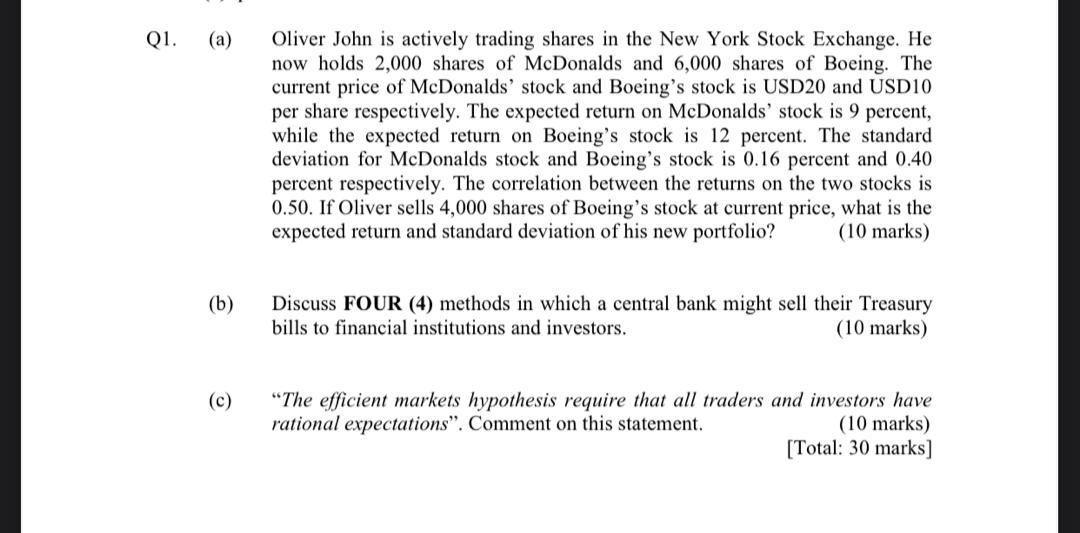

Q1. (a) Oliver John is actively trading shares in the New York Stock Exchange. He now holds 2,000 shares of McDonalds and 6,000 shares of Boeing. The current price of McDonalds' stock and Boeing's stock is USD20 and USD10 per share respectively. The expected return on McDonalds' stock is 9 percent, while the expected return on Boeing's stock is 12 percent. The standard deviation for McDonalds stock and Boeing's stock is 0.16 percent and 0.40 percent respectively. The correlation between the returns on the two stocks is 0.50. If Oliver sells 4,000 shares of Boeing's stock at current price, what is the expected return and standard deviation of his new portfolio? (10 marks) (b) Discuss FOUR (4) methods in which a central bank might sell their Treasury bills to financial institutions and investors. (10 marks) (c) "The efficient markets hypothesis require that all traders and investors have rational expectations". Comment on this statement. (10 marks) [Total: 30 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started