can anyone help me to solve this?

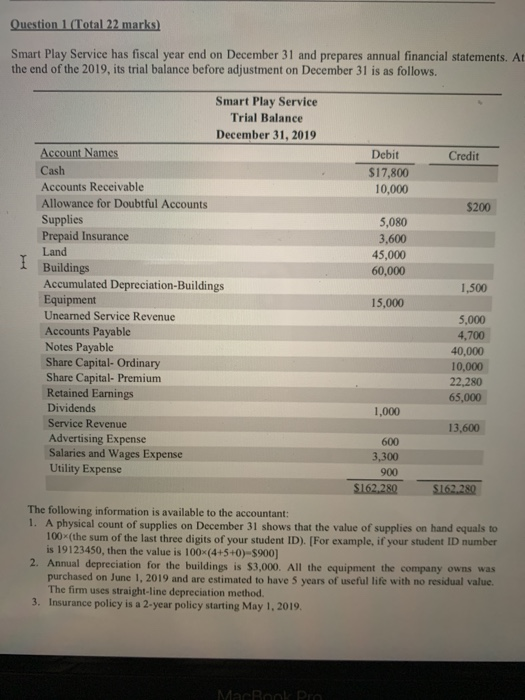

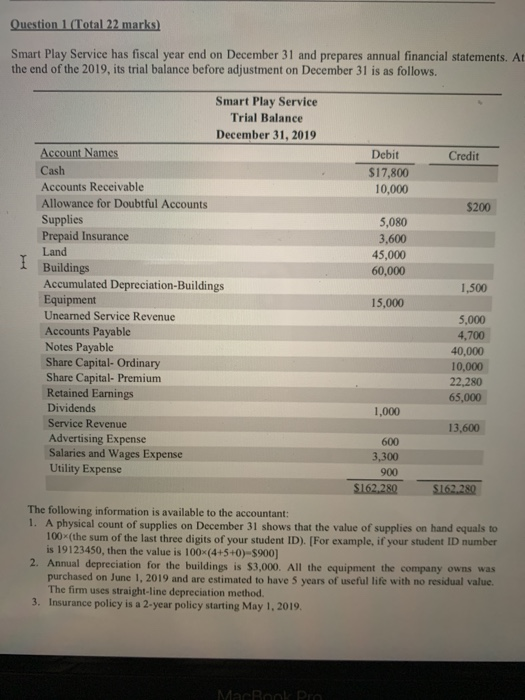

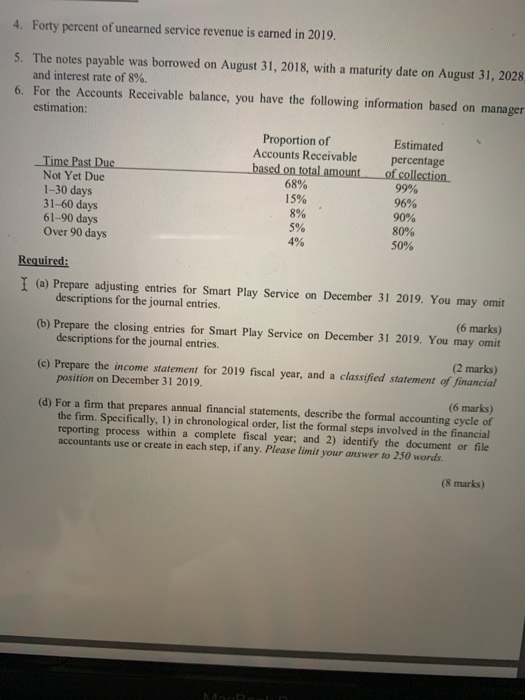

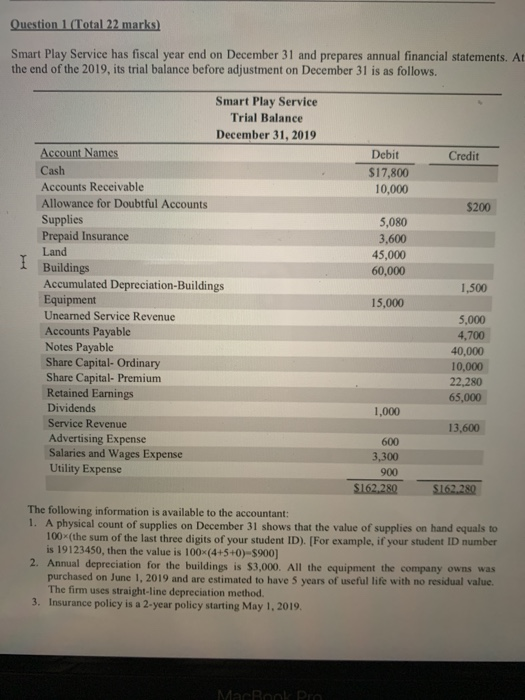

Question 1 (Total 22 marks) Smart Play Service has fiscal year end on December 31 and prepares annual financial statements. Al the end of the 2019, its trial balance before adjustment on December 31 is as follows. Credit Debit $17,800 10,000 $200 5,080 3,600 45,000 60,000 Smart Play Service Trial Balance December 31, 2019 Account Names Cash Accounts Receivable Allowance for Doubtful Accounts Supplies Prepaid Insurance Land Buildings Accumulated Depreciation-Buildings Equipment Uneamed Service Revenue Accounts Payable Notes Payable Share Capital- Ordinary Share Capital- Premium Retained Earnings Dividends Service Revenue Advertising Expense Salaries and Wages Expense Utility Expense 1,500 15,000 5,000 4,700 40,000 10,000 22,280 65,000 1,000 13,600 600 3,300 900 S162.280 $162.280 The following information is available to the accountant: 1. A physical count of supplies on December 31 shows that the value of supplies on hand equals to 100(the sum of the last three digits of your student ID). For example, if your student ID number is 19123450, then the value is 100 (4+5+0)-5900] 2. Annual depreciation for the buildings is $3.000. All the equipment the company owns was purchased on June 1, 2019 and are estimated to have 5 years of useful life with no residual value The firm uses straight-line depreciation method. 3. Insurance policy is a 2-year policy starting May 1, 2019. 4. Forty percent of unearned service revenue is earned in 2019. 5. The notes payable was borrowed on August 31, 2018, with a maturity date on August 31, 2028 and interest rate of 8%. 6. For the Accounts Receivable balance, you have the following information based on manager estimation: Proportion of Estimated Accounts Receivable percentage Time Past Due based on total amount of collection Not Yet Due 68% 99% 1-30 days 15% 96% 31-60 days 8% 90% 61-90 days 5% 80% Over 90 days 50% 4% Required: I (a) Prepare adjusting entries for Smart Play Service on December 31 2019. You may omit descriptions for the journal entries. (6 marks) (b) Prepare the closing entries for Smart Play Service on December 31 2019. You may omit descriptions for the journal entries. (2 marks) (c) Prepare the income statement for 2019 fiscal year, and a classified statement of financial position on December 31 2019. (6 marks) (d) For a firm that prepares annual financial statements, describe the formal accounting cycle of the firm. Specifically, 1) in chronological order, list the formal steps involved in the financial reporting process within a complete fiscal year, and 2) identify the document or file accountants use or create in each step, if any. Please limit your answer to 250 words (8 marks)