Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can anyone help me with the solution ? This question is regarding Canadian Taxes This question is regarding income attribution - non arms length transaction,

can anyone help me with the solution ?

This question is regarding Canadian Taxes

This question is regarding income attribution - non arms length transaction, transfer of property to spouse -non depreciable property.

FMV shows fair market value of property .

And need to calculate canadian tax effect for 2017 and 2018 for Dan ( her husband ) , Anna ( Her daughter) , and Tina ( her sister ) . All other required information is provided in the question ( see picture of the question )

if you need any specific information about this question then let me know .

i hope now you can see ... i have uploaded a clear picture .

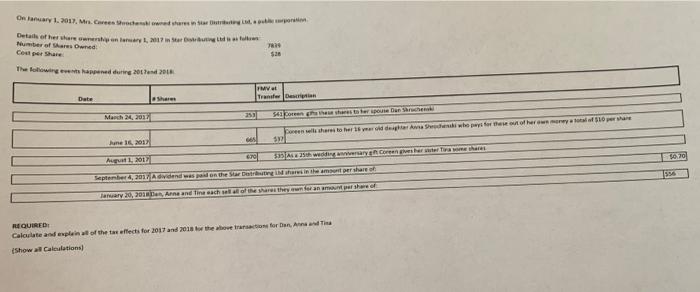

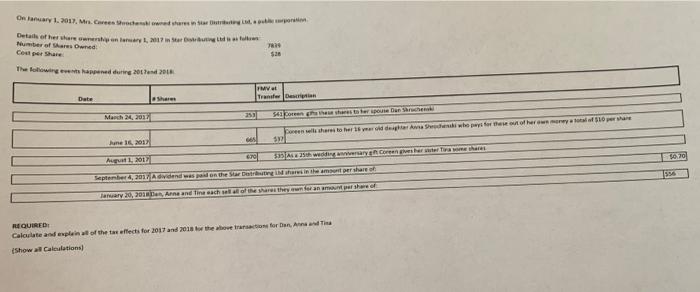

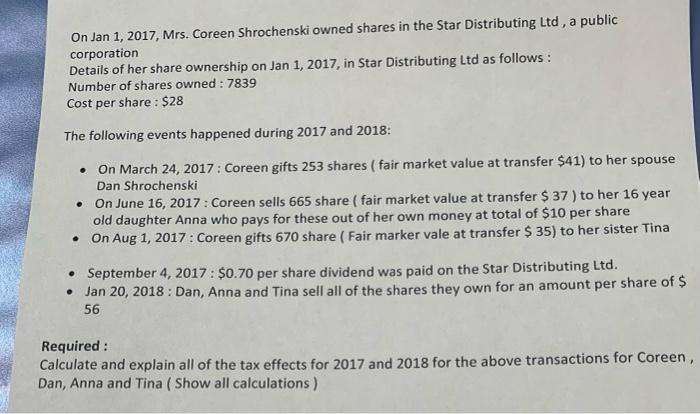

On January 1, 2017, Mr. Chochezo wa stare in prio Dutath other where we un larry, 2017 Serwis ber of shares owned $20 The following shaped during 2017 2018 FMV Transfer Design Date others March 26, 2016 She has to be pune Dan Saw porn there to her 15 year old degana di who were out of her life are 32 June 2011 6.70 35 Ash wedding Gorenger To The A1 MON 1556 September 2014 Addend was on the Star Destrng harus in the emer share January 20, 2017 Arne and in each are they want per here 2017 and 2018 the transaction for Dan, Anna Tina REQUIRED Calculate and explain of the treffects Show all Calculations On Jan 1, 2017, Mrs. Coreen Shrochenski owned shares in the Star Distributing Ltd, a public corporation Details of her share ownership on Jan 1, 2017, in Star Distributing Ltd as follows: Number of shares owned: 7839 Cost per share : $28 The following events happened during 2017 and 2018: . . On March 24, 2017: Coreen gifts 253 shares (fair market value at transfer $41) to her spouse Dan Shrochenski On June 16, 2017: Coreen sells 665 share ( fair market value at transfer $ 37 ) to her 16 year old daughter Anna who pays for these out of her own money at total of $10 per share On Aug 1, 2017: Coreen gifts 670 share ( Fair marker vale at transfer $ 35) to her sister Tina . . September 4, 2017 : $0.70 per share dividend was paid on the Star Distributing Ltd. Jan 20, 2018 : Dan, Anna and Tina sell all of the shares they own for an amount per share of $ 56 Required: Calculate and explain all of the tax effects for 2017 and 2018 for the above transactions for Coreen, Dan, Anna and Tina ( Show all calculations )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started