Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can anyone help me with these 3 calculations pls? Mini-Case B: (3 marks-1 each) Jing is concerned about having to repay her Old Age Security

Can anyone help me with these 3 calculations pls?

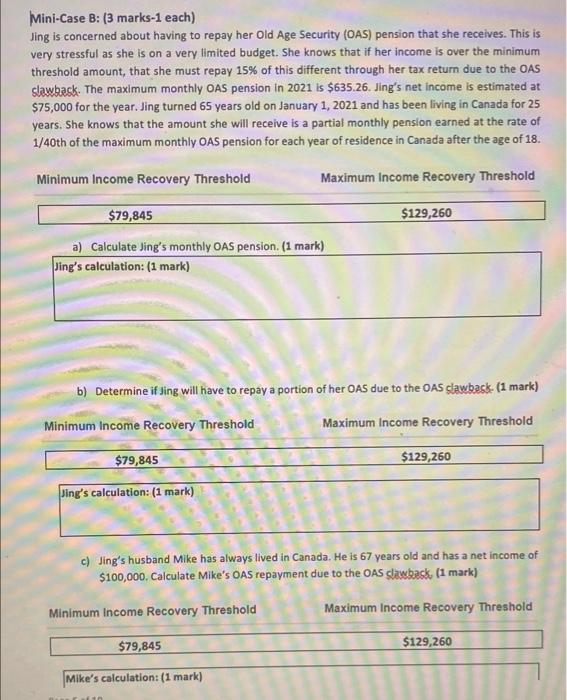

Mini-Case B: (3 marks-1 each) Jing is concerned about having to repay her Old Age Security (OAS) pension that she receives. This is very stressful as she is on a very limited budget. She knows that if her income is over the minimum threshold amount that she must repay 15% of this different through her tax return due to the OAS slawback. The maximum monthly OAS pension in 2021 is $635.26. Jing's net income is estimated at $75,000 for the year. Jing turned 65 years old on January 1, 2021 and has been living in Canada for 25 years. She knows that the amount she will receive is a partial monthly pension earned at the rate of 1/40th of the maximum monthly OAS pension for each year of residence in Canada after the age of 18. Minimum Income Recovery Threshold Maximum Income Recovery Threshold $129,260 $79,845 a) Calculate Jing's monthly OAS pension. (1 mark) Jing's calculation: (1 mark) b) Determine if sing will have to repay a portion of her OAS due to the OAS slawbask. (1 mark) Minimum Income Recovery Threshold Maximum Income Recovery Threshold $79,845 $129,260 Jing's calculation: (1 mark) a c) Jing's husband Mike has always lived in Canada. He is 67 years old and has a net income of $100,000. Calculate Mike's OAS repayment due to the OAS clawback, (1 mark) Minimum Income Recovery Threshold Maximum Income Recovery Threshold $79,845 $129,260 Mike's calculation: (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started