Can anyone help me with this Financial Analysis Project? I need help with numbers 5,6,7. I have chosen Coca-Cola Company.

I ALSO provided a link for QUESTION NUMBER 5. DO NOT USE GOOGLE FINANCE. https://www.marketwatch.com/investing/stock/ko/financials

I provided a link below for the 2017 10-k report - https://www.coca-colacompany.com/annual-review/2013/img/2013-annual-report-on-form-10-k.pdf

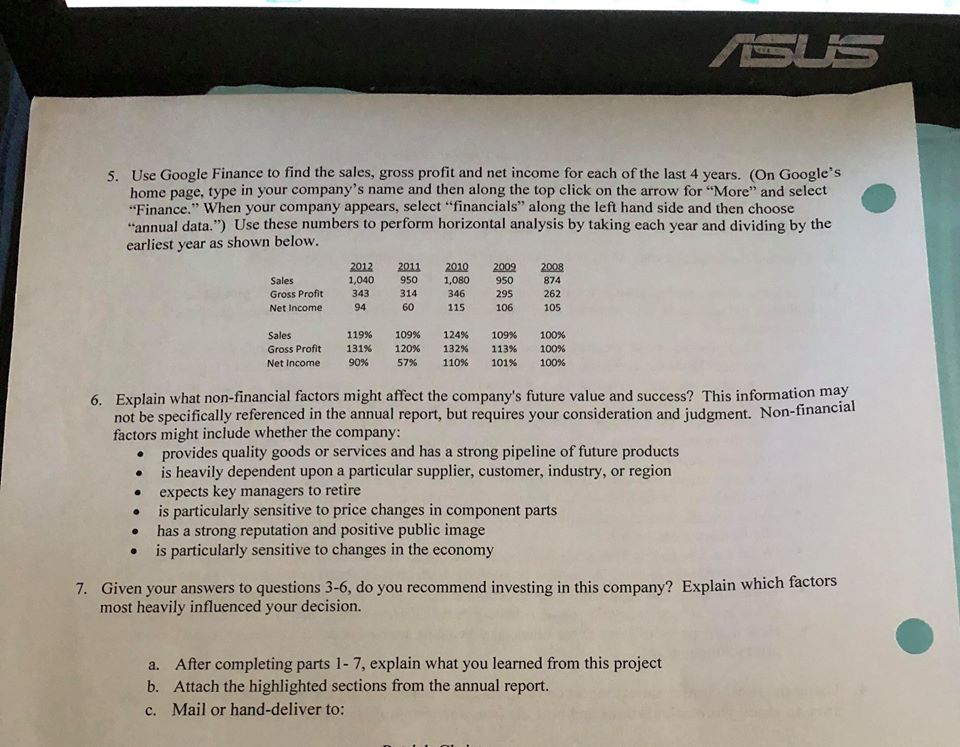

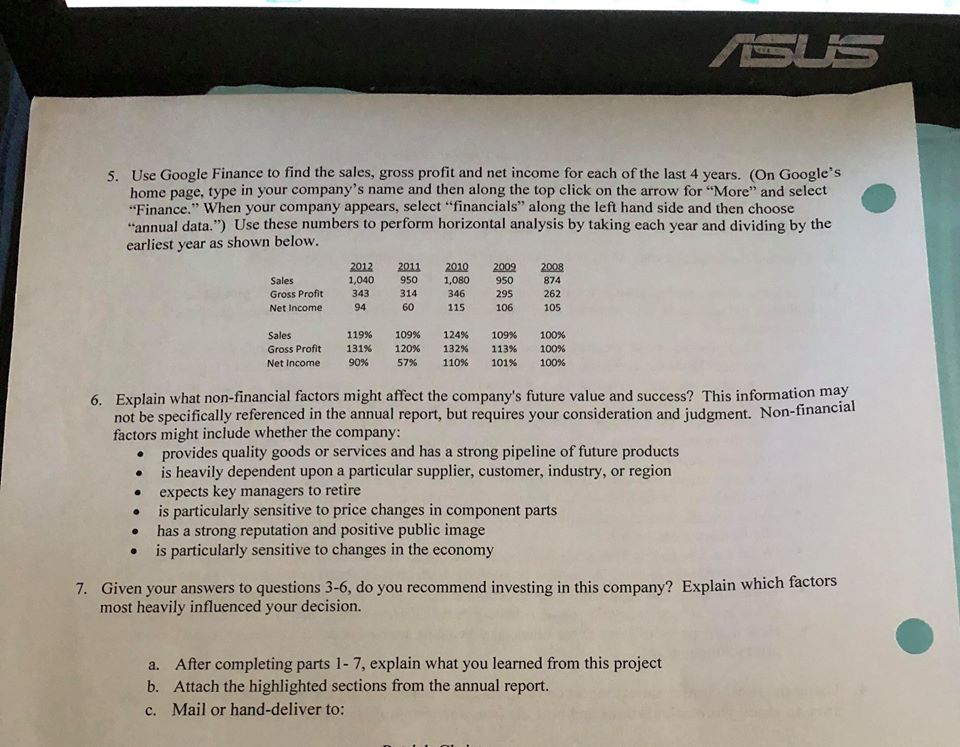

Use Google Finance to find the sales, gross profit and net income for each of the last 4 years. (On Google's home page, type in your company's name and then along the top click on the arrow for "More" and select "Finance." When your company appears, select "financials" along the left hand side and then choose "annual data.") Use these numbers to perform horizontal analysis by taking each year and dividing by the earliest year as shown below. 5. 2012 2011 2010 2009 2008 Sales 1,040 9501,080 950 874 Gross Profit 343 314 346 295 262 Net Income 94 60 115 106 105 Sales Gross Profit Net Income 119% 131% 90% 109% 120% 57% 124% 132% 110% 109% 113% 101% 100% 100% 100% Explain what non-financial factors might affect the company's future value and success? This information may not be specifically referenced in the annual report, but requires your consideration and judgment. Non-financia factors might include whether the company 6. provides quality goods or services and has a strong pipeline of future products is heavily dependent upon a particular supplier, customer, industry, or region expects key managers to retire is particularly sensitive to price changes in component parts has a strong reputation and positive public image is particularly sensitive to changes in the economy Given your answers to questions 3-6, do you recommend investing in this company? Explain which factors most heavily influenced your decision. 7. a. After completing parts 1-7, explain what you learned from this project b. Attach the highlighted sections from the annual report. c. Mail or hand-deliver to: Use Google Finance to find the sales, gross profit and net income for each of the last 4 years. (On Google's home page, type in your company's name and then along the top click on the arrow for "More" and select "Finance." When your company appears, select "financials" along the left hand side and then choose "annual data.") Use these numbers to perform horizontal analysis by taking each year and dividing by the earliest year as shown below. 5. 2012 2011 2010 2009 2008 Sales 1,040 9501,080 950 874 Gross Profit 343 314 346 295 262 Net Income 94 60 115 106 105 Sales Gross Profit Net Income 119% 131% 90% 109% 120% 57% 124% 132% 110% 109% 113% 101% 100% 100% 100% Explain what non-financial factors might affect the company's future value and success? This information may not be specifically referenced in the annual report, but requires your consideration and judgment. Non-financia factors might include whether the company 6. provides quality goods or services and has a strong pipeline of future products is heavily dependent upon a particular supplier, customer, industry, or region expects key managers to retire is particularly sensitive to price changes in component parts has a strong reputation and positive public image is particularly sensitive to changes in the economy Given your answers to questions 3-6, do you recommend investing in this company? Explain which factors most heavily influenced your decision. 7. a. After completing parts 1-7, explain what you learned from this project b. Attach the highlighted sections from the annual report. c. Mail or hand-deliver to