Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can anyone help me with this homework question? Kindly help me as soon as possible as i have a few more hours to submit. Thank

Can anyone help me with this homework question? Kindly help me as soon as possible as i have a few more hours to submit. Thank you.

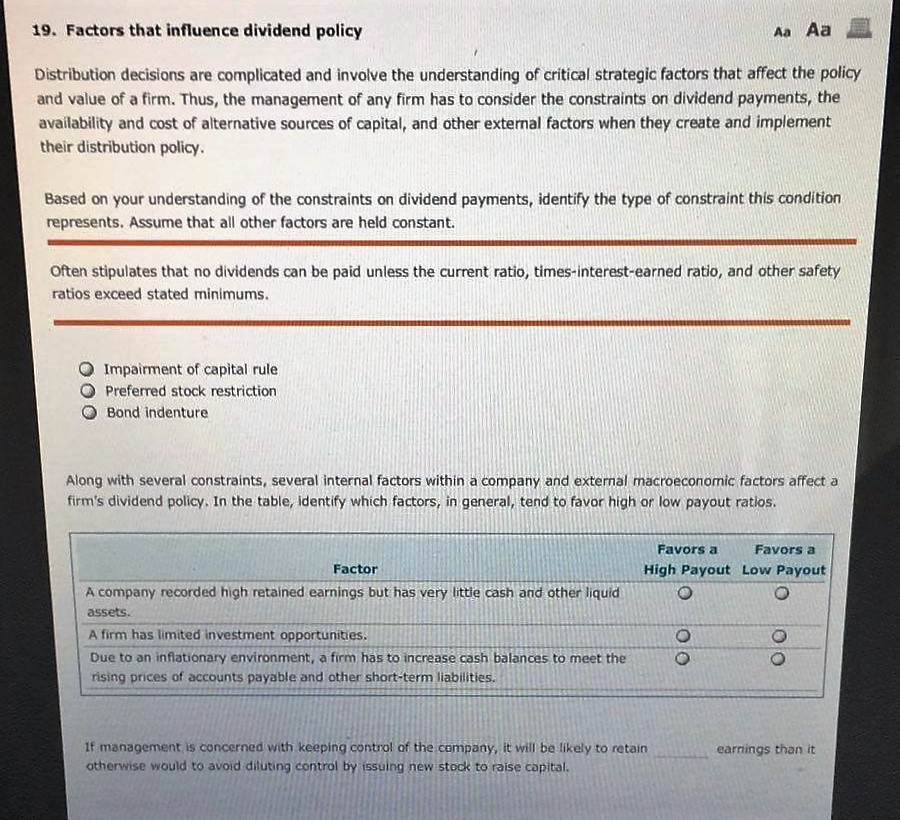

19. Factors that influence dividend policy Aa Aa Distribution decisions are complicated and involve the understanding of critical strategic factors that affect the policy and value of a firm. Thus, the management of any firm has to consider the constraints on dividend payments, the availability and cost of alternative sources of capital, and other external factors when they create and implement their distribution policy. Based on your understanding of the constraints on dividend payments, identify the type of constraint this condition represents. Assume that all other factors are held constant. Often stipulates that no dividends can be paid unless the current ratio, times-interest-earned ratio, and other safety ratios exceed stated minimums. Impairment of capital rule Preferred stock restriction O Bond indenture Along with several constraints, several internal factors within a company and extemal macroeconamic factors affect a Along with several constraints, several internal factors within a company and external macroeconomic factors affect a firm's dividend policy. In the table, identify which factors, in general, tend to favor high or low payout ratios. Favors a Favors a Factor High Payout Low Payout A company recorded high retained earnings but has very littie cash and other liquid assets. A firm has limited investment opportunities Due to an inflationary environment, a firm has to increase cash balances to meet the rising prices of accounts payable and other short-term liabilities. If management is concerned with keeping control of the company, it will be likely to retain otherwise would to avoid diluting control by issuing new stock to raise copital. earnings than itStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started