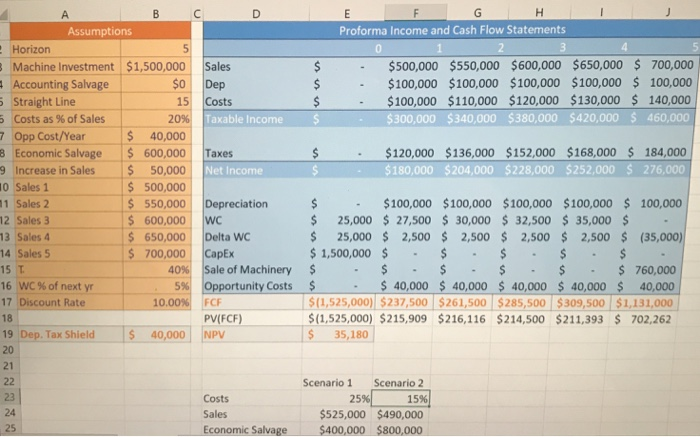

Question: Can anyone help me with this showing formulas please? Assumptions Proforma Income and Cash Flow Statements Horizon Machine Investment $1,500,000 Accounting Salvage Straight Line Costs

Assumptions Proforma Income and Cash Flow Statements Horizon Machine Investment $1,500,000 Accounting Salvage Straight Line Costs as % of Sales Opp Cost/Year Sales $0 Dep 15 Costs $500,000 $550,000 $600,000 $650,000 700,000 $$100,000 $100,000 $100,000 $100,000 100,000 $100,000 $110,000 $120,000 $130,000 140,000 $300,000 $340,000 $380,000 $420,000 460,000 20% Taxable Income$ $ 40,000 8 Economic Salvage 600,000 Taxes 120,000 $136,000 $152,000 $168,000 184,000 $180,000 $204,000 $228,000 $252,000$ 276,000 Increase in Sales S 50,000 Net Income 0 Sales 1 1 Sales2 2 Sales 3 13 Sales 4 14 Sales 5 15 16 WC % of next yr 17 Discount Rate 18 19 Dep. Tax Shield $ 500,000 550,000 Depreciation $600,000 WC $100,000 $100,000 $100,000 $100,000 100,000 $25,000 $ 27,500 $ 30,000 32,500 $35,000$ 25,000 2,500 2,500 2,500 2,500 (35,000) $650,000 Delta WC 700,000 CapEx 40% 5% |sale of Machinery Opportunity Costs FCF PV(FCF) 1,500,000 $ s $ $(1,525,000) $237,500 $261,500 $285,500 $309,500 $1,131,000 (1.525,000) $215,909 $216,116 $214,500 $211,393 S 702,262 $ 35,180 $$ $ 40,000 $ 40,000 $40,000 $ 40,000 $ 40,000 760,000 10.00%| 40,000 NPV 21 Scenario 1 Scenario 2 25% Costs Sales Economic Salvage 15% $525,000 $490,000 $400,000 $800,000 Assumptions Proforma Income and Cash Flow Statements Horizon Machine Investment $1,500,000 Accounting Salvage Straight Line Costs as % of Sales Opp Cost/Year Sales $0 Dep 15 Costs $500,000 $550,000 $600,000 $650,000 700,000 $$100,000 $100,000 $100,000 $100,000 100,000 $100,000 $110,000 $120,000 $130,000 140,000 $300,000 $340,000 $380,000 $420,000 460,000 20% Taxable Income$ $ 40,000 8 Economic Salvage 600,000 Taxes 120,000 $136,000 $152,000 $168,000 184,000 $180,000 $204,000 $228,000 $252,000$ 276,000 Increase in Sales S 50,000 Net Income 0 Sales 1 1 Sales2 2 Sales 3 13 Sales 4 14 Sales 5 15 16 WC % of next yr 17 Discount Rate 18 19 Dep. Tax Shield $ 500,000 550,000 Depreciation $600,000 WC $100,000 $100,000 $100,000 $100,000 100,000 $25,000 $ 27,500 $ 30,000 32,500 $35,000$ 25,000 2,500 2,500 2,500 2,500 (35,000) $650,000 Delta WC 700,000 CapEx 40% 5% |sale of Machinery Opportunity Costs FCF PV(FCF) 1,500,000 $ s $ $(1,525,000) $237,500 $261,500 $285,500 $309,500 $1,131,000 (1.525,000) $215,909 $216,116 $214,500 $211,393 S 702,262 $ 35,180 $$ $ 40,000 $ 40,000 $40,000 $ 40,000 $ 40,000 760,000 10.00%| 40,000 NPV 21 Scenario 1 Scenario 2 25% Costs Sales Economic Salvage 15% $525,000 $490,000 $400,000 $800,000

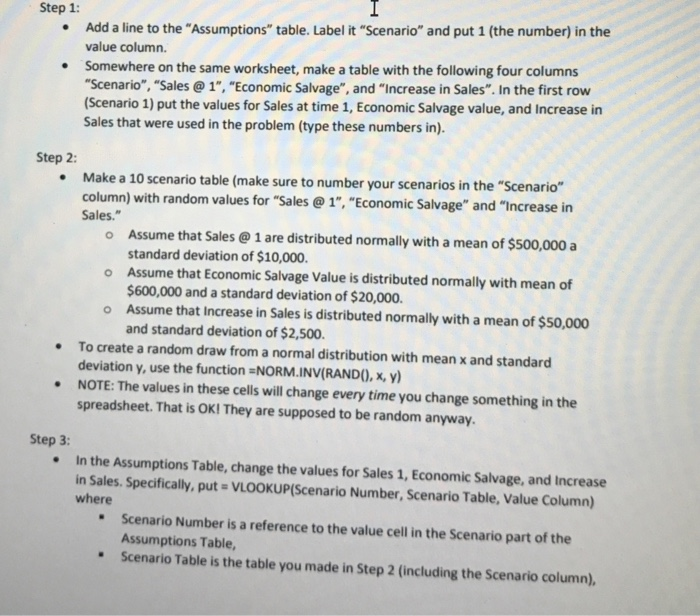

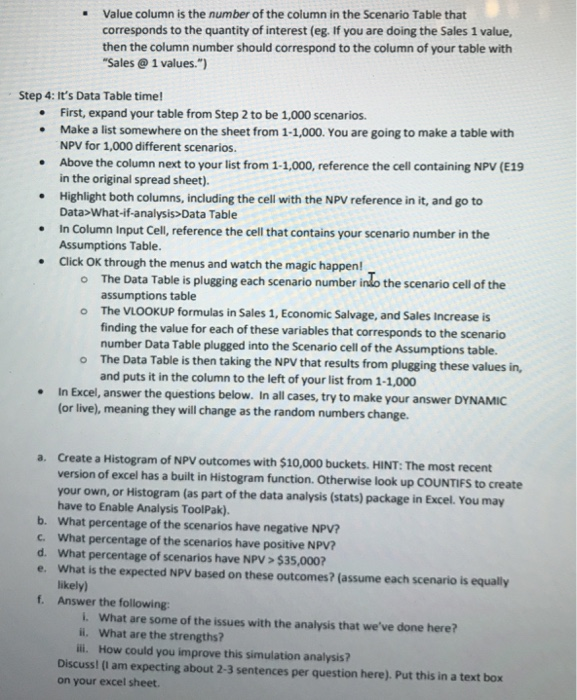

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts