Can anyone help please

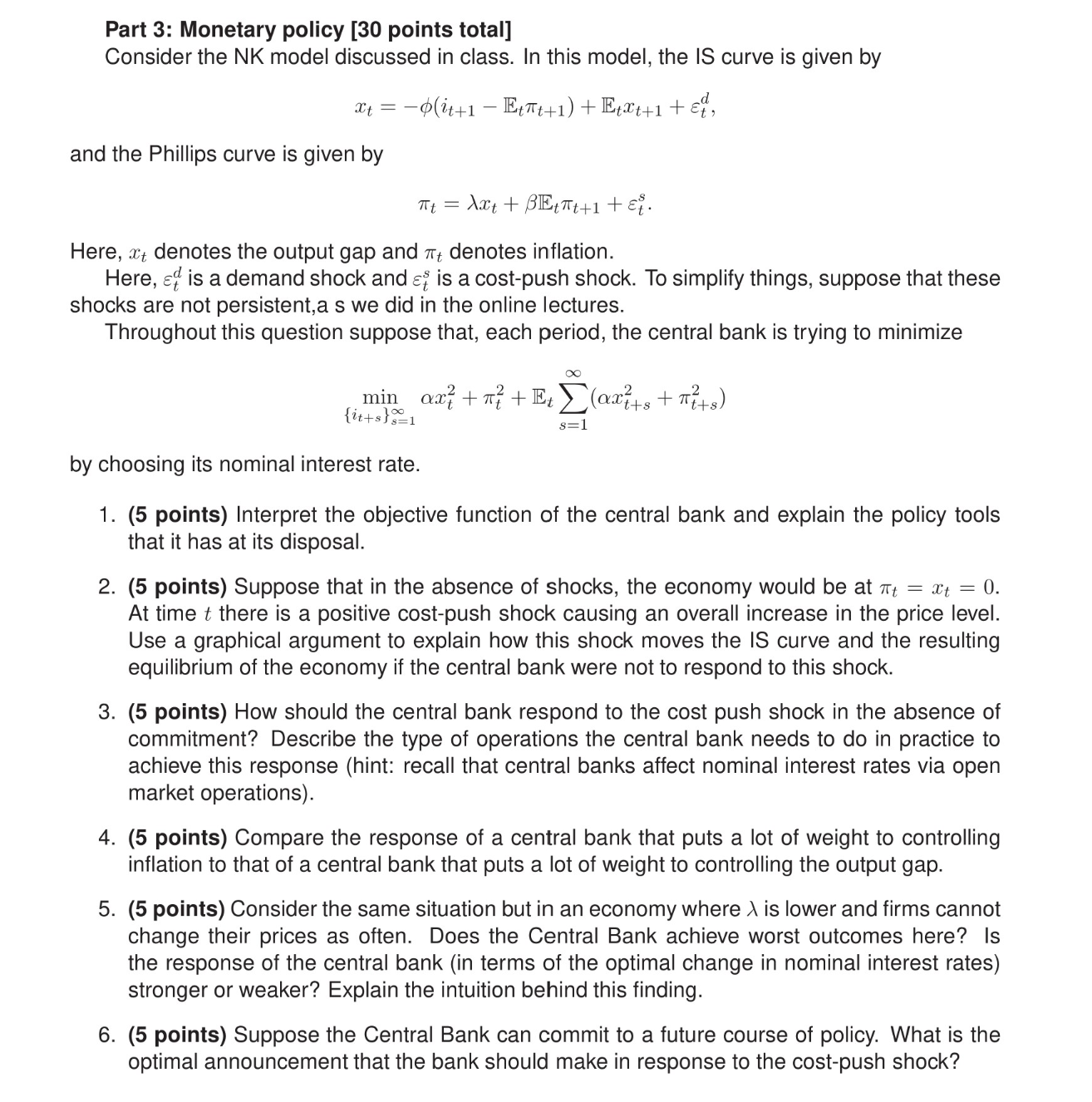

Part 3: Monetary policy [30 points total] Consider the NK model discussed in class. In this model, the is curve is given by wt = '(it+1 * EtiTt+1)+ Et$t+1 + 5?: and the Phillips curve is given by 71} = ASL} + El'p + 5:. Here, 3:} denotes the output gap and n denotes inflation. Here, sf is a demand shock and sf is a cost-push shock. To simplify things, suppose that these shocks are not persistent,a s we did in the online lectures. Throughout this question suppose that, each period, the central bank is trying to minimize 00 - 2 2 2 2 min amt +1rt 4%}:thst +7rt+3) {it-+5 E21 3:1 by choosing its nominal interest rate. 1 . (5 points) Interpret the objective function of the central bank and explain the policy tools that it has at its disposal. . (5 points) Suppose that in the absence of shocks. the economy would be at 7n = :17; = 0. At time t there is a positive cost-push shock causing an overall increase in the price level. Use a graphical argument to explain how this shock moves the IS curve and the resulting equilibrium of the economy if the central bank were not to respond to this shock. . (5 points) How should the central bank respond to the cost push shock in the absence of commitment? Describe the type of operations the central bank needs to do in practice to achieve this response (hint: recall that central banks affect nominal interest rates via open market operations). . (5 points) Compare the response of a central bank that puts a lot of weight to controlling inflation to that of a central bank that puts a lot of weight to controlling the output gap. . (5 points) Consider the same situation but in an economy where )l is lower and firms cannot change their prices as often. Does the Central Bank achieve worst outcomes here? Is the response of the central bank (in terms of the optimal change in nominal interest rates) stronger or weaker? Explain the intuition behind this finding. . (5 points) Suppose the Central Bank can commit to a future course of policy. What is the optimal announcement that the bank should make in response to the costpush shock