Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can anyone help Q2: Jennifer Corporation has issued 300,000 shares of $3 par value common stock. It authorized 600,000 shares. The paid-in capital in excess

can anyone help

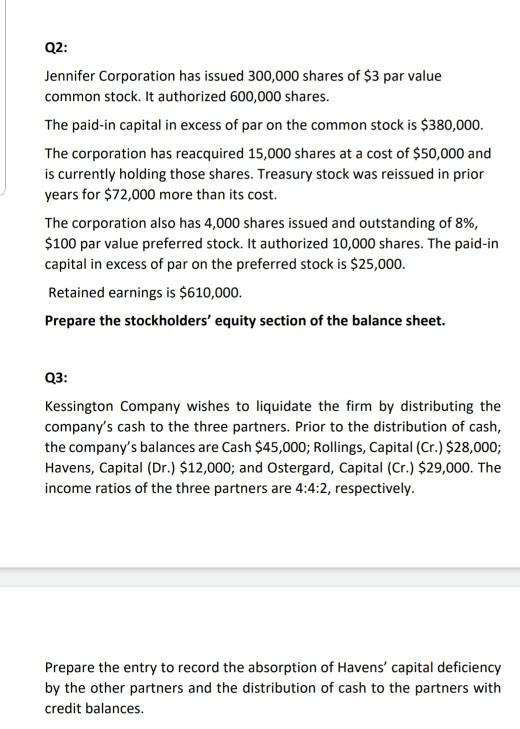

Q2: Jennifer Corporation has issued 300,000 shares of $3 par value common stock. It authorized 600,000 shares. The paid-in capital in excess of par on the common stock is $380,000. The corporation has reacquired 15,000 shares at a cost of $50,000 and is currently holding those shares. Treasury stock was reissued in prior years for $72,000 more than its cost. The corporation also has 4,000 shares issued and outstanding of 8%, $100 par value preferred stock. It authorized 10,000 shares. The paid-in capital in excess of par on the preferred stock is $25,000. Retained earnings is $610,000. Prepare the stockholders' equity section of the balance sheet. Q3: Kessington Company wishes to liquidate the firm by distributing the company's cash to the three partners. Prior to the distribution of cash, the company's balances are Cash $45,000; Rollings, Capital (Cr.) $28,000; Havens, Capital (Dr.) $12,000; and Ostergard, Capital (Cr.) $29,000. The income ratios of the three partners are 4:4:2, respectively. Prepare the entry to record the absorption of Havens' capital deficiency by the other partners and the distribution of cash to the partners with credit balances

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started