Question

Can anyone help with all 5 questions/problems? All information is listed below. One-month Project -- The project focuses on Ellipses Corporation which begins on Page

Can anyone help with all 5 questions/problems? All information is listed below.

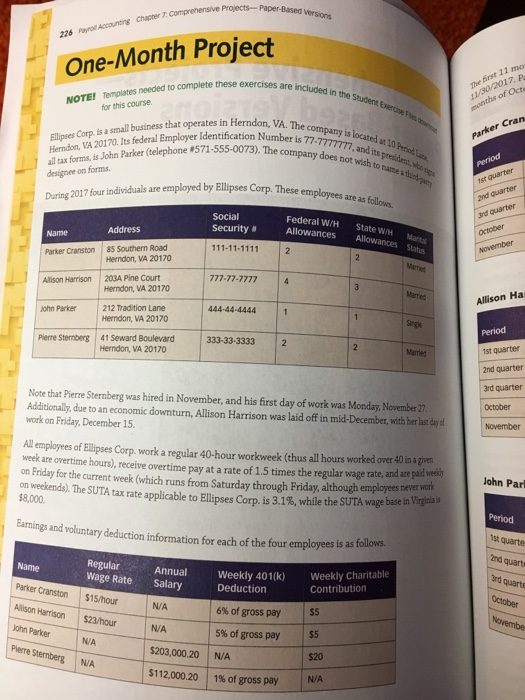

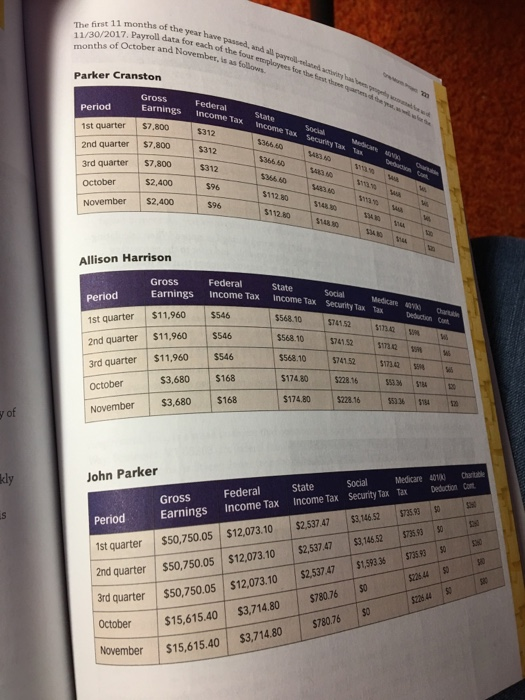

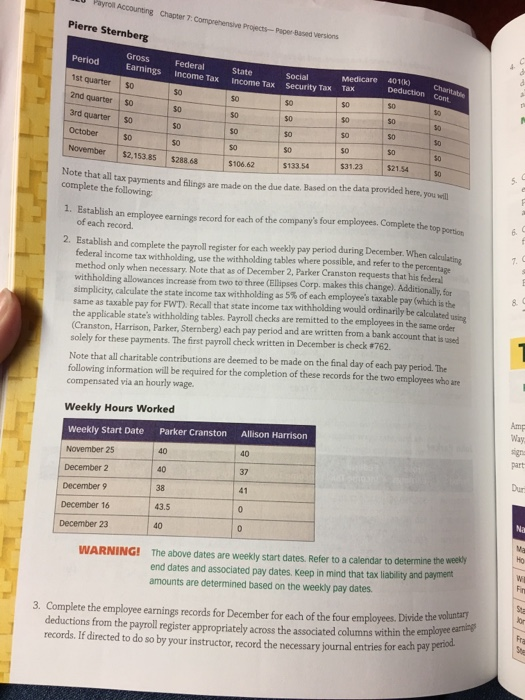

One-month Project -- The project focuses on Ellipses Corporation which begins on Page 226. You will complete payroll-related tasks for the month of December and will then finalize year-end reporting. All forms and documents needed for this problem are located under Handouts/Chapter 7 Final Payroll Project Documents. Read pages 226 -229. These pages will give you information regarding the payroll records and general information regarding the companys employees as well as what needs to be done.

1--- Establish an employee earnings record for each of the companys four employees. Complete the top portion of each record at this time. I have included the accumulated earnings for each employee prior to the month of December. Locate the earnings records in the Final Project Template worksheet.

2---Complete the payroll register for each weekly pay period during December. You will need to complete five payroll registers (12/1, 12/8, 12/15, 12/22, 12/29). Locate the payroll registers in the Final Project Template worksheet.

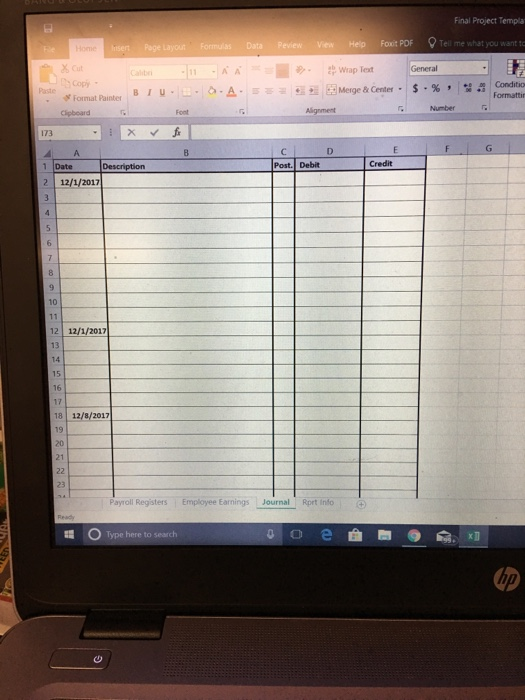

3---Complete the employee earnings records for the month of December for each of the four employees. Earnings records are located in the Final Project Template worksheet. Record the necessary journal entries for each pay period. Locate the journal in the Final Project Template worksheet.

4---Complete Form 941 for the 4th quarter Form 941 is located under Chapter 6 Final Payroll Project Documents. There is an excel summarized Information sheet for the 941. This report is located in the Final Project Template worksheet under Rprt Info-941. Once you add your December earnings information in this report, you will have the needed information to complete Form 941 at your fingertips. You will need to upload Form 941 separately under coursework. You do not have to record the necessary journal entries associated with Form 941.

5---Complete Copy A of Form W-2 for each of the four employees. W-2 forms are located under Chapter 6 Final Payroll Project Documents. You will need to do a file save as four times in order to complete a W-2 for each employee. You only have to complete the first document (Copy A) for each employee.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started