Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can anyone know how to do this question?? its mangerial accounting and itd all one question its just the tables. thank uuuu these were the

can anyone know how to do this question?? its mangerial accounting and itd all one question its just the tables. thank uuuu

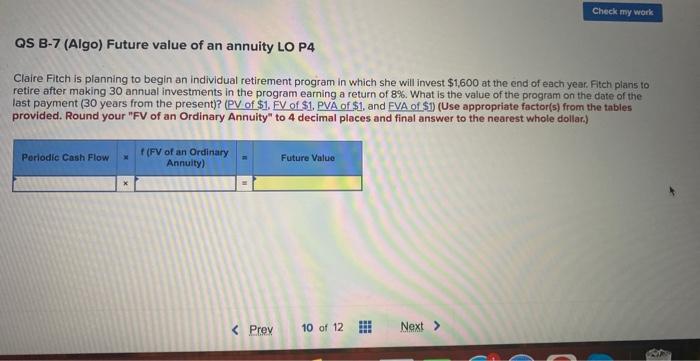

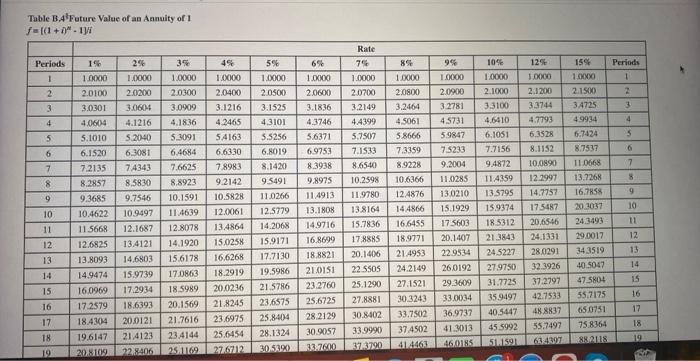

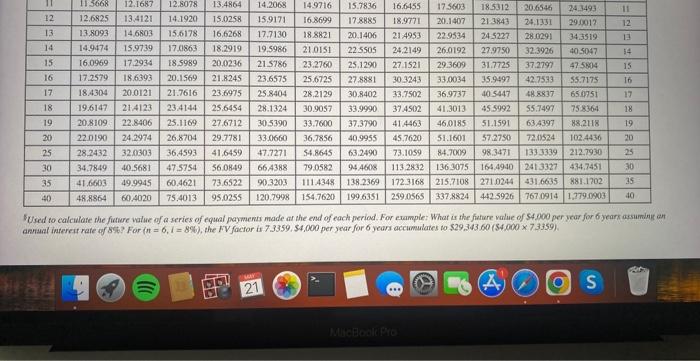

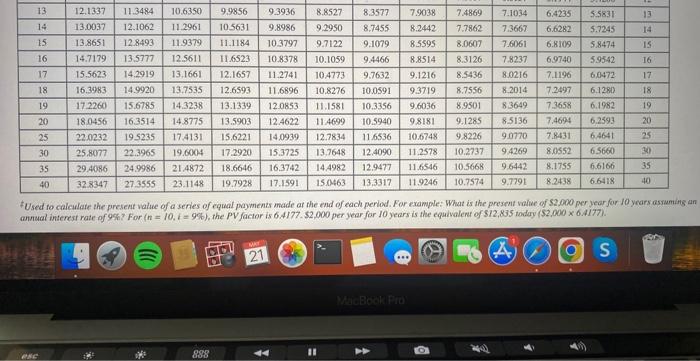

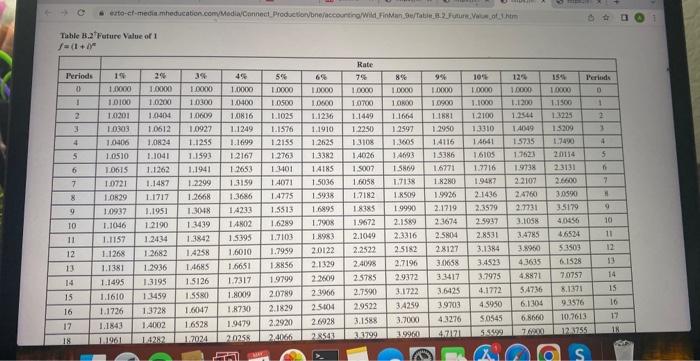

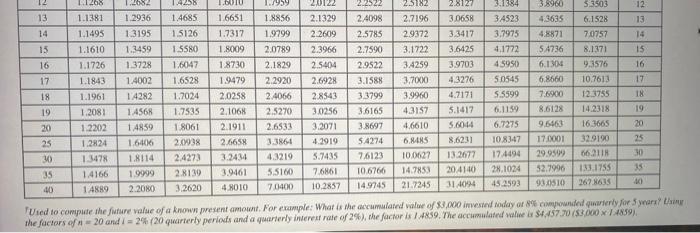

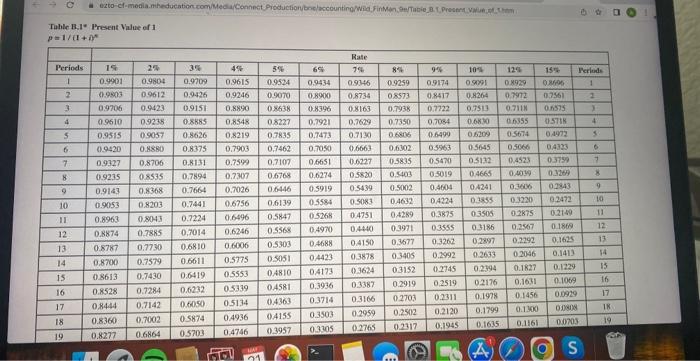

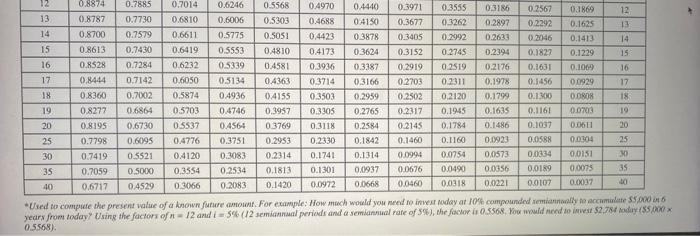

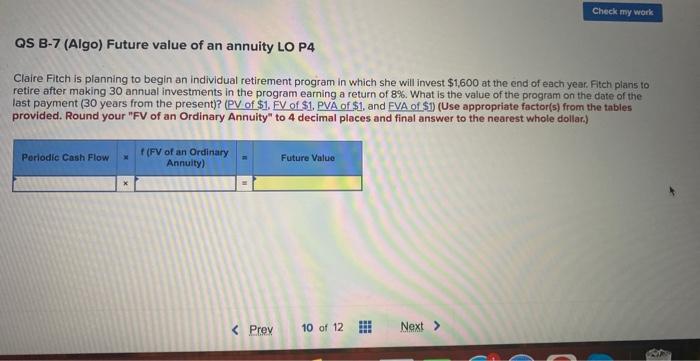

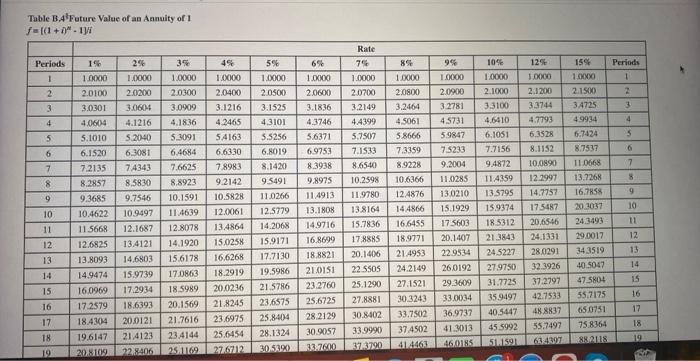

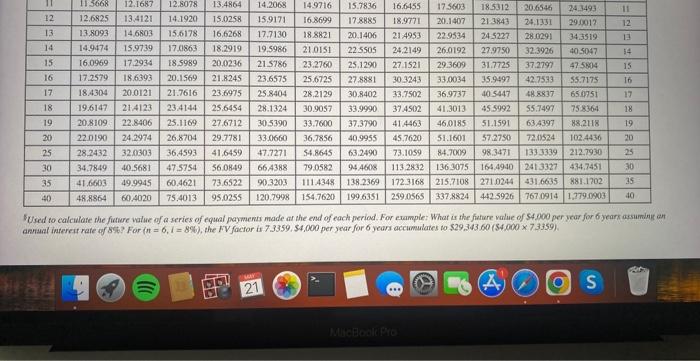

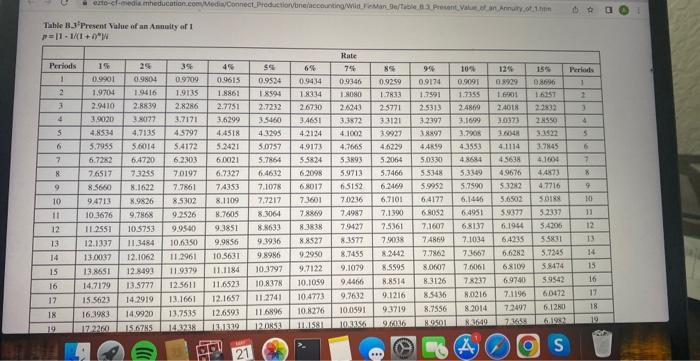

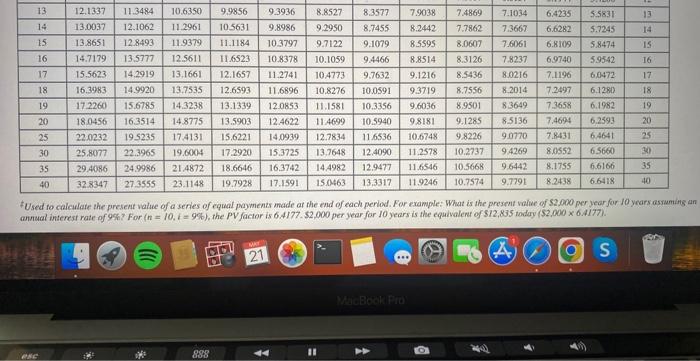

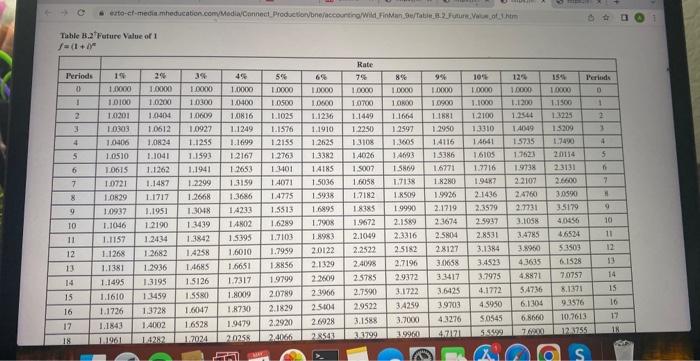

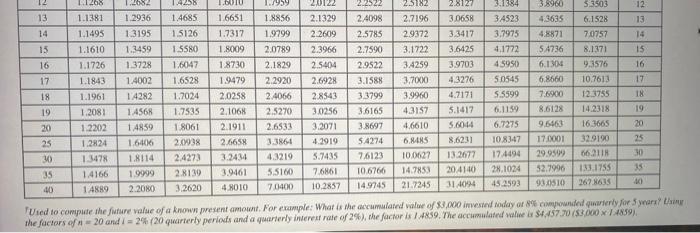

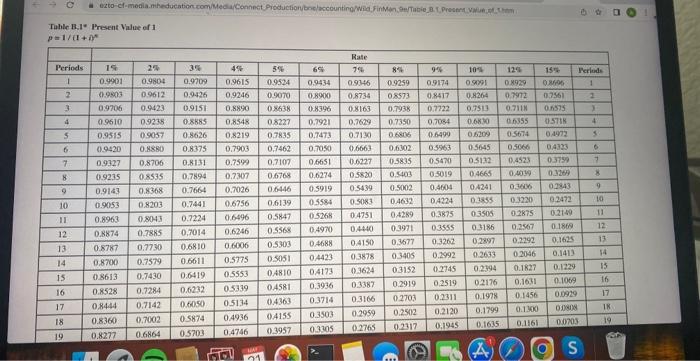

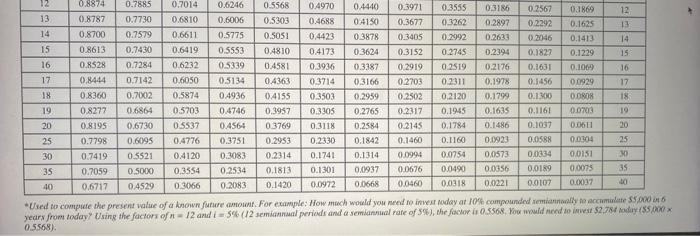

QS B-7 (Algo) Future value of an annuity LO P4 Claire Fitch is planning to begin an individual retirement program in which she will invest $1,600 at the end of each year. Fitch plans to retire after making 30 annual investments in the program earning a return of 8%. What is the value of the program on the date of the last payment ( 30 years from the present)? (PV of $1. EV of \$1, PVA of $1, and FVA of \$1) (Use appropriate factor(5) from the tables provided. Round your "FV of an Ordinary Annuity" to 4 decimal places and final answer to the nearest whole dollar.) Table B,4 Foture Value of an Anmuity of I f=[(1+)N1]i Woed to calculate the future value of a series of equal payments made at the end of each period. For example: What is the fitture value of 54000 per yeur for 6 yeark assuming Thble-13_3f Present Value of an Anuwity of 1 =11N(1+0)M \#Used to calculate the present value of a series of equal payments made at the end of each period. For example: What is the present valie of $2 ono per year for 10 yrars assumiths Table 4.2+Feture Value of 1 f=11+m FUied to compute the furure value of a known present amount. For example: What is the accumulated walue of $3,000 invesud foday of 8% cominiounded quarlerly for 5 ynars? Hatur Tahle B.I" Present Value of 1 p=1/(1+i)c years from today? Usins the foctors of n=12 and t=5% ( 12 semicnnaul periads and a sembaenual rate of 5% 0.5568). QS B-7 (Algo) Future value of an annuity LO P4 Claire Fitch is planning to begin an individual retirement program in which she will invest $1,600 at the end of each year. Fitch plans to retire after making 30 annual investments in the program earning a return of 8%. What is the value of the program on the date of the last payment ( 30 years from the present)? (PV of $1. EV of \$1, PVA of $1, and FVA of \$1) (Use appropriate factor(5) from the tables provided. Round your "FV of an Ordinary Annuity" to 4 decimal places and final answer to the nearest whole dollar.) Table B,4 Foture Value of an Anmuity of I f=[(1+)N1]i Woed to calculate the future value of a series of equal payments made at the end of each period. For example: What is the fitture value of 54000 per yeur for 6 yeark assuming Thble-13_3f Present Value of an Anuwity of 1 =11N(1+0)M \#Used to calculate the present value of a series of equal payments made at the end of each period. For example: What is the present valie of $2 ono per year for 10 yrars assumiths Table 4.2+Feture Value of 1 f=11+m FUied to compute the furure value of a known present amount. For example: What is the accumulated walue of $3,000 invesud foday of 8% cominiounded quarlerly for 5 ynars? Hatur Tahle B.I" Present Value of 1 p=1/(1+i)c years from today? Usins the foctors of n=12 and t=5% ( 12 semicnnaul periads and a sembaenual rate of 5% 0.5568)

these were the tables that were given to answer the questions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started